Analysis reveals that prior to the approval of the Ethereum [ETH] ETF, a specific whale address made bold moves by acquiring more ETH at a specific price.

As a result, this address has garnered significant unrealized profits. Furthermore, deeper analysis indicates a similar pattern among other whale addresses before the ETF approval.

Whale Accumulates Ethereum and Ecosystem Tokens

An analysis by Lookonchain unveils that a specific whale wallet anticipated the approval of the Ethereum spot ETF and made substantial ETH purchases.

Data indicates that the whale acquired 8,733 ETH at approximately $3,054.56, totaling around $26.67 million. Consequently, the whale currently holds approximately $6 million in unrealized profits. Following the approval of the Form 19b-4 by the Securities and Exchange Commission (SEC), the whale proceeded to acquire other tokens within the Ethereum ecosystem, amounting to $24.7 million.

Among these tokens is Lido DAO token [LDO], representing the platform with the highest amount of ETH staked. The unrealized profits of these ecosystem tokens in the wallet amount to approximately $1 million.

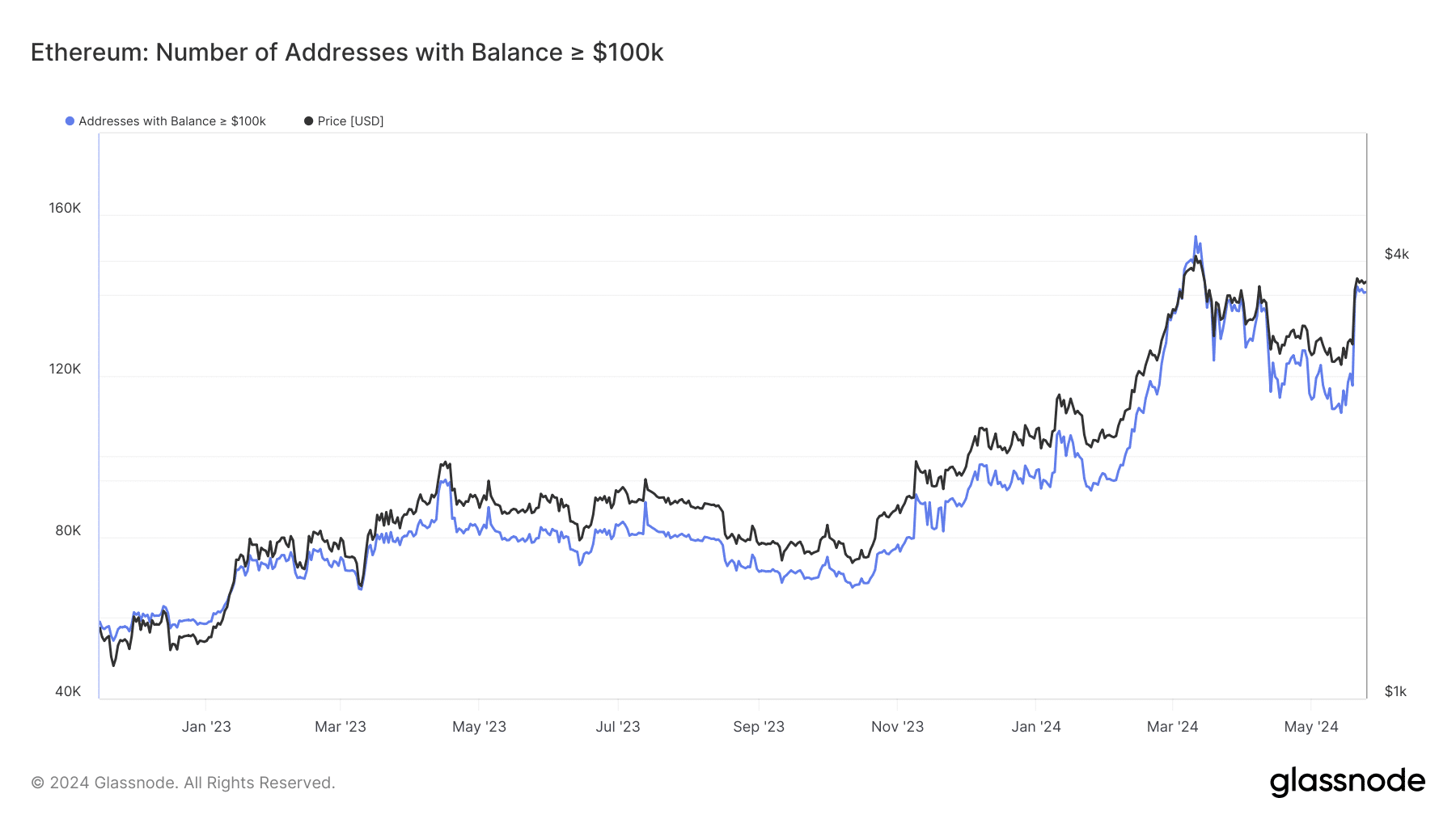

Source: Glassnode

Ethereum whale activity intensifies

Analysis of Ethereum addresses holding 10,000 ETH or more indicates significant movement in recent days. According to data from Glassnode, the number of such addresses decreased before a reversal trend around May 19th.

A chart illustrates an increase in the number of addresses from around 997 to about 1,006 at the time of writing. Further examination reveals a notable increase in the number of addresses holding ETH worth $100,000 or more. During the same period, this figure has risen from about 117,500 to over 140,000 according to the current report.

Related: ETH Price Drops Despite Ethereum ETF Approval

ETH Staked shows a slight decrease

A look at the total Ethereum staked indicates a short-term decline, followed by an increase around May 20th. According to the chart, it has increased to over 32.5 million ETH from around 32.3 million ETH during this period. As of the time of writing, the total staked ETH is approximately 32.56 million, showing a slight decrease.

Additionally, the current staked volume accounts for about 27.1% of Ethereum’s total supply.

Ethereum maintains a price increase

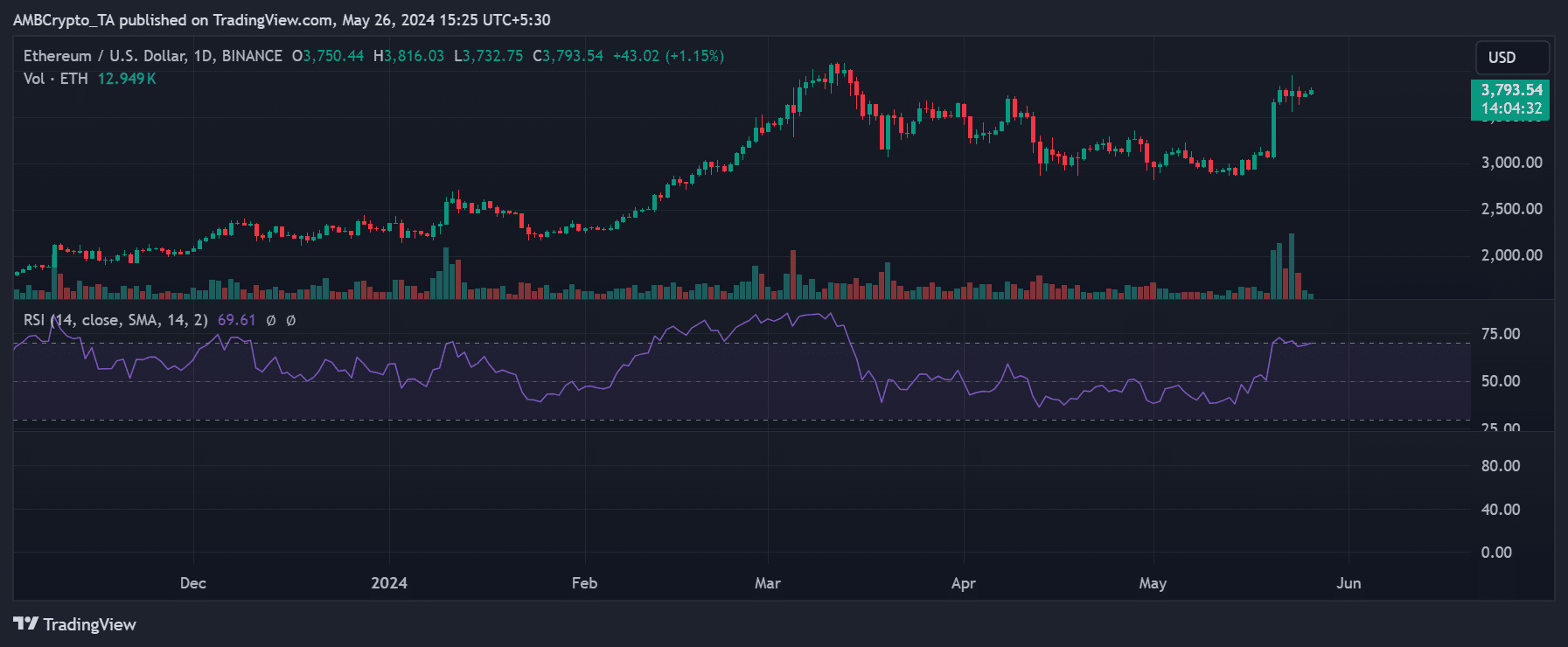

Source: TradingView

As of the time of writing, Ethereum is trading around $3,790, reflecting a more than 1% increase. Daily timeframe chart analysis shows efforts to maintain the $3,700 price level since its rise to that level.

The current trend indicates Ethereum’s efforts to establish the $3,600 range as support. The Relative Strength Index (RSI) suggests Ethereum is slightly below the overbought territory. This implies a potential strong uptrend but also suggests the possibility of a price decrease, even amidst another potential price increase.