Ethereum (ETH) has undergone a period of strong growth, surpassing $4,000, highlighting the possibility of surpassing its previous all-time high (ATH).

Although the price has dropped from its peak, there are still positive signs, with the prospect of setting a new ATH still within reach.

How is Ethereum supply trending on exchanges?

According to new data from CryptoQuant, Ethereum is showing strength through a gradual decrease in the amount of ETH sent to exchanges. The chart illustrates a consistent decrease in the amount of ETH sent for live trading on the exchange over the past few months. This signal shows that some holders have withdrawn their funds from the exchange, a sign of holding assets or buying and holding.

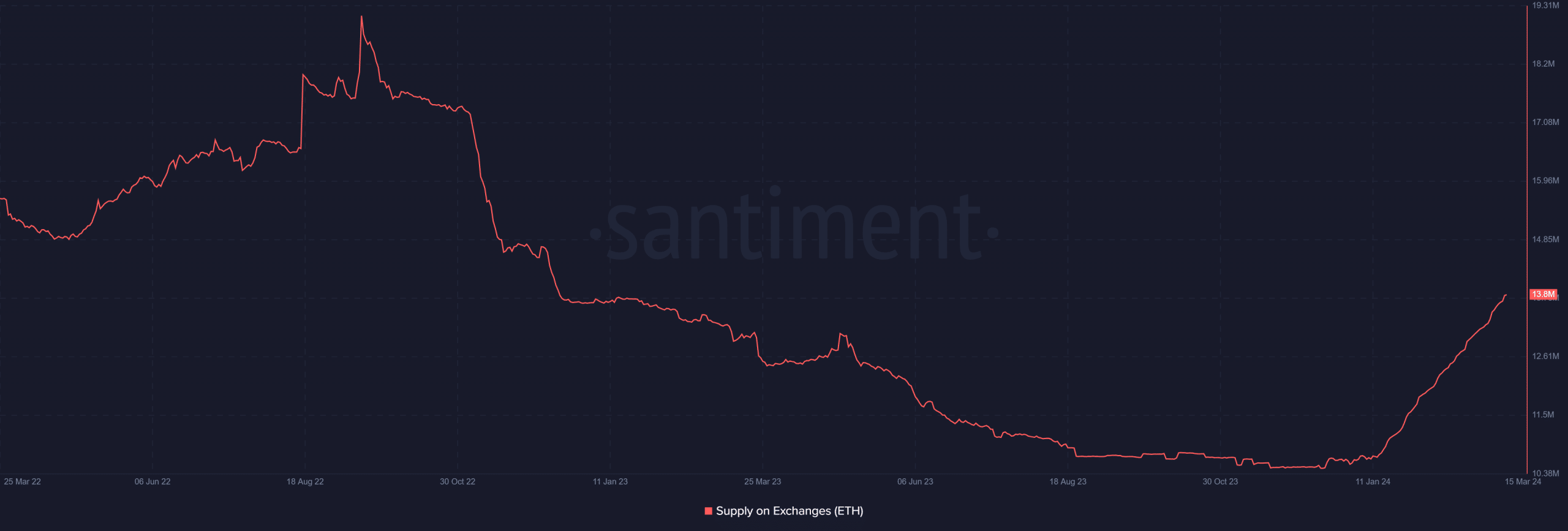

However, a more detailed look from Santiment shows the opposite trend. Since January, Ethereum supply on exchanges has increased. The chart shows an increase from about 10 million to more than 13 million at this time.

Source: Santiment

This increase shows that a large number of users have transferred their ETH to the exchange, possibly to take advantage of ETH’s recent price fluctuations.

Comparing off-exchange supply with on-exchange supply provided a clearer view of the situation. Analysis of supply on the exchange shows a relatively stable recent trend. The volume is over 121 million to date, indicating a significant amount of ETH is held outside of exchanges.

Ethereum falls below new high

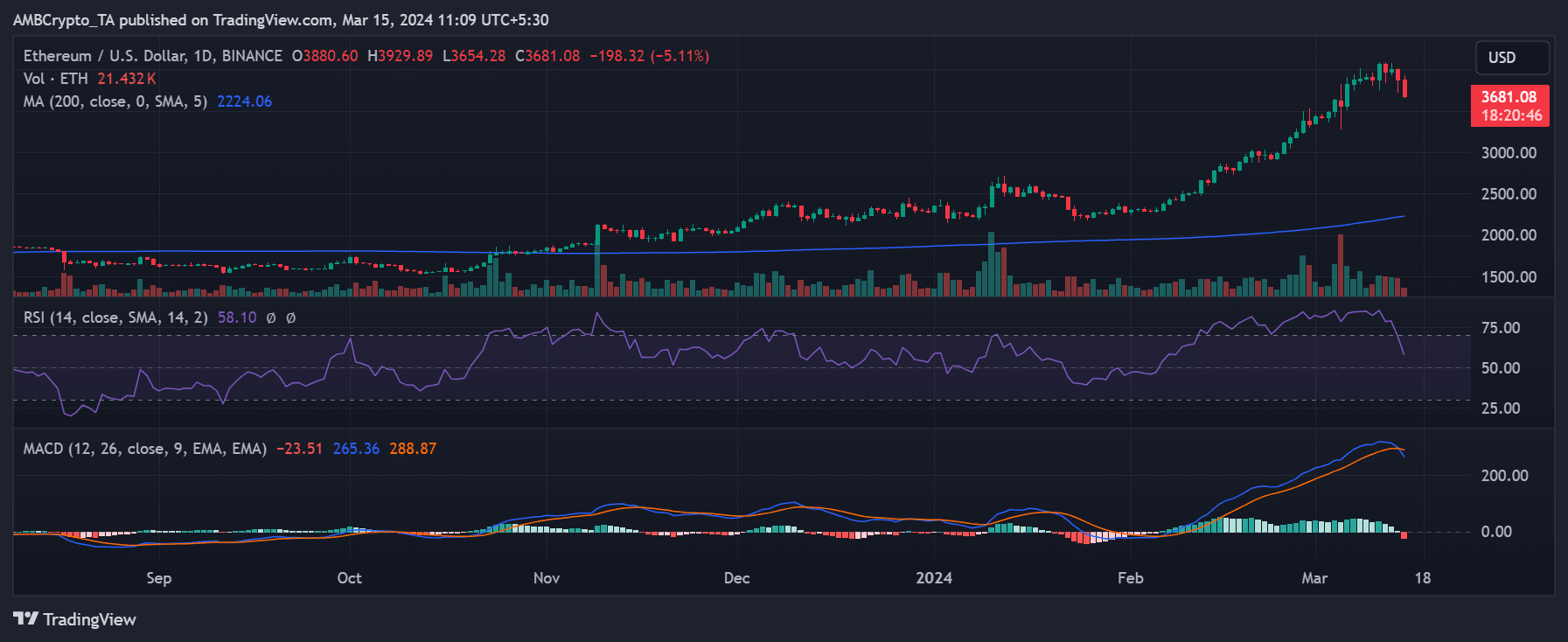

Ethereum has recorded a sharp decline, taking the price below new highs. Analysis of Ethereum’s daily performance shows a drop of more than 3% late on March 14, when the price stabilized around $3,870. This marks a step back from the $4,000 price level at the beginning of the week.

Source: Trading View

However, as of press time, the decline has escalated further, with the price falling more than 5% to around $3,680. This is the largest and consecutive decrease since around February 24.

Related: Ethereum Dips as Demand for Put Options Surges Significantly

The volume of holders continues to increase

Despite signs of a downturn, data on Ethereum supply on exchanges suggests this may just be a temporary reaction. Supply on exchanges is still significantly exceeding supply on exchanges, indicating that a large amount of Ethereum is held outside of exchanges.

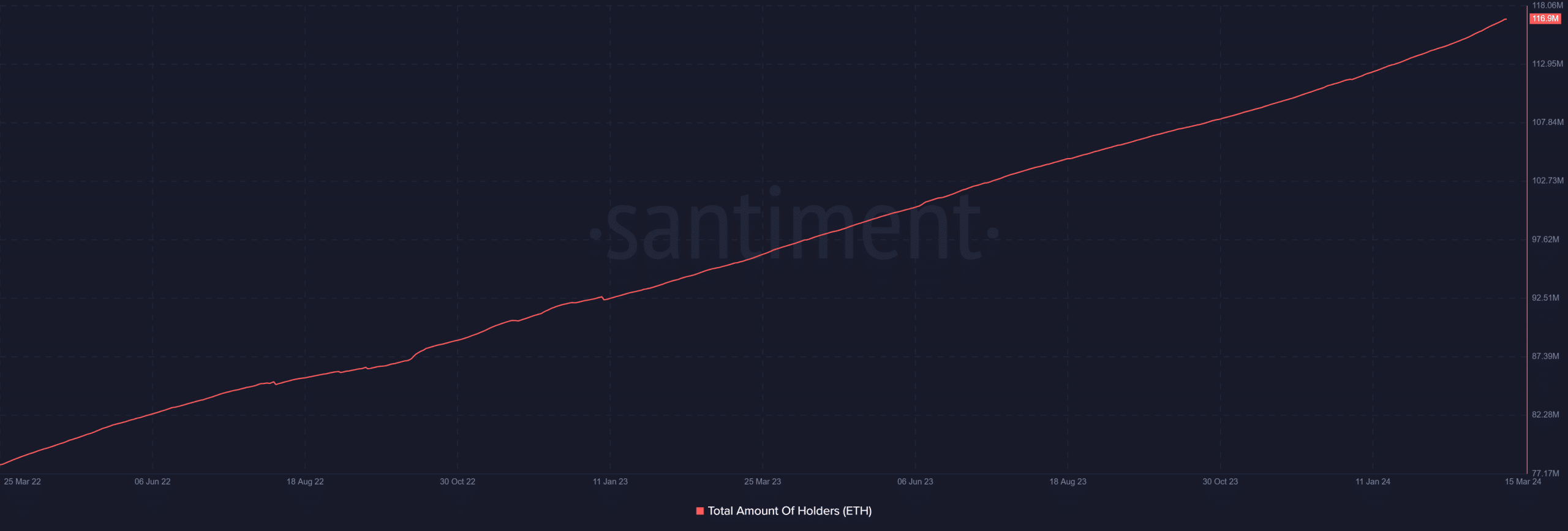

Source: Santiment

Meanwhile, the number of Ethereum holders continues to increase, according to analysis from Santiment, showing a steady increase over many months. As of this writing, the number has reached 117 million. This increase shows steady interest from investors continuing to accumulate Ethereum.

The accumulation trend remains a positive sign for Ethereum’s price, despite the recent price drop, when combined with significant holdings of Ethereum outside of exchanges.