In February, the Ethereum price experienced a notable surge alongside Bitcoin, reaching new yearly highs. Interestingly, this upward momentum hasn’t prompted significant actions from ETH holders, as both retail and whale investors continue accumulating in anticipation of breaking a pivotal resistance zone unchallenged since April 2022.

Ethereum Price Braces for Bullish Test

As of the latest update, Ethereum is trading at $3,527, reflecting a 40% increase over the past three weeks and marking multi-month highs. The altcoin is now approaching a crucial resistance zone ranging from $3,582 to $3,829, a formidable barrier for ETH over the past three years.

Historically, during previous bull runs in April 2021 and August 2021, Ethereum breached this resistance but failed to test it as support. The eventual successful test of the upper limit at $3,829 led to ETH achieving an all-time high of $4,626.

Notably, this marks the second attempt in the past two years, with the previous one falling short in March 2023. The significance of this zone is underscored by its alignment with the 50.0% and 61.8% Fibonacci Retracement, with the latter considered the bull run support floor. Therefore, breaching and successfully testing this resistance zone could signal a prosperous bull rally for ETH.

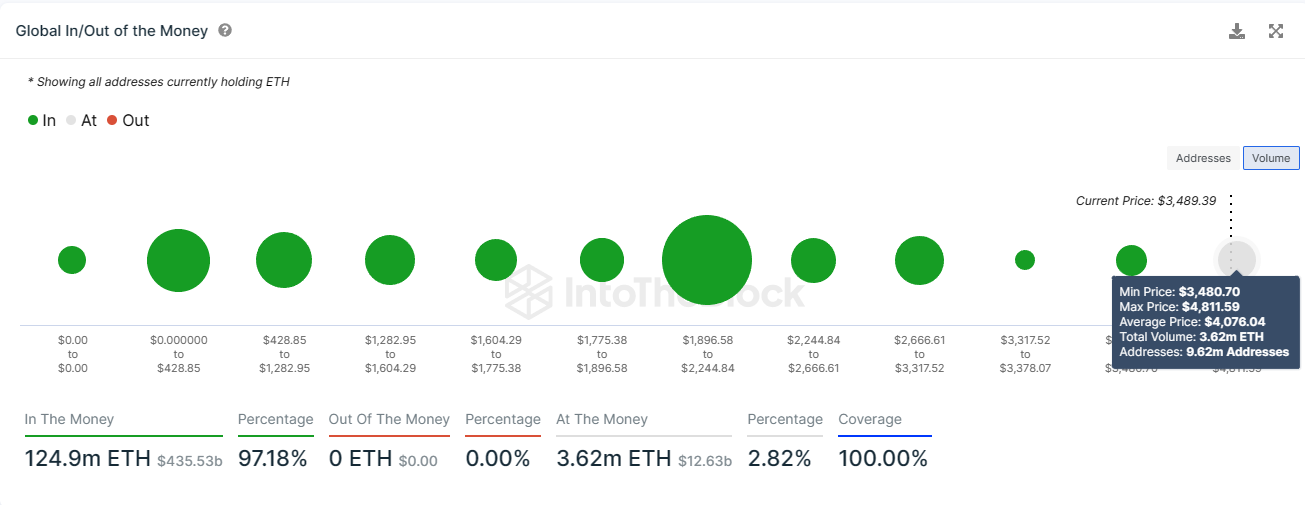

Despite the recent surge, ETH holders seem reluctant to sell and capitalize on profits, given that not much of the supply has become profitable during this 40% increase. According to the Global In/Out of the Money (GIOM) indicator, approximately 3.62 million ETH, valued at over $12.69 billion, is on the verge of profitability, indicating a potential motive for continued holding among the majority of investors.

Purchased at an average cost of $4,076, this supply is poised for profitability should the aforementioned breakthrough materialize. If successful, it would mark the first instance since November 2021 that over 90% of the entire circulating Ethereum supply is in a profitable position.

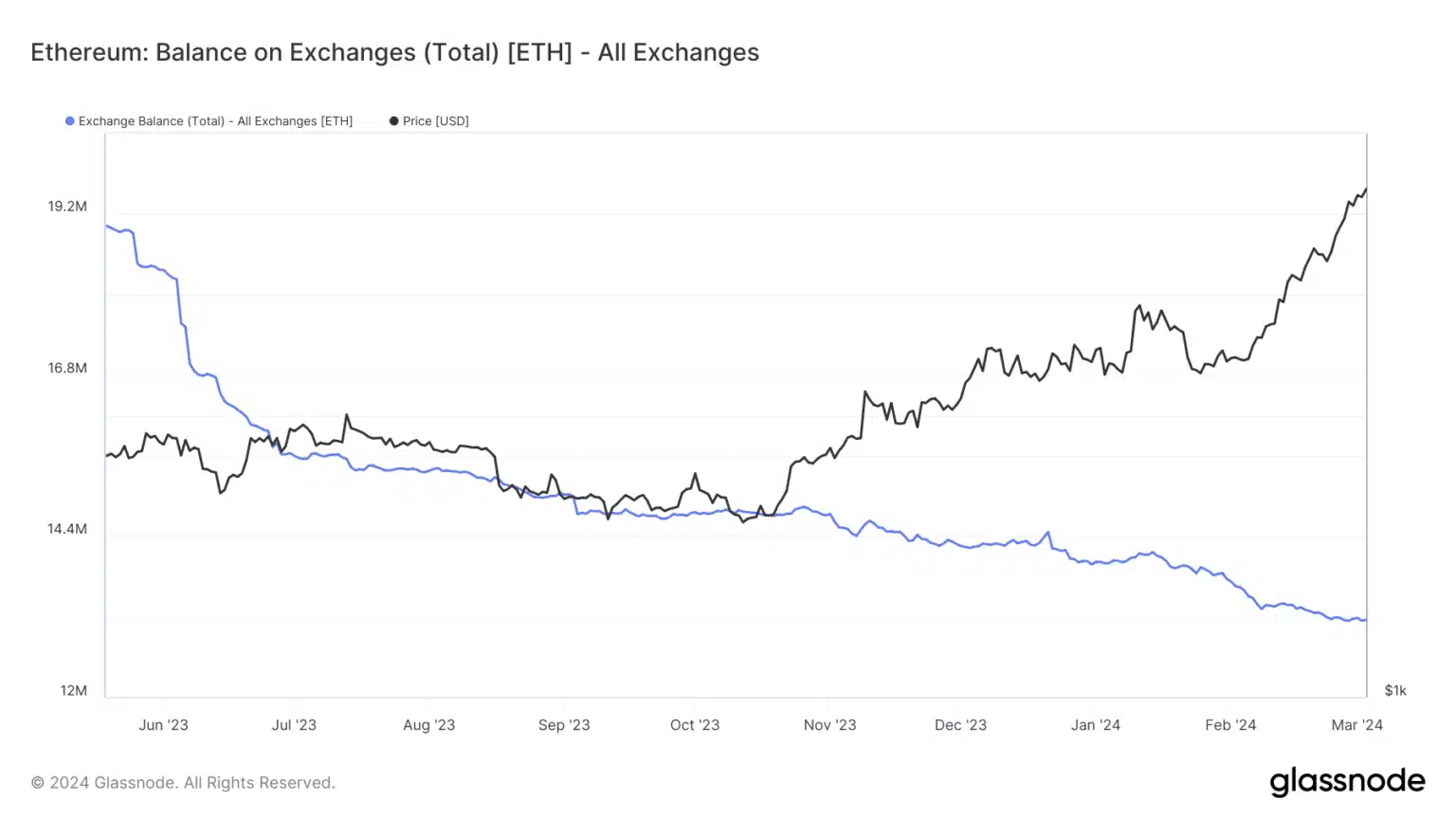

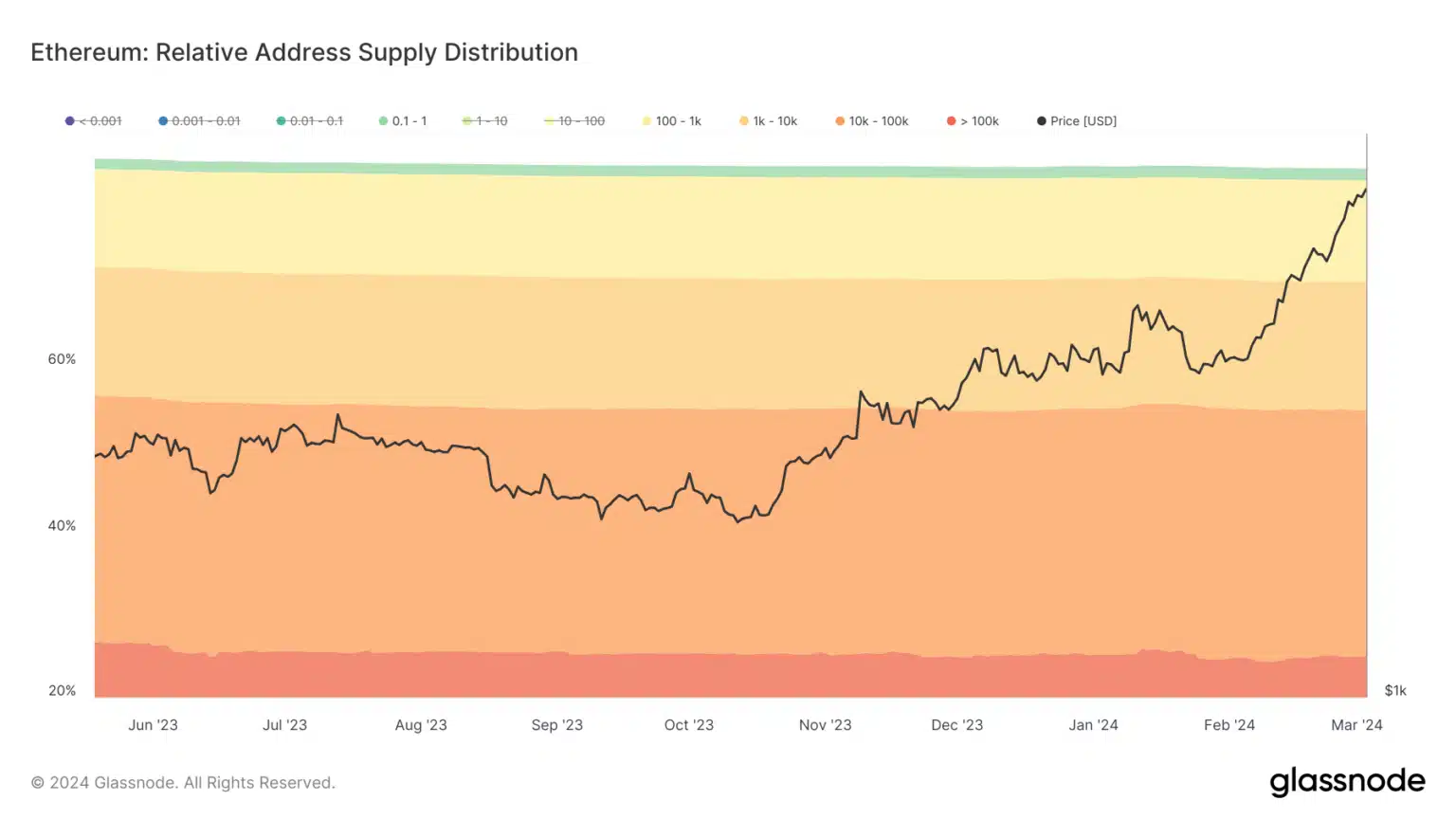

The steadfastness of ETH holders is evident in their actions. There has been no notable increase in supply on exchanges in the past month, a potential sign of reluctance to sell. Additionally, the balance of whales (addresses holding between 100 to 100,000 ETH) has not experienced a significant decrease.

As a result, both retail and whale holders are likely to resist the temptation to secure profits until there is clarity on whether Ethereum succeeds or fails in breaching the critical resistance.

ETH Price Prediction: Overbought Signal Suggests Potential Correction

In the event that ETH falls short of breaking the $3,582 barrier, a correction may be imminent. The Relative Strength Index (RSI) indicates that Ethereum is currently overbought, a condition not observed since May 2021.

Related: Ethereum’s Price Surge: Will It Hit $4,000?

Overbought assets suggest saturation of bullish sentiment, potentially leading to a sell-off for profit booking. Therefore, if the breach is unsuccessful, ETH holders might opt to sell to lock in profits before any potential downturn in the altcoin’s value.

On the weekly chart, a decline to $3,336 could be observed. However, a weekly candlestick close below this level would negate the bullish outlook, potentially triggering a further decline in the ETH price to $3,031.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE