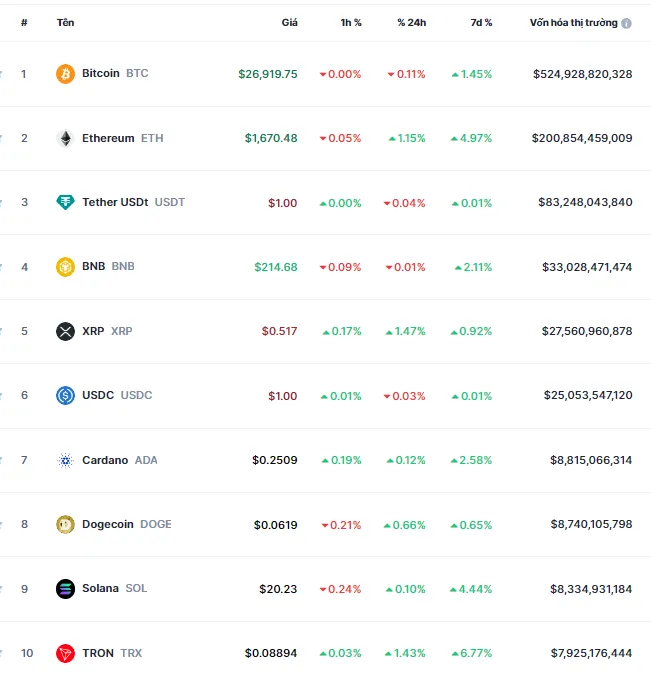

As of September 30th, the price of Bitcoin has been fluctuating around $26,900, showing a slight increase of over 1% compared to the previous weekend. Meanwhile, Ethereum, the second-largest cryptocurrency, has experienced a nearly 5% surge, reaching $1,670.

Other cryptocurrencies in the top 10 have also seen minor gains in the past week, with Binance Coin (BNB) rising by 2%, Cardano (ADA) advancing by 2.5%, Solana (SOL) making a 4% ascent, and Tron (TRX) climbing by 7%.

Performance of the Top 10 Cryptocurrencies

Source: CoinMarketCap

Short-Term Bitcoin Traders in Deep Loss

According to the virtual currency analysis company Glassnode, 97.5% of short-term Bitcoin traders are currently facing losses, and a pessimistic sentiment prevails in the cryptocurrency market.

The recent decline in Bitcoin’s price over the past few months has been a test of investors’ determination. In reality, not many people have faith in Bitcoin at this stage. In the digital asset market, there is a term called STH, referring to those who hold tokens for a short period, typically less than 155 days. As of September 17th, a staggering 97.5% of short-term Bitcoin traders are in the red.

Glassnode points out that there have been sudden shifts in the psychology of cryptocurrency traders since Bitcoin’s price dropped from $29,000 to $26,000 in mid-August, leading to a wave of selling.

Expectations of Fear and Negative Sentiments

On the other hand, Week On-Chain predicts that indicators suggest increased levels of panic and negative sentiment in the near future. According to data from Alternative on September 12th, the market’s extreme sentiment dropped to 30 points before rebounding to a neutral zone with a score of 47, only to dip back into fear at 44 points on September 24th.

This reflects a general cautious attitude among Bitcoin investors. Many believe that a deeper price decline will continue in the near future. However, there are still debates in the market, with some optimists suggesting that Bitcoin’s fortune will come in the early fourth quarter of 2023.

Huobi exchange was hacked for 5,000 ETH

In the past week, the cryptocurrency market faced another unfortunate incident as the cryptocurrency exchange Huobi was hacked, resulting in the theft of 5,000 ETH, equivalent to $7.9 million, with the identity of the thief remaining undisclosed.

“HTX (Huobi exchange) suffered a loss of 5,000 ETH due to a hacker attack. The exchange has fully compensated for the losses incurred from the hack and resolved the related issues. All user assets are secure,” stated Justin Sun, Senior Advisor at Huobi, on his X account (formerly Twitter) on September 25th.

Before September 24th, the blockchain analytics platform Cyvers detected a suspicious transaction in which 5,000 ETH from Huobi’s hot wallet was transferred to an unfamiliar address. Subsequently, this wallet transferred 1,000 ETH to a third address to distribute the assets.

A day later, Huobi sent a message to the recipient wallet in Chinese, stating, “We have confirmed your true identity. Please return the funds. We will offer a 5% reward to the white-hat hacker. You have 7 days to consider. If you do not return the funds by October 2nd, we will seek legal intervention. If you return the funds, we will hire you as a security advisor for the exchange.”

According to Medium, the hacker has not yet laundered the stolen ETH through mixing services or other anonymous tools, indicating a willingness to take risks while waiting for an opportunity to convert the assets into cash.

On X, Justin Sun continuously reassured the community. However, he did not disclose the identity of the suspect. He mentioned, “5,000 ETH, equivalent to $8 million, is a relatively small amount compared to the $3 billion in assets we hold for users. The damage from the hack is equivalent to the exchange’s two weeks’ revenue.”

Huobi: A Significant Cryptocurrency Exchange

Huobi was one of the three major cryptocurrency exchanges in the world, following Binance and Coinbase by the end of 2022. As of September 26th, the exchange’s daily trading volume reached $673 million, ranking it 10th according to Coinmarketcap statistics. The exchange originates from China and changed ownership at the end of last year. The new owner of the exchange is Justin Sun, who is also the owner of the Poloniex exchange and the founder of the TRON cryptocurrency project.