El Salvador is on the verge of changing the country’s fortunes with the discovery of a potential $3 trillion gold reserve, sparking debate over lifting the mining ban, sustainable development, and the possibility of investing more heavily in Bitcoin.

$3 Trillion Gold Discovery in El Salvador: A Call to Mining for Bitcoin Investment

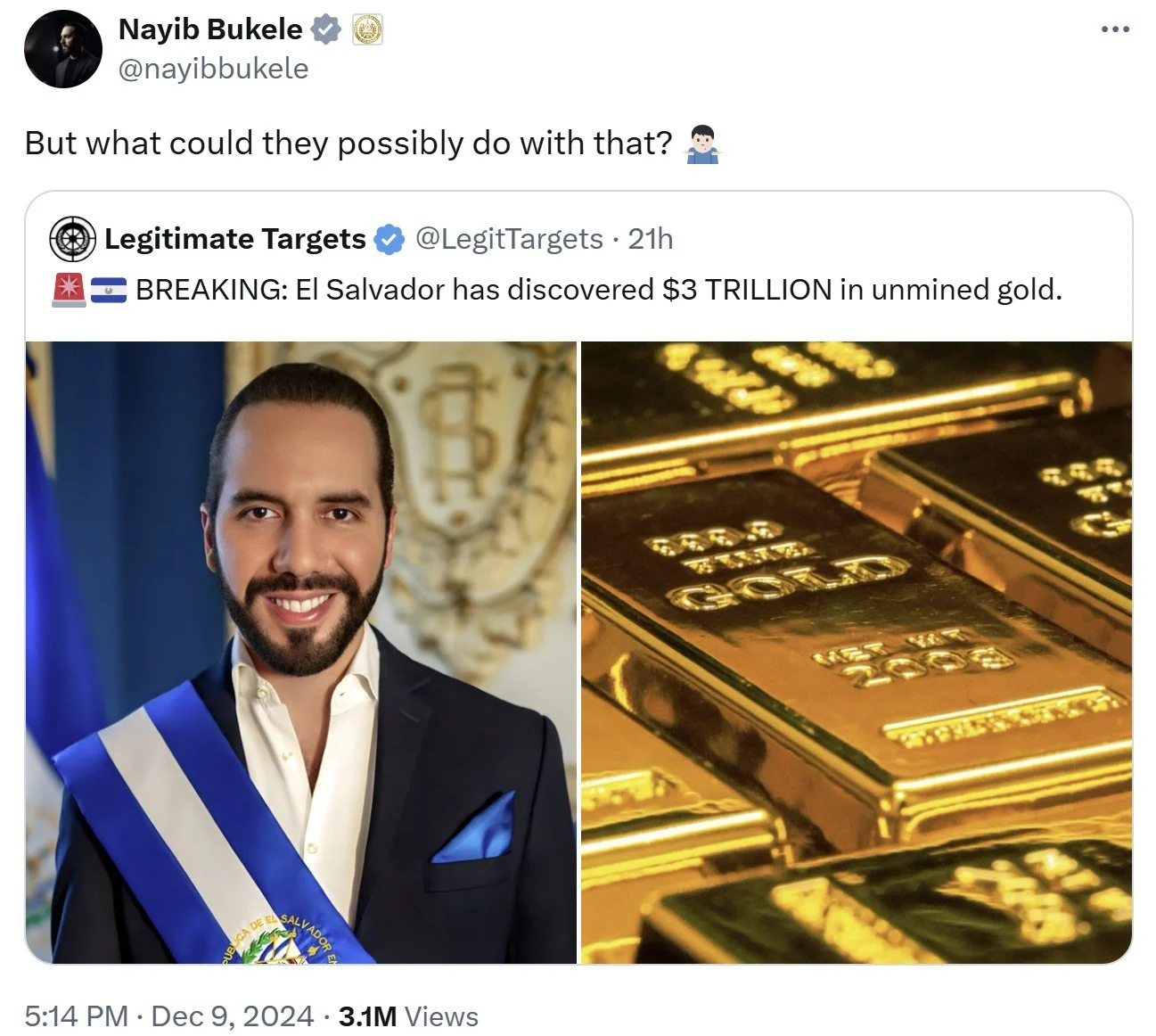

El Salvador’s President Nayib Bukele has highlighted the immense potential of the country’s untapped gold reserves, which could be worth more than $3 trillion if fully exploited. In a post on social media platform X last week, Bukele highlighted the role of responsible gold mining in driving the country’s economic development. He envisions that gold revenues could fund important projects such as job creation, infrastructure upgrades, and inclusive economic growth.

Bukele also proposed lifting the 2017 ban on metals mining, arguing that the policy is holding back the country’s ability to exploit and utilize its rich natural resources.

According to studies he cited, only 4% of El Salvador’s mining areas have been surveyed, and the results showed that there are about 50 million ounces of gold with an estimated value of $131 billion – equivalent to about 380% of the country’s current GDP. President Bukele believes that if fully exploited, these gold reserves could be worth more than $3 trillion, or about 8,800% of GDP.

He also revealed:

“We have discovered other precious materials such as gallium, tantalum, tin, and many other materials that are essential for the fourth and fifth industrial revolutions.”

Max Keiser, a prominent Bitcoin advocate, has proposed using gold reserves to invest in Bitcoin, which fits Bukele’s vision. He suggested issuing zero-interest convertible preferred shares to raise capital to buy Bitcoin on a large scale. Keiser argued that Bitcoin’s growing dominance over gold makes it a more valuable asset in the long run. On social media X, he shared: “El Salvador should take advantage of its $3 trillion gold reserves by selling zero-interest convertible preferred shares (like Saylor did) and buy as much Bitcoin as possible when the price is below $200,000. As Bitcoin continues to replace the value of gold at a rapid pace, the real value of gold may be as low as 1/10 of its current estimate. Still, $300 billion in Bitcoin now is better than a depreciating asset like gold in the future.”