Volatility in the price of Ethereum (ETH) continues to attract investor interest despite weekly fluctuations, as it maintains its position as the world’s second largest cryptocurrency by price market value.

On May 3, the price of Ethereum not only recovered but also significantly surpassed the $3000 mark. This development has reinvigorated the market and increased a sense of optimism among the investor community.

Ethereum whale activity

The growth in question, combined with a significant increase in activity by major investors, has drawn attention to the future price movements of the coin. Recently, around 36,000 ETH were converted and large investors made these competitive transactions with Solana.

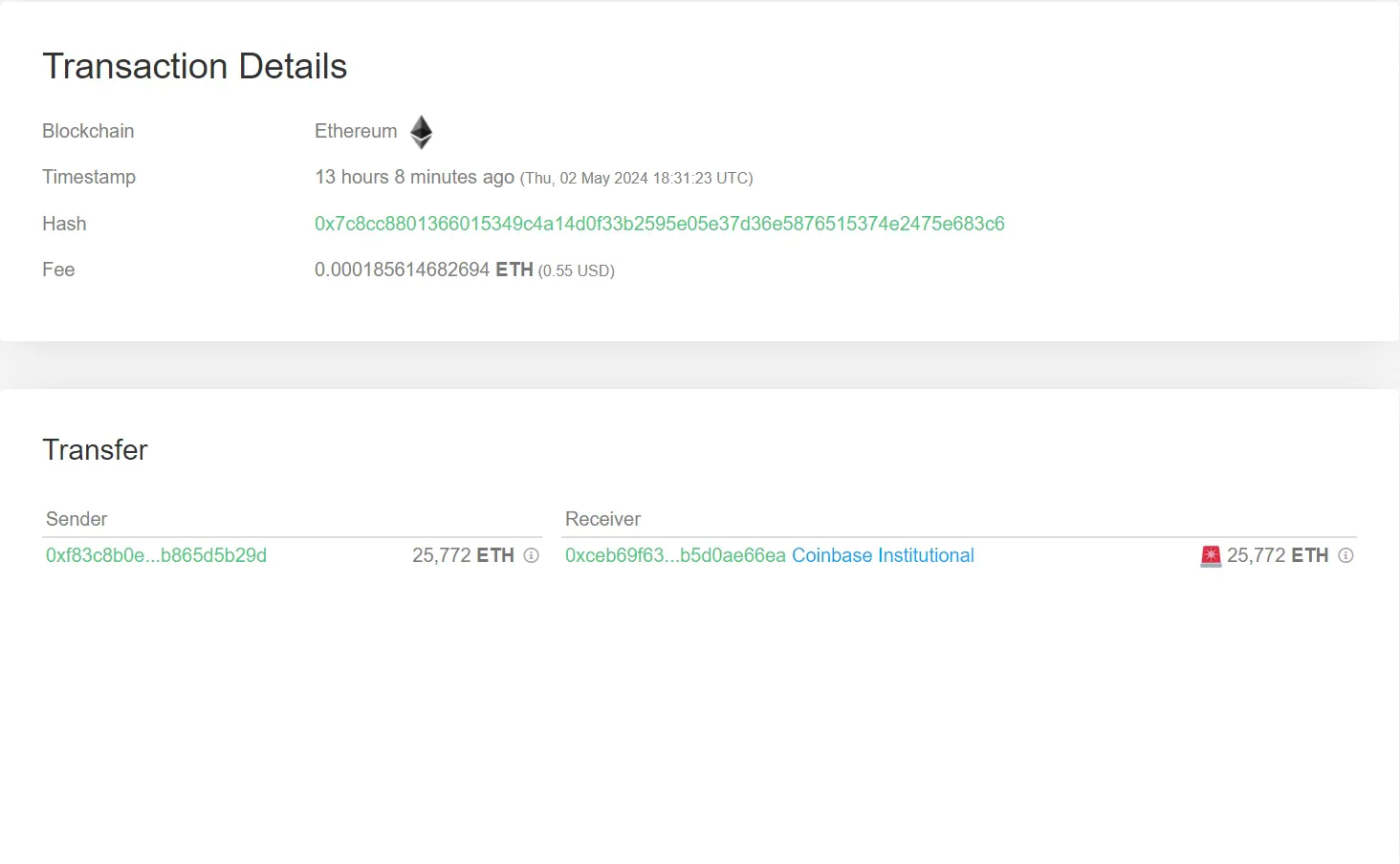

Online analytics platforms have revealed that a total of 36,762 ETH were converted the previous day. Notably, the large investor with address 0xf83c… made an important move by transferring 25,772 ETH to Coinbase Institutional, one of the leading companies in the cryptocurrency sector. In contrast, the large investor with address 0x0b4… purchased 10,990 ETH from Coinbase during the same period, demonstrating contrasting strategies.

Ethereum historical data

Ethereum’s recent price movements, along with the corresponding transactions, have caused a mixed feeling in the larger cryptocurrency market. While one major investor continued to buy tokens amid the market downturn, another major investor sold a large amount of similar tokens, highlighting the bearish trend of ETH.

Related: ETH Trading at $3000 But Demand on the Decline

However, at this point, the bullish trend has shifted to a more bullish shape. At the time of writing, Ethereum’s price has increased by 3.08% over the past 24 hours and is currently at $3,001. Investors are watching the price move at $3000, as shown by the monthly chart showing the consolidation period.

Investors continue to carefully monitor the token’s price movements to discern more information on price trends amid sharp declines in the stock market and BTC following the rally, potentially affecting the market dynamics. Notably, XRP, a token backed by Ripple Labs, has experienced a period of stagnation in value since entering a legal battle with the US SEC. On the other hand, historical data shows that after halving cycles, there is often a sharp increase in altcoins. However, this does not always guarantee future price movements.