Ethereum Price Plunges Within Minutes

On January 3, Ether experienced a significant 14% correction, plummeting from $2,380 to $2,050 within a brief two-hour timeframe. This price level hadn’t been observed since December 1, 2023, and the abrupt swing resulted in the liquidation of $100 million worth of ETH long future contracts – leveraged bets anticipating a price increase.

Now, traders are grappling with the implications of this correction, questioning whether it marks the conclusion of the bullish trend following three unsuccessful attempts to breach the $2,400 mark in the preceding month. Curiously, Ether’s price dipped below $2,150 for the third time during this period, further complicating the assessment of the bullish momentum.

A key observation from the price chart is the rapid rebound to $2,230 on January 3, hinting that the factors triggering panic selling and derivatives liquidations may be losing their impact. Some suggest that the catalyst was a market analysis released on the same day, predicting the rejection of the spot Bitcoin ETF and attributed to Matrixport. Notably, Matrixport was co-founded by Jihan Wu, renowned for his successful venture in the ASIC miner business at Bitmain.

Crucially, investors are now weighing the recent statements of Eric Balchunas, a senior ETF analyst at Bloomberg. In an interview, Balchunas asserted that the odds of approval stand at 90%, yet he cautioned that the final decision from the U.S. Securities and Exchange Commission may take more time to materialize. Essentially, market reactions have been overly pronounced in both directions, displaying unwarranted confidence in the January 10 deadline and failing to discern Matrixport analysts’ opinions from concrete news and events.

Potential for an Ethereum ETF

Attorney and commercial litigator Joe Carlasare succinctly captured the scenario in a social media post. According to Carlasare, “the market was overbought,” signaling that buyers had employed excessive leverage, rendering bulls vulnerable to whales and market makers. This deduction stems from an analysis of the ETH monthly futures annualized premium, which ideally should fall within the 5% to 10% range in healthy markets.

I know people are desperate for a narrative, but Bitcoin didn’t sell off because of some silly report about ETF denial.

It sold off because nothing goes straight up and it’s an easy grab for liquidity to do a long squeeze. In short, the market was overbought.

— Joe Carlasare (@JoeCarlasare) January 3, 2024

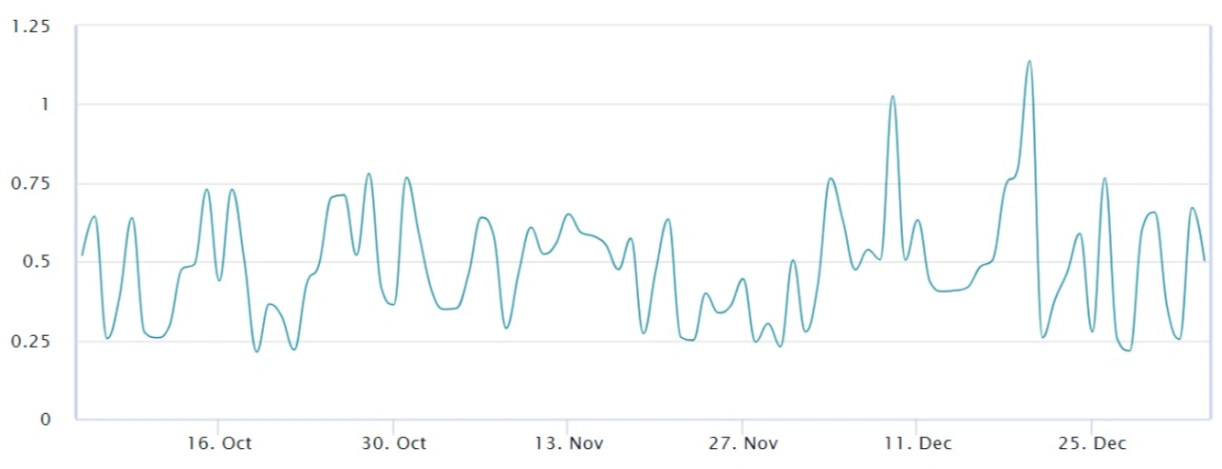

The data underscores a rising demand for leveraged ETH long positions, with the futures contract premium surging from 11% on December 18, 2023, to 27% on January 2, 2024. However, sustaining such positions for extended periods proved costly for buyers, following a 15% rally in ETH’s price during that timeframe.

The most recent substantial setback for Ether bulls in the futures markets dates back to August 17, 2023, when $170 million worth of long positions were liquidated. During that episode, a 15% intraday correction unfolded, causing the price to plummet from $1,800 to $1,530. Remarkably, ETH swiftly rebounded to $1,680 within two hours. However, the subsequent medium-term recovery proved unsustainable, leading ETH to revisit the $1,530 bottom on September 11, 2023.

To assess the exposure of whales and arbitrage desks utilizing derivatives, a closer examination of Ether options volume becomes imperative. Analyzing both put (sell) and call (buy) options allows for an estimation of the prevailing bullish or bearish sentiment.

Related: Vitalik Buterin Updates Ethereum’s Roadmap for 2024

With the exception of a brief period on December 19, 2023, ETH put options consistently trailed call options in volume, roughly by a factor of two. This indicates a diminished demand for protective strategies, underscoring the prevalent confidence and excessive optimism witnessed in the Ether futures markets.

The precise cause of the 14% flash crash on January 3 may remain elusive. However, based on Ether derivatives markets, it appears that investors grew overconfident and heavily relied on excessive leverage. Importantly, this doesn’t necessarily invalidate Ether’s bullish trend or diminish the likelihood of surpassing the $2,400 resistance before the ETF decision. The data suggests a healthier market, at least from a derivatives perspective.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE