Markets initially stumbled when Trump imposed tariffs on aluminum and steel, escalating an ongoing trade war. According to a Feb. 9 report by the Associated Press, Trump declared that all imported steel and aluminum would be subject to a 25% tariff. Additionally, he announced plans for reciprocal tariffs on countries that impose import fees on U.S. goods.

“If they are charging us 130% and we’re charging them nothing, that’s not going to continue,” Trump asserted.

The crypto market responded with a sharp but temporary decline, as widespread losses were observed across digital assets. However, a steady recovery soon followed.

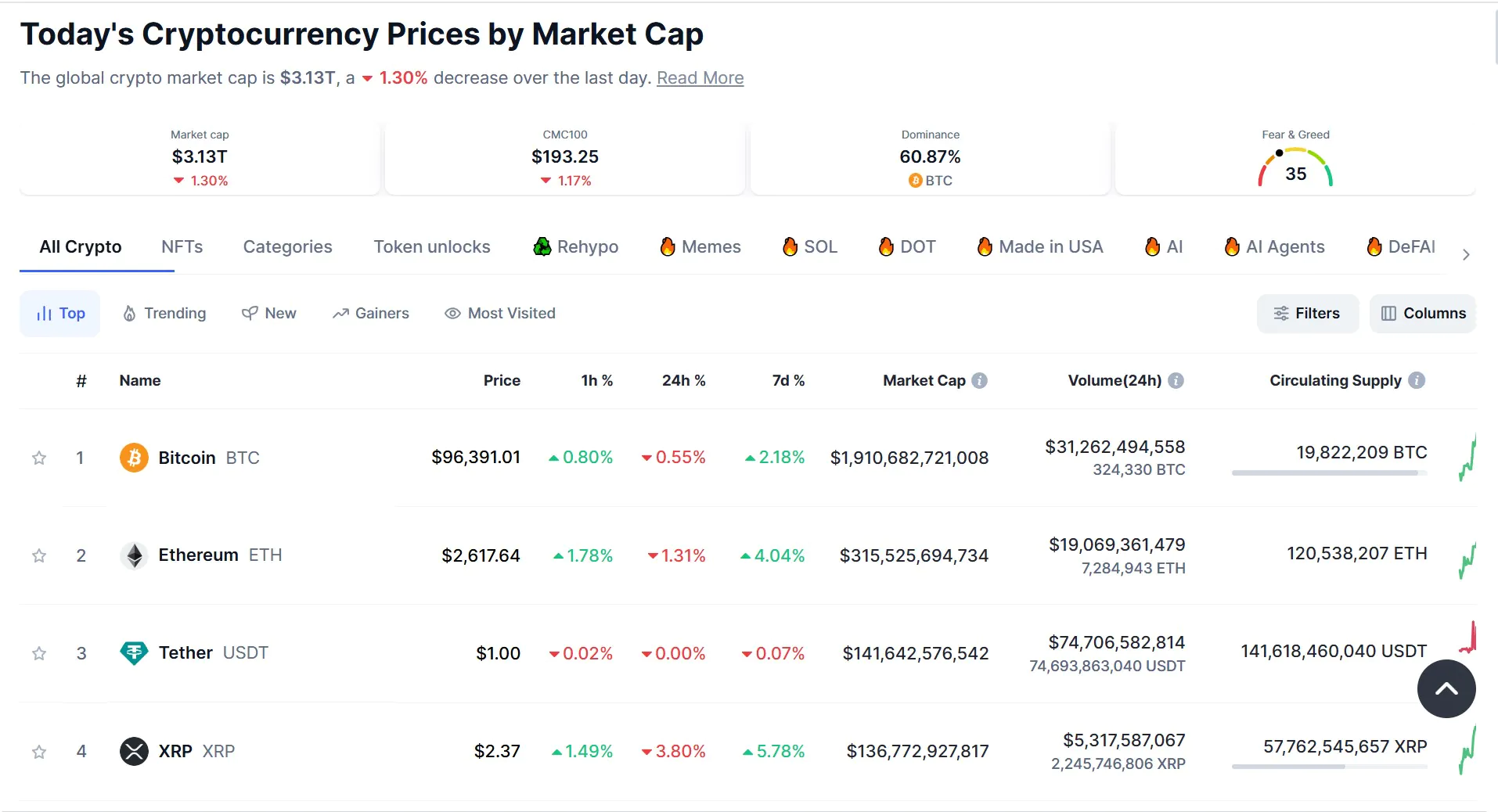

Bitcoin, which briefly dropped to $94,000, has since rebounded above $97,000, according to CoinMarketCap. Similarly, Ether, which fell to a low of $2,537, has climbed back to $2,645, nearly reaching its pre-announcement levels.

The total cryptocurrency market capitalization also reflected the turbulence, initially slipping from $3.15 trillion to $3.10 trillion before rebounding to $3.13 trillion, per CoinMarketCap data.

Meanwhile, the Crypto Fear & Greed Index, which gauges market sentiment for Bitcoin and other cryptocurrencies, has remained in “fear” territory over the past week, averaging a score of 44 out of 100. The latest update on Feb. 10 registered a further decline, with the index dropping to 43 from the previous day’s 46.

Trump has also signaled plans for additional tariffs on the European Union, targeting superconductors, oil, gas, steel, and copper.

Earlier, on Feb. 1, he imposed a 25% tariff on key trading partners Canada and Mexico, alongside a 10% tariff on China, triggering sharp declines in both stock and crypto markets. Estimates vary, but Bybit co-founder and CEO Ben Zhou speculated that total liquidations may have ranged between $8 billion and $10 billion.

However, the crypto market rebounded after Trump temporarily paused the planned tariffs on Mexico and Canada for 30 days on Feb. 3. Despite the reprieve, he has not ruled out reinstating the levies once the suspension period expires.