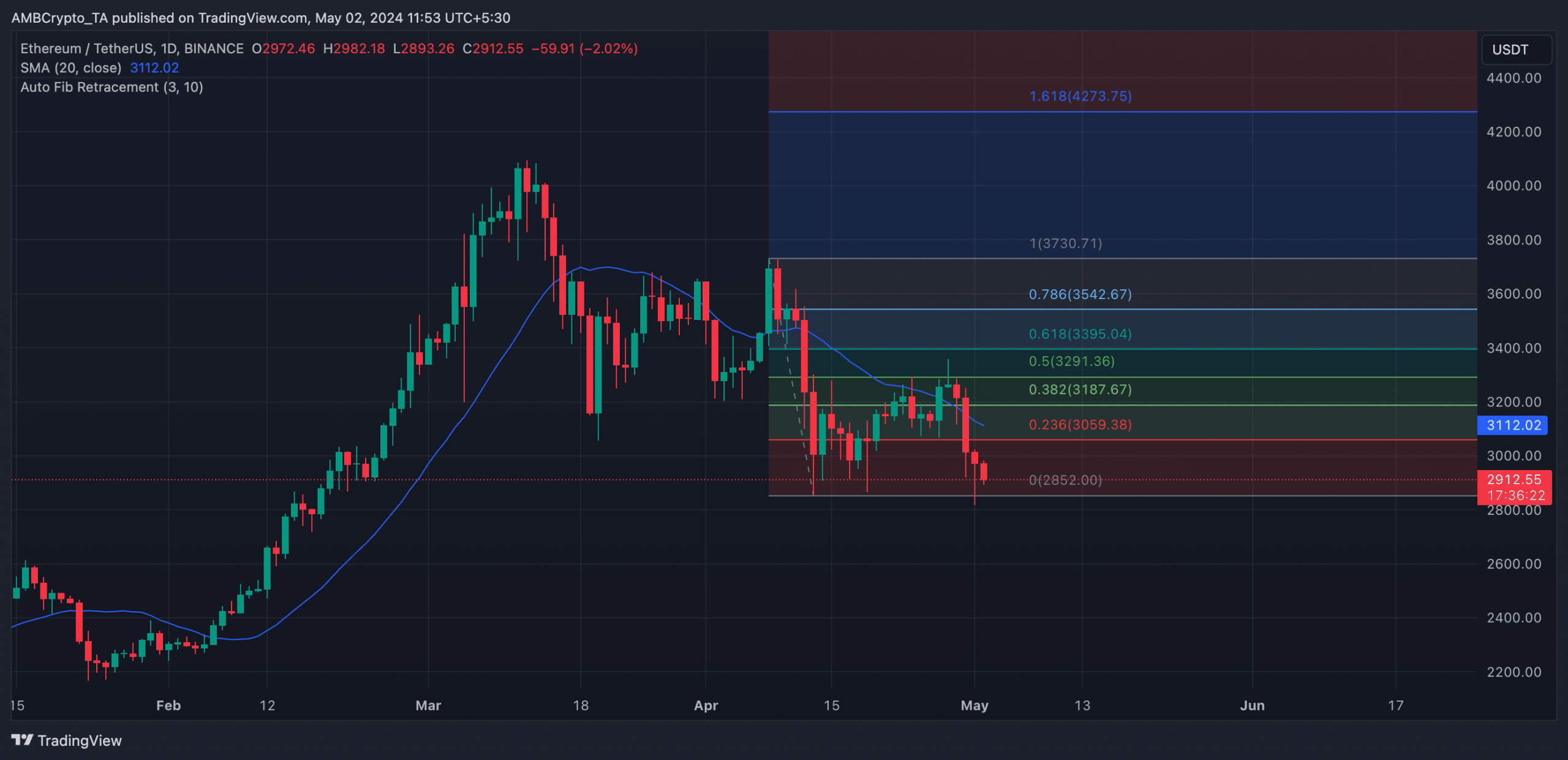

Ethereum (ETH) recently crossed above the 20-day simple moving average (SMA), which could lead to a deeper decline in the short term. When the price of an asset goes below the 20-day SMA, this usually indicates that the short-term trend of that asset is bearish. Traders often take this as a sign that sellers are in control and the price may continue to fall.

ETH price movement data on the 1-day chart shows that the price fell below the 20-day SMA on April 30. As selling pressure increased, ETH broke support and closed the trading session on May 1 at low $2850. Although the price has fallen to $2,913 at press time after 24 hours, the upward pressure is still too weak to sustain any significant price increase in the short term.

Source: ETH/USDT on TradingView

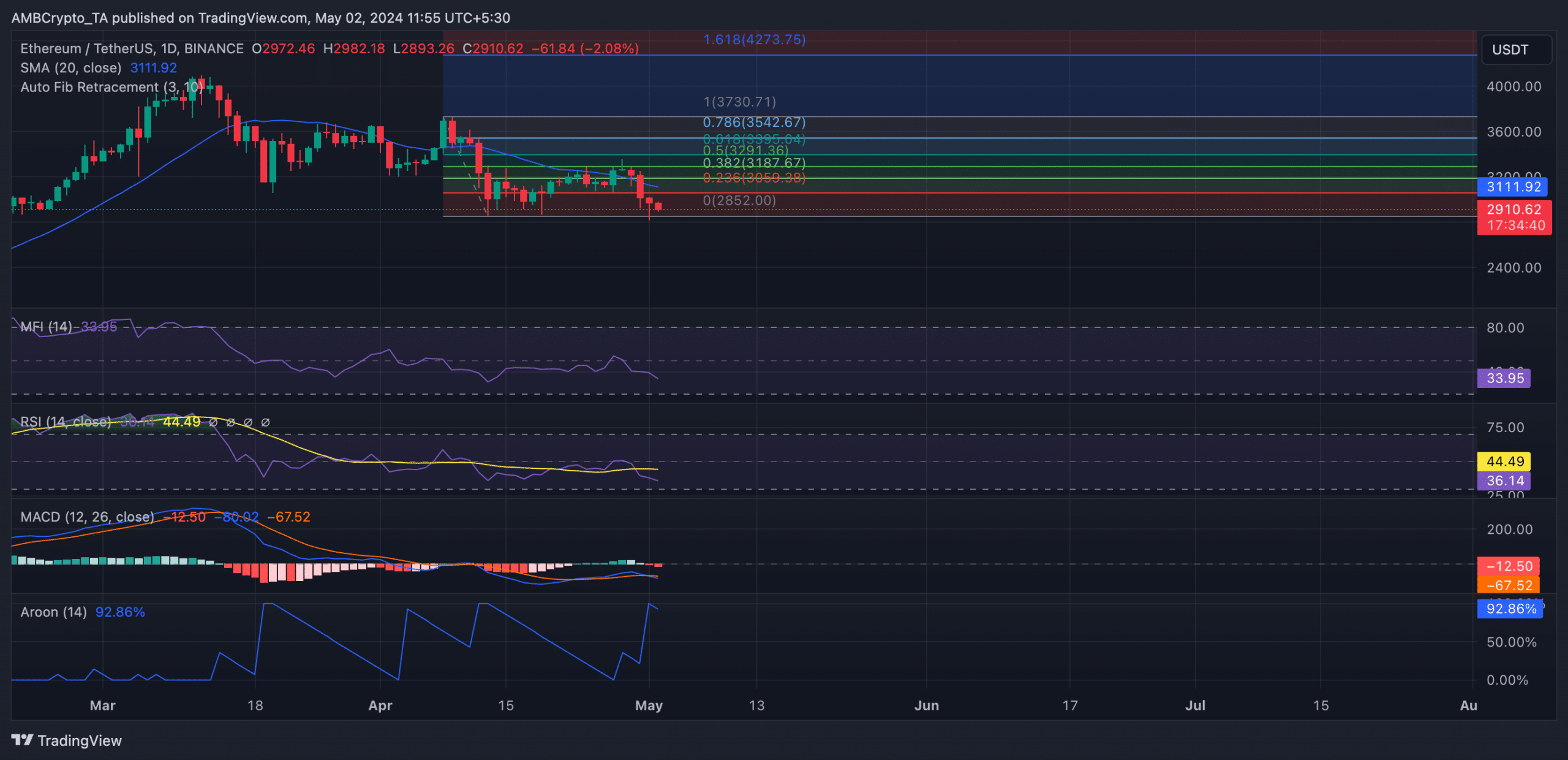

On May 1, ETH’s MACD line (blue) crossed above the signal line (orange) in a downtrend as the price fell below support. This intersection is a bearish sign. Both lines are below the zero line, which, when this happens, confirms the current downtrend and indicates the possibility of further declines in ETH price.

At the same time, ETH’s Aroon Downlink (blue) at the time of this writing is 92.86%. This indicator identifies trend strength and potential reversal points in an asset’s price movement. When the Aroon Down line is near the 100 level, this shows that the downtrend is strong and the price has recently reached a relative low.

Related: SEC Continues to Delay Approval of Immediate Ethereum ETF

Additionally, key ETH momentum indicators have shown a significant decrease in demand for altcoins. The relative strength index (RSI) is currently 36.46, while the money flow index (MFI) is 33.96. The values of these indicators show that market investors are prioritizing the distribution of ETH rather than the accumulation of new coins.

Source: ETH/USDT on TradingView

An assessment of ETH’s network activity using a 30-day average confirmed a decrease in demand for the altcoin over the last month. According to data from Santiment, the number of daily addresses involved in at least one ETH transaction last month decreased by 7%.

Similarly, the number of new addresses created for ETH decreased last month. On-chain data shows that this number has decreased by 10% in the past 30 days.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE