Following the approval of eight spot Ethereum ETFs by the U.S. Securities and Exchange Commission (SEC) on Thursday, May 23, the price of Ether (ETH) has held steady at $3,800, showing no significant signs of an upward trend.

Despite this, ETH has seen a substantial rally of over 30% in the past week. Investors are currently adopting a cautious stance, watching closely to see if this development will result in a “sell-the-news” event.

Ethereum (ETH) Price Shows Major Volatility

Leading up to the U.S. SEC’s announcement of its decision on the spot Ethereum ETF approval, ETH prices exhibited significant volatility. In the tense hour before the official approval, ETH initially dropped to $3,500 around the time of the traditional U.S. market close.

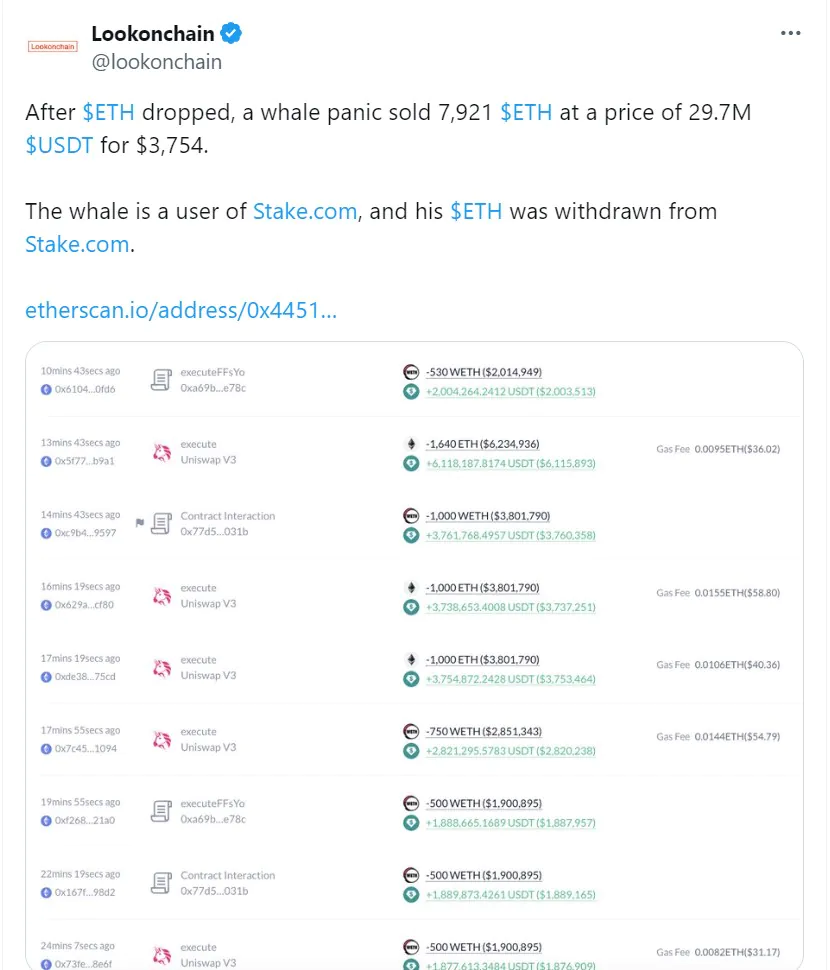

However, it then surged to nearly $3,900 upon the emergence of initial unconfirmed reports suggesting approval, eventually settling above $3,800 after confirmation. Amid these large price swings, a whale sold a substantial 7,900 ETH holdings worth $29 million.

During this turbulent period, liquidations of leveraged crypto derivative positions surged to over $350 million throughout the day, marking the highest figure since May 1, according to CoinGlass data.

Related: SEC Officially Approves 8 Ethereum Spot ETFs

Most of these liquidated positions were longs, anticipating price increases, totaling approximately $250 million. This indicates that traders who had overextended themselves with leverage were caught off guard by the abrupt price drop. ETH traders were particularly affected, with $132 million in liquidations.

ETH Price Action Ahead

The approval of the spot Ethereum ETFs could drive more than $500 million in inflows, as predicted by analysts. However, this might take some time to materialize and initiate an uptrend.

Several on-chain indicators suggest that Ethereum could easily establish a base above $4,000 and continue rallying to $5,000-$6,000 by August this year.

While the approval of Bitcoin ETFs led to strong institutional inflows, it will be interesting to see if the launch of Ether ETFs will lead to greater institutional adoption.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

Hi

Please

I thought I made money here

Hi

Hi