Interest in Ethereum [ETH] has escalated as the bullish mood in the cryptocurrency market soared, especially after the approval of the Bitcoin ETF. However, as it progresses, there are signs that Ethereum’s bullish trend is undergoing a change.

Interest in put options increased

According to data from QCP, ETH’s risk shift to the downside shows growing demand for put options, which are seen as a hedge against potential risks from fixed buying position. Additionally, altcoin investors can also buy ETH put options to mitigate the downward price fluctuations of altcoins. These reactions are raising concerns about the possibility of a market correction, especially given the high level of leverage in the market.

However, it is predicted that the market will react strongly to any downward price fluctuations. The shift to a bearish mood could be driven by upcoming events that could create volatility in ETH price, including the Dencun upgrade, which could impact prices and sentiment of the market.

Concerns about the upgrades are to be expected, as not all upgrades have a positive impact on the price of ETH. For example, the Merge update to move Ethereum from a Proof of Work to Proof of Stake network caused a major adjustment.

These concerns, coupled with uncertainty about the approval of Ethereum ETF applications, could create FUD in the market.

How is ETH doing?

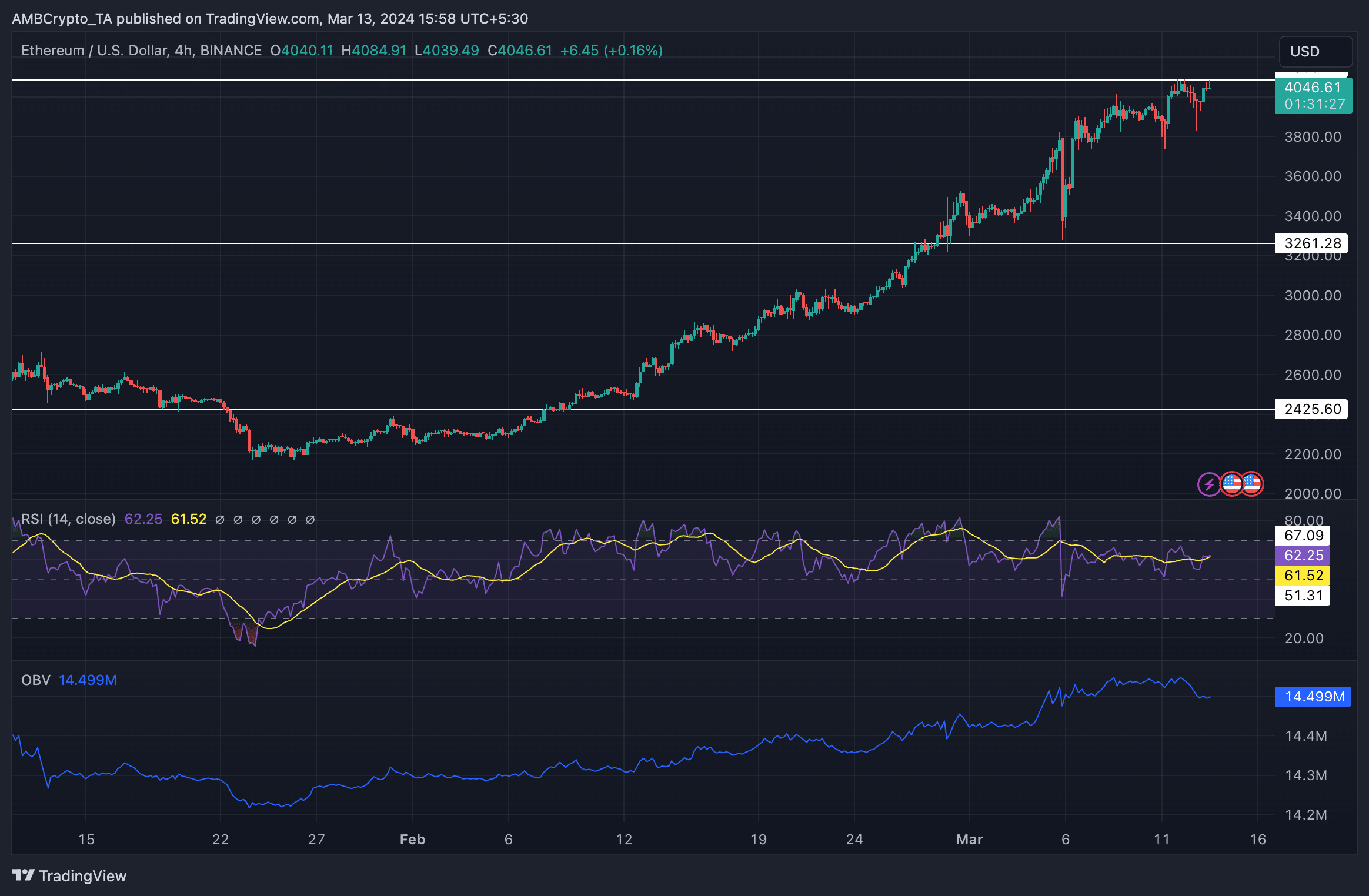

Source: Trading View

Regarding the current situation of ETH, at the time of writing, ETH is trading at 4046 USD and has increased steadily to this price. Despite some minor adjustments, the overall trend is still up.

Related: Successful Deployment of Dencun Upgrade

However, ETH’s OBV (On Balance Volume) has decreased significantly over the past few days. This shows that selling pressure is greater than buying pressure, potentially indicating a weakening trend or upcoming price decline.

Retail continues to accumulate

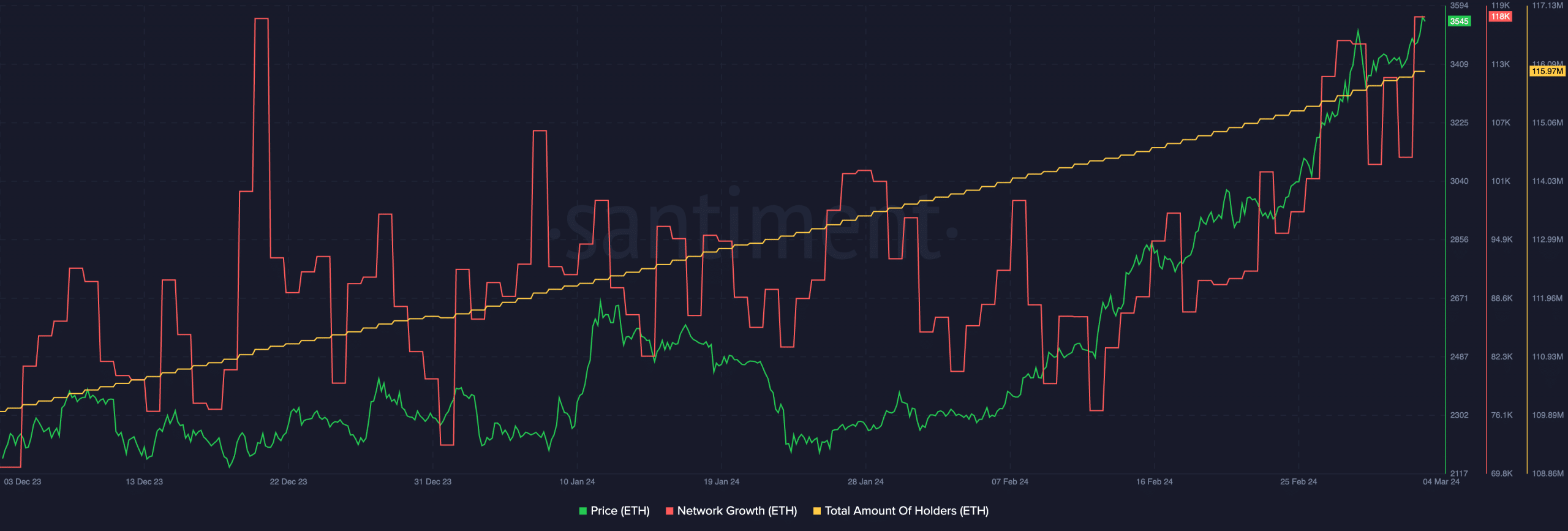

Source: Santiment

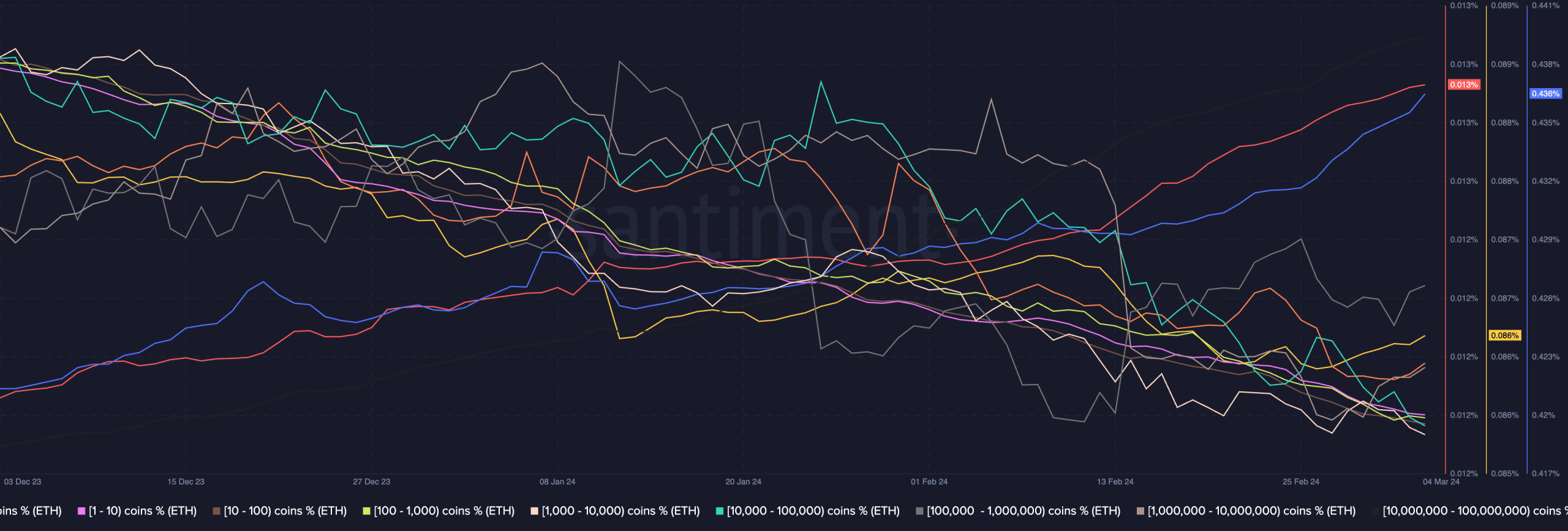

ETH network growth is also increasing, showing interest in ETH from new addresses. However, when looking at the behavior of addresses in general, we see that it is mainly retail investors who are showing more interest in ETH. On the other hand, large investors are not showing the same interest and are not accumulating ETH to the same extent.

Source: Santiment

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE