Recent market fluctuations notwithstanding, altcoins such as Ethereum (ETH) and Ripple (XRP) have managed to maintain their positions over the past week.

Indeed, recent analysis has hinted at another potential surge in altcoin prices in the coming days.

Amidst Bitcoin’s (BTC) downward trend, which has seen the entire market lose value over the past few weeks, altcoins have been striving to hold their ground. According to the latest analysis from Rekt Capital, despite Bitcoin’s 18% recovery post-halving, the altcoin market cap continues to hover around $315 billion as a support.

Is there a buying interest in ETH?

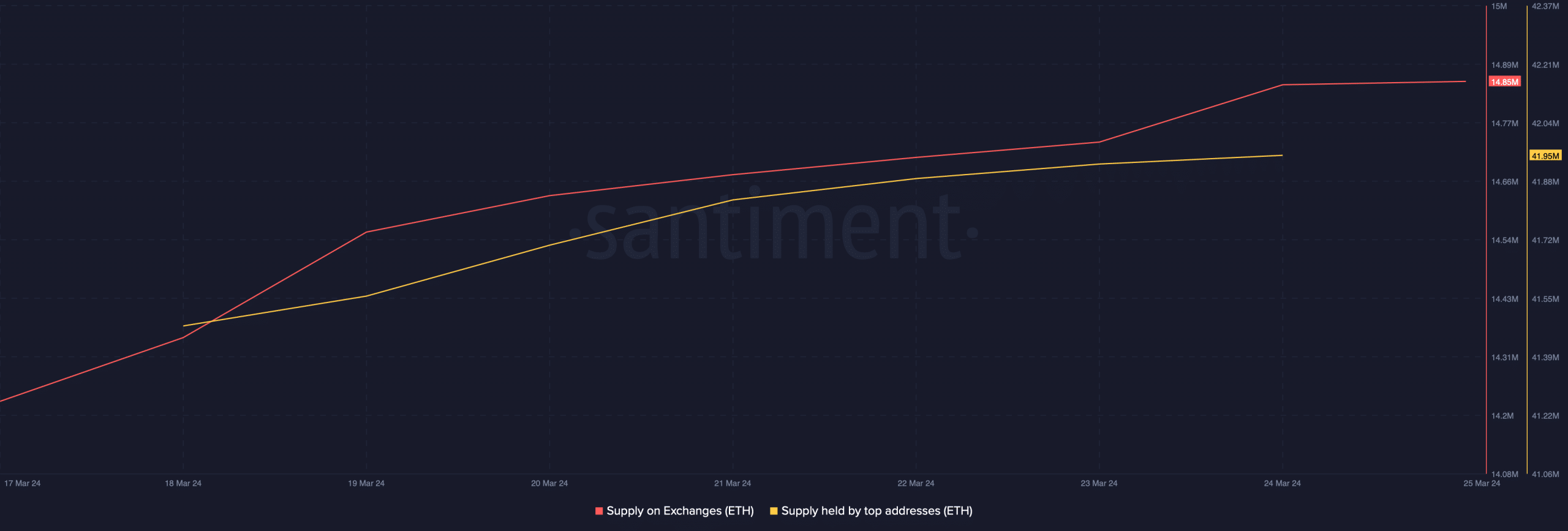

At the time of writing, there is significant selling pressure on ETH, evident through an increase in the token’s supply on exchanges.

However, an intriguing observation is that despite the price decline and high selling pressure, the supply of ETH from leading addresses continues to increase. This indicates that whales are still bullish on the token.

Source: Santiment

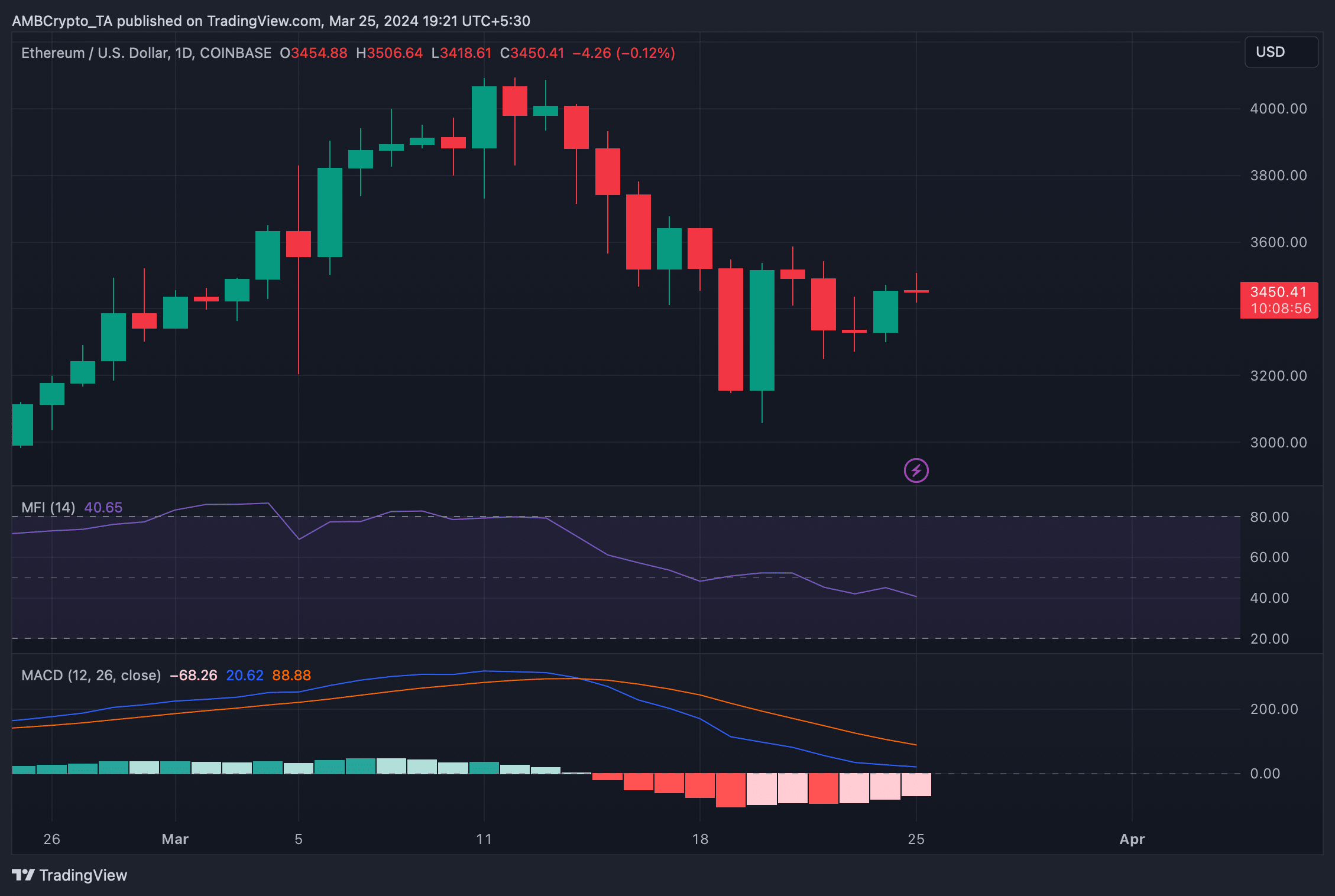

To see if whale confidence translates into reality, we’ve examined ETH’s daily chart. Despite the potential for altcoin price increases, ETH’s figures remain unstable.

The token’s MACD indicator suggests a price advantage in favor of declines at the time of writing. Additionally, its Relative Strength Index (RSI) has recorded a sharp decrease, further indicating a downward trend.

Source: TradigView

What’s happening with XRP?

Following Ethereum, we’ve looked into the status of XRP as it’s also one of the leading altcoins. According to CoinMarketCap, XRP has risen by over 2% in the past seven days.

At the time of writing, the token is trading at $0.6301 with a market cap of over $34 billion.

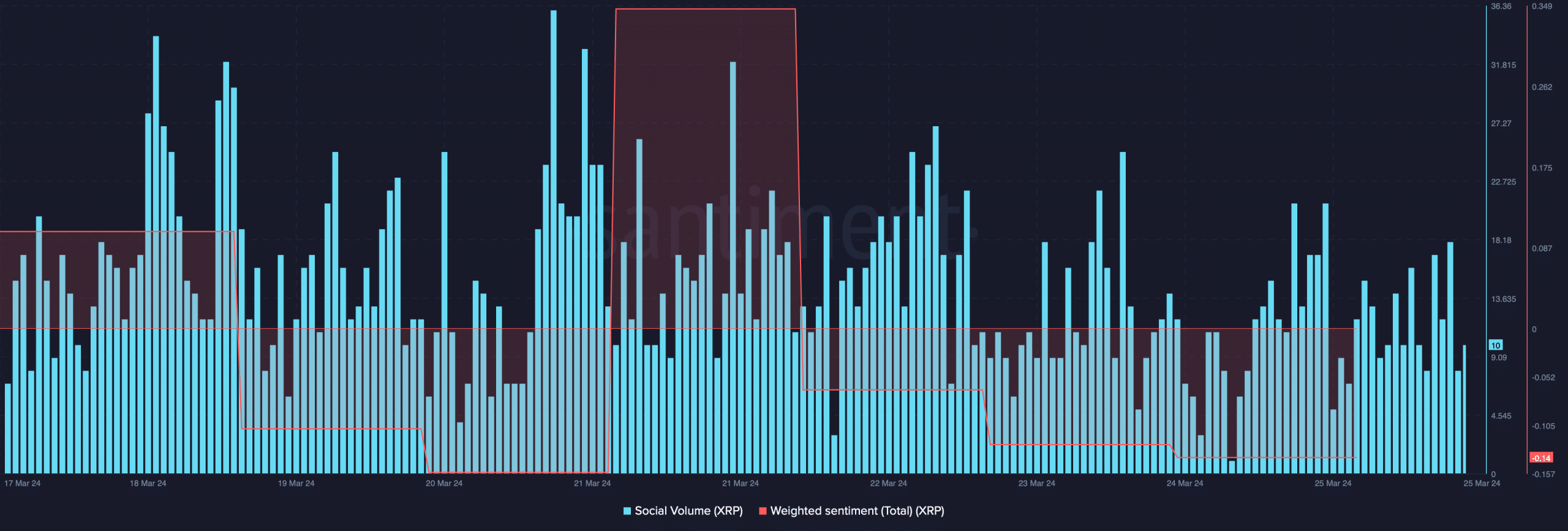

Source: Santiment

However, despite the price increase, the token’s social volume is still decreasing. Its Social Sentiment is also declining, meaning bearish sentiment surrounding it is prevailing in the market.

Related: Ethereum Targets $3000 with Positive On-Chain Signals

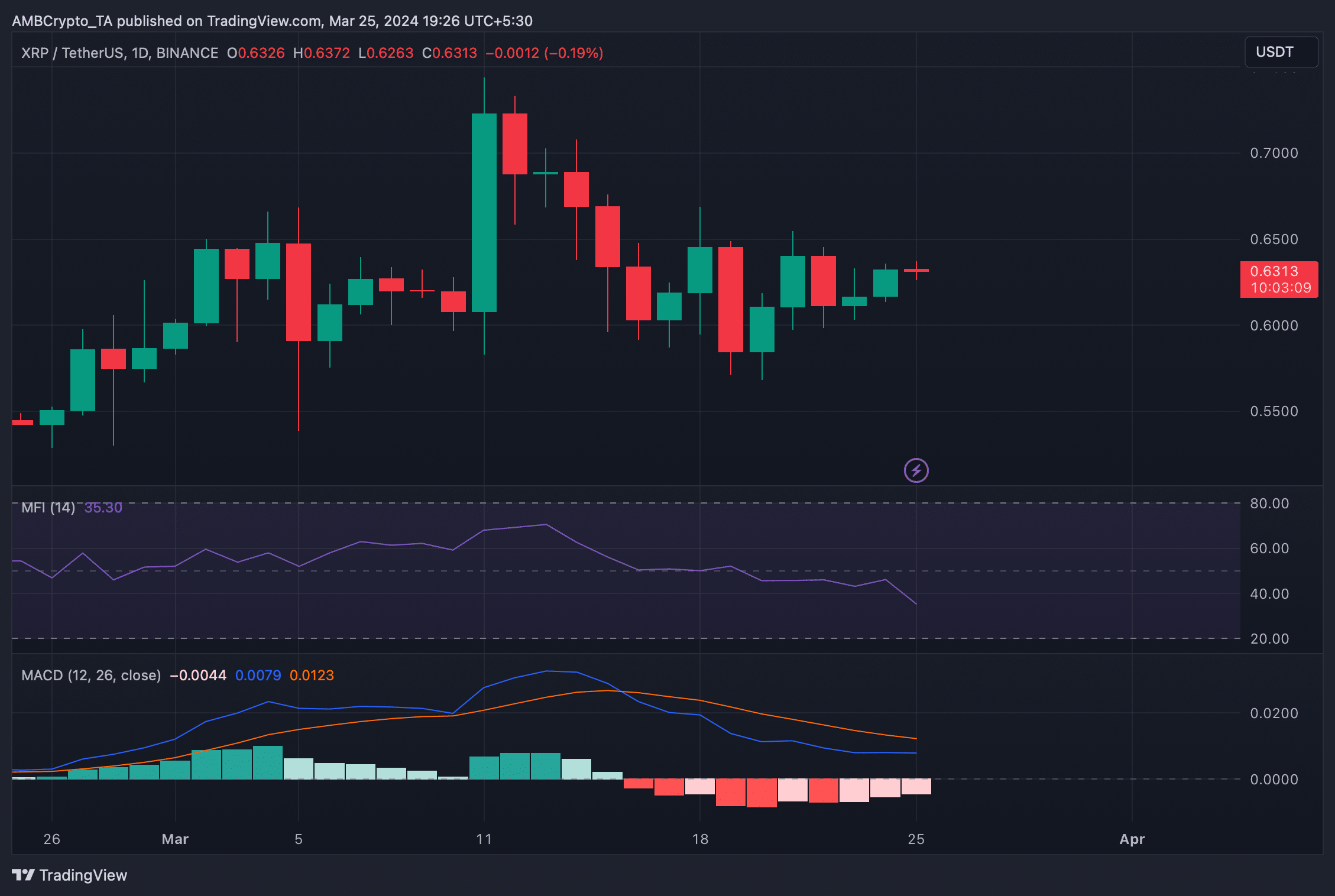

Subsequently, we’ve examined its daily chart to see if its figures resemble ETH’s. It’s no surprise that the findings are similar. XRP’s MACD indicator is also decreasing, and its RSI indicator is signaling a price decline.

Source: TradingView

It will be interesting to observe the trajectory of altcoins in the coming days, particularly considering the downward price indicators of leading altcoins.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

What a precise one