During the initial three days on the market, spot Bitcoin ETFs recorded a cumulative trading volume of around $10 billion, maintaining Grayscale Investments and BlackRock as frontrunners in this sector.

Grayscale’s recently transformed Bitcoin Trust ETF (GBTC) reported Tuesday’s trading volumes at approximately 25 million shares, equivalent to $970 million, based on data from Yahoo Finance analyzed by Blockworks. This followed trading volumes of $2.3 billion and $1.8 billion on Thursday and Friday, respectively.

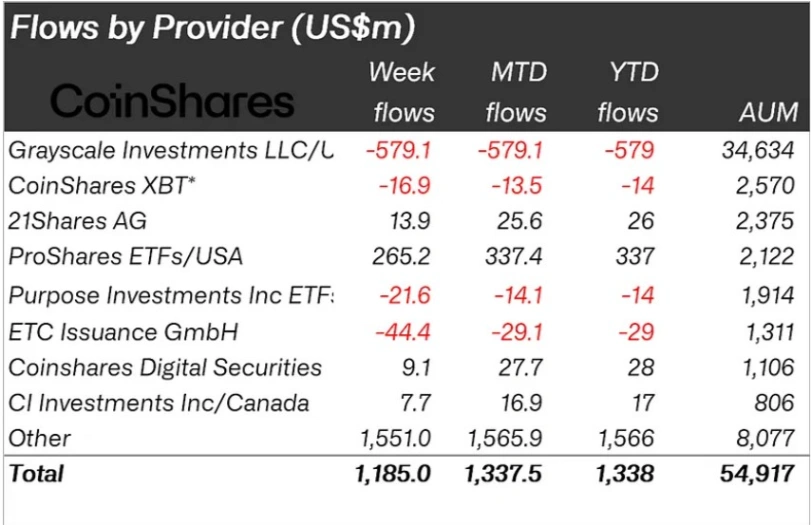

Despite the substantial trading activity, the elevated volumes for GBTC did not indicate a net influx of funds. According to a CoinShares report released on Monday, the trust experienced net outflows of $579 million last week. Although recently converted to an ETF, GBTC had its origins in 2013 and currently manages approximately $27 billion in assets.

Industry analysts, as reported by Blockworks last week, anticipated continued outflows for GBTC over time, citing its comparatively high fee of 1.5% compared to competitors.

On the other hand, BlackRock’s iShares Bitcoin Trust (IBIT) recorded trading volumes of nearly 15 million shares, amounting to approximately $370 million on Tuesday. Simultaneously, the Fidelity Wise Origin Bitcoin Fund (FBTC) saw around 8.2 million shares, valued at approximately $310 million, traded during the day.

Uncommon for Ether to Outperform Bitcoin by 15%

The last occurrence of Ether outperforming Bitcoin by 17% took place 14 months ago, as Ether surged from $1,305 to $1,615 within seven days leading to October 29, 2022. However, the subsequent closure of the gap occurred swiftly in the following 11 days, with ETH crashing below $1,100 on November 9, 2022.

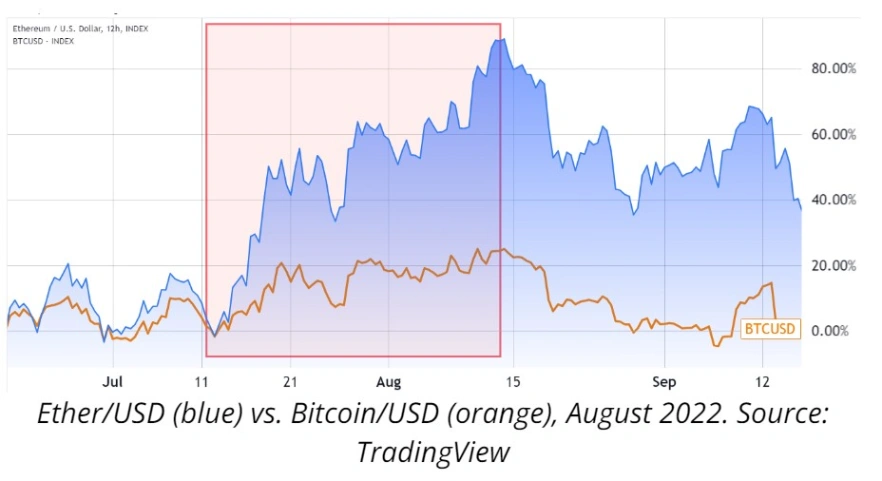

It’s crucial not to rely on a single historical instance for price guidance, especially considering the unique circumstances surrounding November 2022, marked by the FTX exchange downfall due to reports of fund mismanagement and a potential $8 billion shortfall. A counter-example exists in the 31 days from July 13, 2022, to August 13, 2022, during which Ether outperformed Bitcoin by an impressive 63%.

Despite Ether’s rally from $1,080 to $1,990 during the period ending August 13, 2022, and its inability to breach the $2,000 mark, the gap relative to Bitcoin’s price persisted in the following month. This sustained gap, despite a correction in the overall cryptocurrency market capitalization, deviated from the norm, considering Bitcoin’s usual dominance.

Ethereum Network Activity Indicates Robust Strength and Growing Demand for ETH

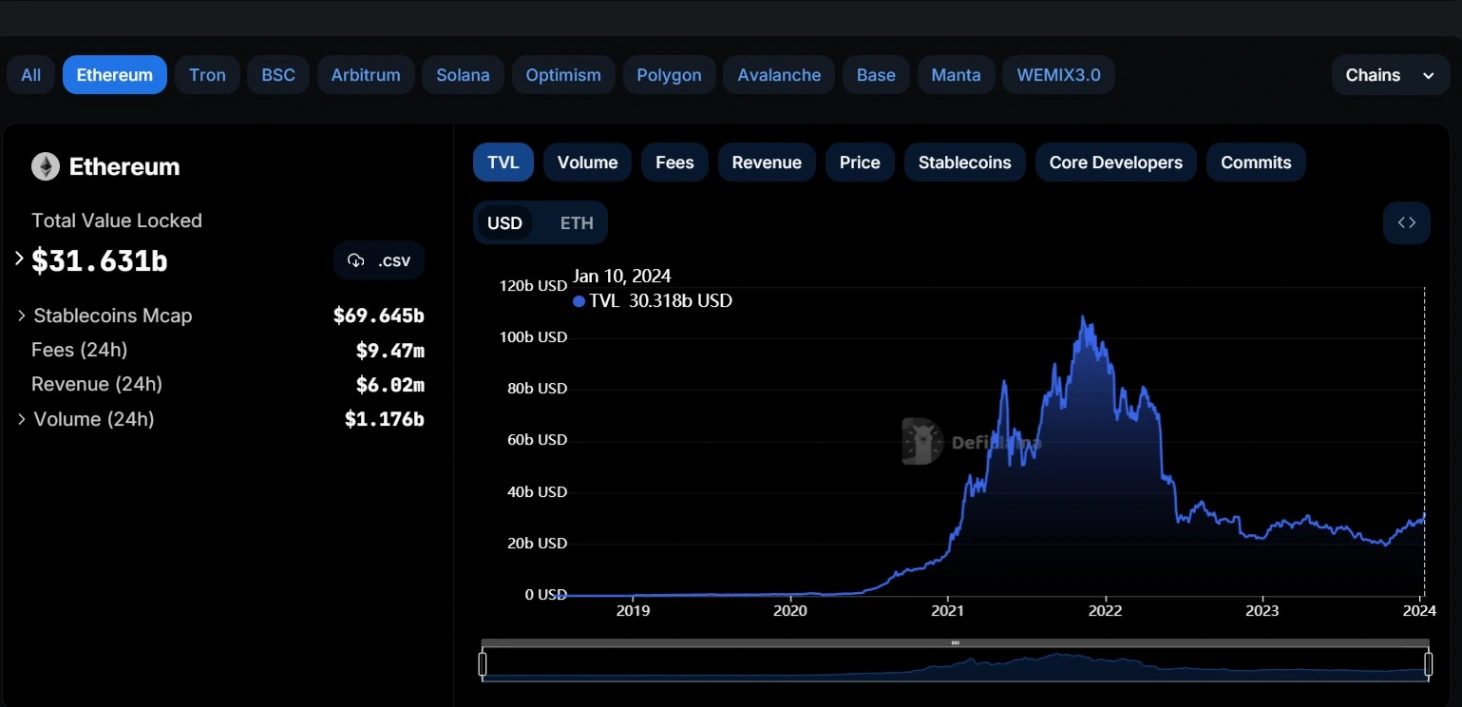

To assess Ether’s ability to maintain the $2,500 support, it is essential to scrutinize Ethereum’s network activity, including its scaling solutions. The strength and demand for ETH can be gauged through decentralized applications (DApps), as their usage, users, and volumes are key indicators of Ether’s market demand.

To gauge network demand, analyzing metrics related to decentralized application (DApp) usage is crucial, especially considering that projects in areas like gaming, decentralized finance (DeFi), and non-fungible token marketplaces may not be financially intensive, making the total value locked (TVL) metric less relevant. Over the past 30 days, leading Ethereum DApps have witnessed an average 26% decrease in the number of active addresses.

Despite this decline in active addresses, Ethereum DApps recorded a notable 41% increase in volume over the same period, driven by surges in Uniswap, Balancer, ParaSwap, and Aave. Even when excluding activity in Ethereum rollups, the base layer maintains a 6 to 1 advantage over its primary competitor, BNB Chain. This underlines how criticisms of Ethereum’s high fees, raised by bears, are overstated in terms of its dominance in the DeFi industry.

Related: Is Ethereum’s Comeback Possible as it Struggles Against BTC?

In addition to robust on-chain activity, Ether’s price could receive a boost from the upcoming “Dencun” hard fork. This upgrade aims to enhance data availability and reduce costs for rollup transactions, with test implementations expected to commence on January 17. Additionally, analysts from Bloomberg ETF project a 70% likelihood of an Ethereum ETF approval by May, further strengthening bullish momentum and the $2,500 price support.