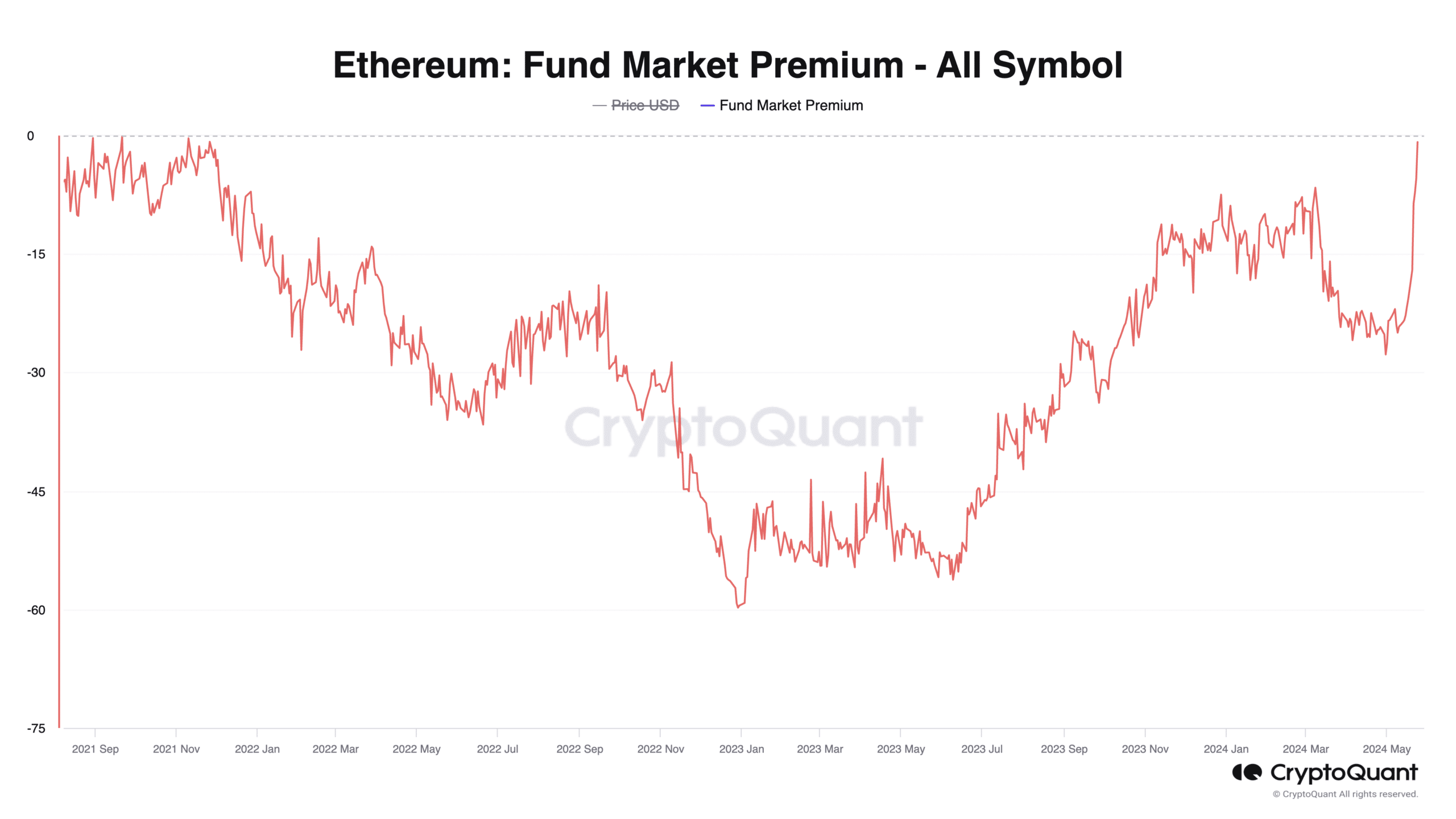

Ethereum is currently trading above $3800, facing selling pressure along with the broader market correction over the past 48 hours. According to CryptoQuant data, Ethereum’s [ETH] Fund Market Premium has reached its highest point in three years.

While this metric has been on an upward trend since early May, most of the recovery occurred after the U.S. Securities and Exchange Commission (SEC) approved eight spot ETH exchange-traded fund (ETF) applications on May 23.

The ETH Fund Market Premium measures the difference between the coin’s spot market price and the price of funds or trusts based on Ethereum. An increase in this metric indicates rising demand for ETH within investment funds.

This suggests that investors are willing to pay a premium to access Ethereum through investment funds rather than buying it at the spot market price. As of this writing, the ETH Fund Market Premium stands at -0.81.

According to CryptoQuant data, the last time it reached this level was on November 10, 2021. A few days later, on November 16, the altcoin hit its all-time high of $4,891.

Coinbase is bearing the brunt of this shift

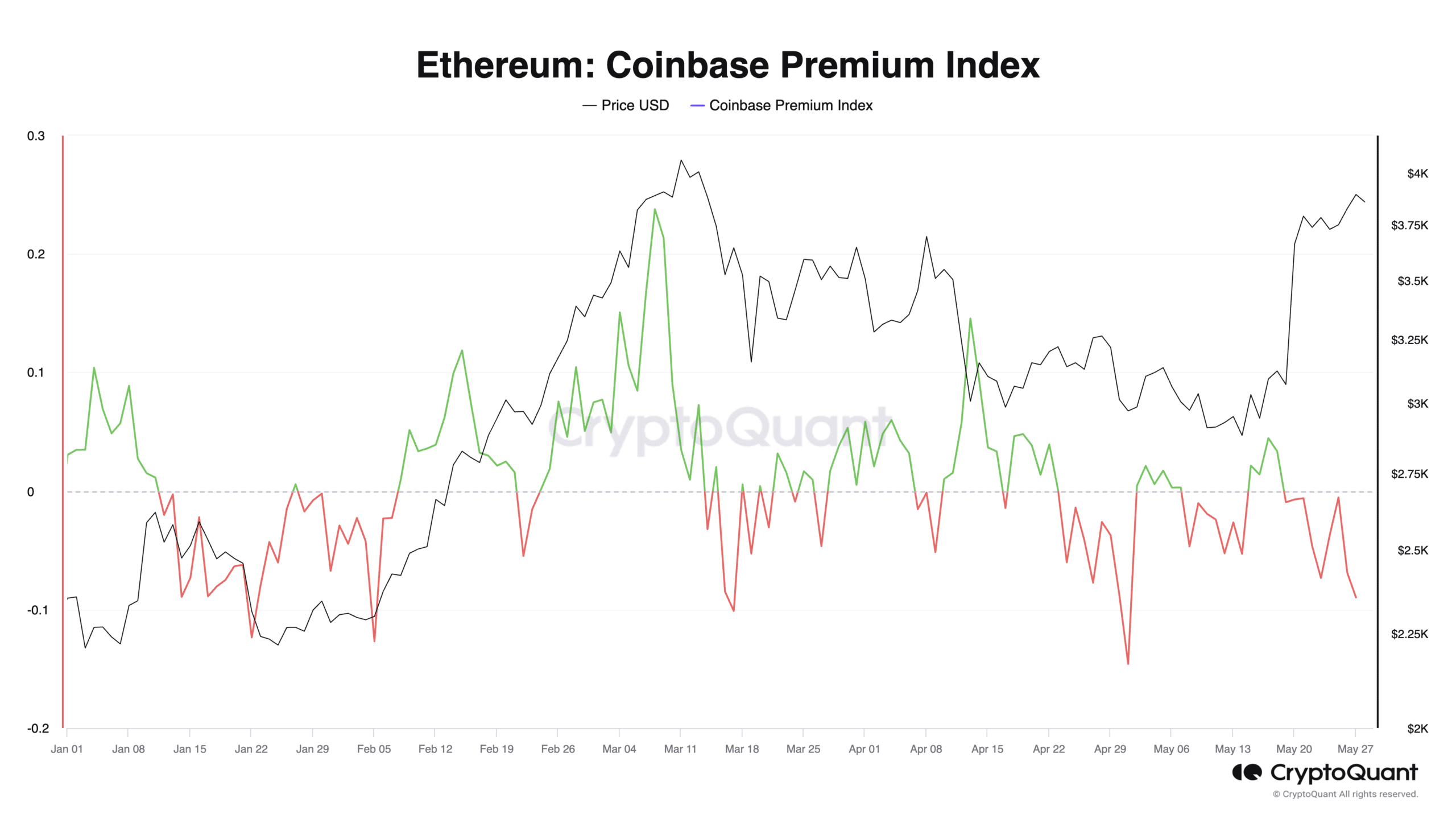

The gradual decline in the Coinbase Premium Index (CPI) highlights the growing preference among U.S. investors to access ETH through investment funds.

The CPI, which tracks the price difference between ETH on Coinbase and Binance, has dipped back into negative territory, indicating reduced trading activity on the U.S.-based exchange. As of this writing, ETH’s CPI stands at -0.08.

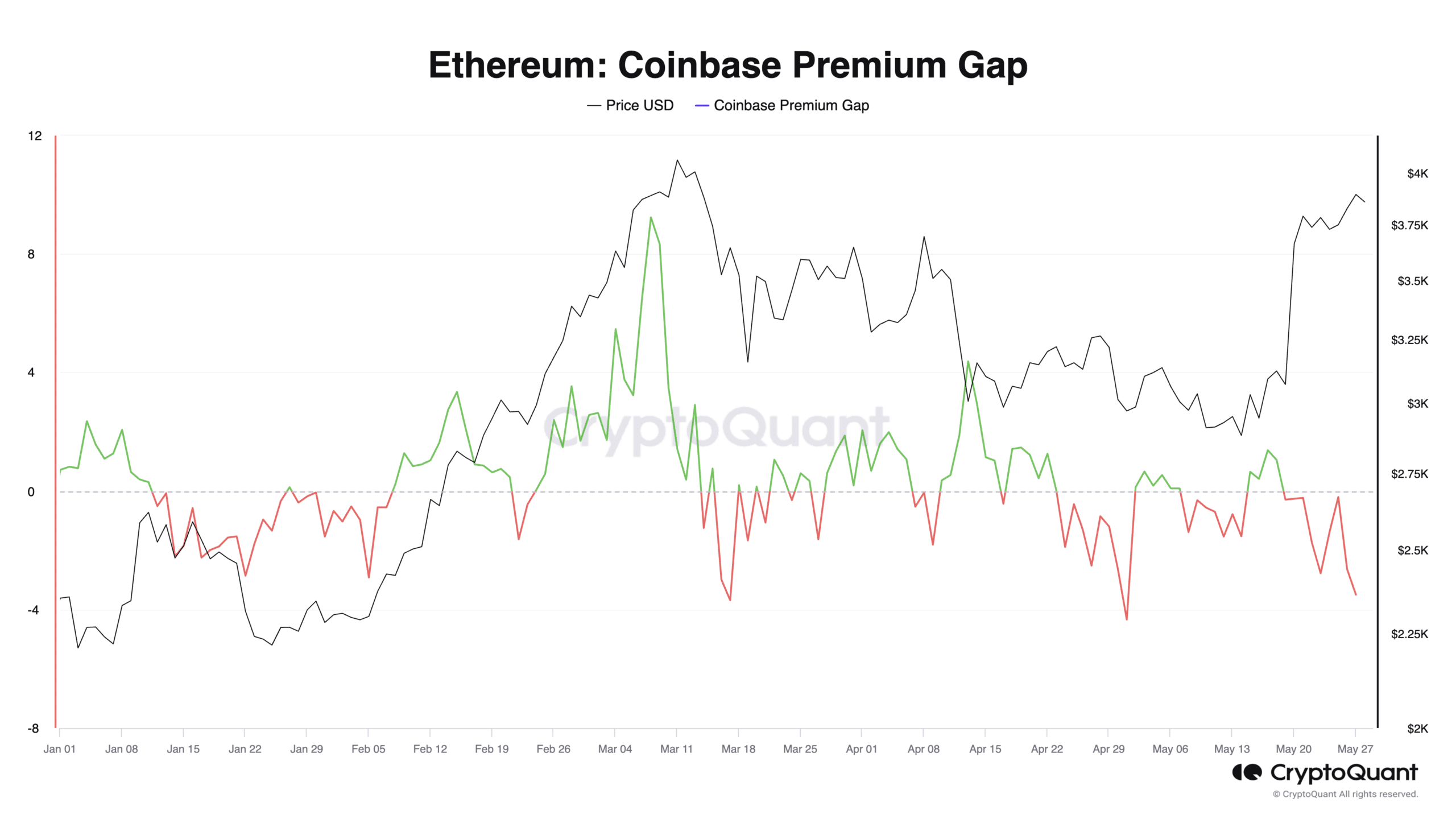

Corroborating this trend, the Coinbase Premium Gap (CPG) for ETH is also negative at the time of writing.

A negative CPG suggests that the altcoin is trading at a lower price on Coinbase compared to other major exchanges. This discrepancy can arise from various factors, including market imbalances and liquidity issues. In this case, however, it appears to be driven by a shift in focus towards ETH-based investment products.

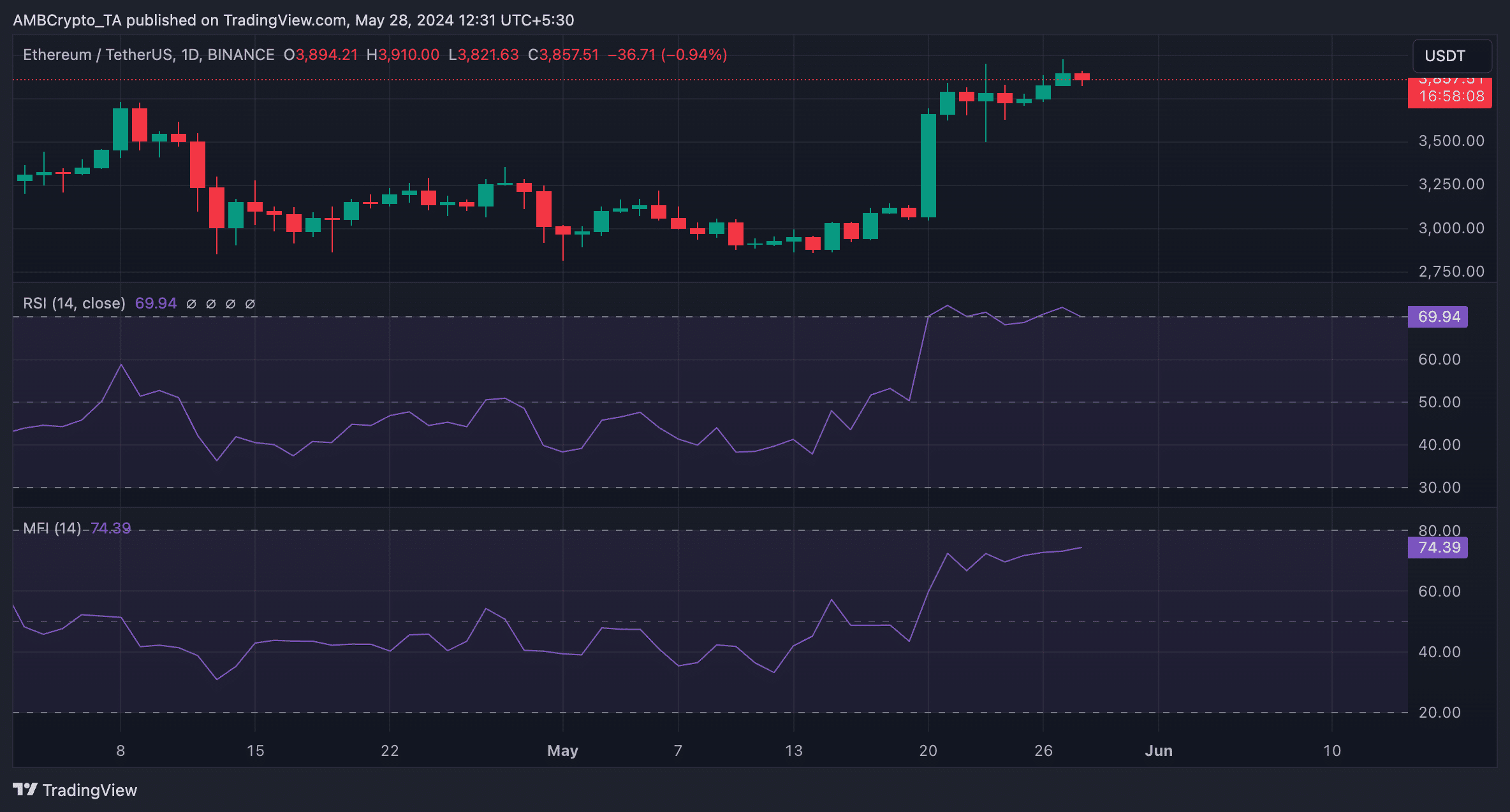

Reflecting the increasing momentum, key indicators show significant accumulation activity for ETH in recent days. As of now, ETH’s Relative Strength Index (RSI) is at 70.17, and its Money Flow Index (MFI) stands at 74.41.

Related: Spot Ethereum ETFs to Attract Massive Inflows

It is important to note that at these levels, buyers might be nearing exhaustion as the market overheats. Consequently, a minor price correction could be on the horizon.

BTC

BTC  ETH

ETH  USDT

USDT  SOL

SOL  BNB

BNB  USDC

USDC  XRP

XRP  DOGE

DOGE  TON

TON  ADA

ADA

Good job

High vvhh