TThe United States Federal Reserve Open Market Committee’s September decision on interest rates was entirely anticipated, with the FOMC holding rates at the current position of5.25 to5.5. As also anticipated, the commission indicated there may be another rate hike coming this time, with Chairman Jerome Powell averring — as usual — in hisSept. 20 press conference that the job of getting affectation back to the Fed’s 2 target is in “ no way done. ”

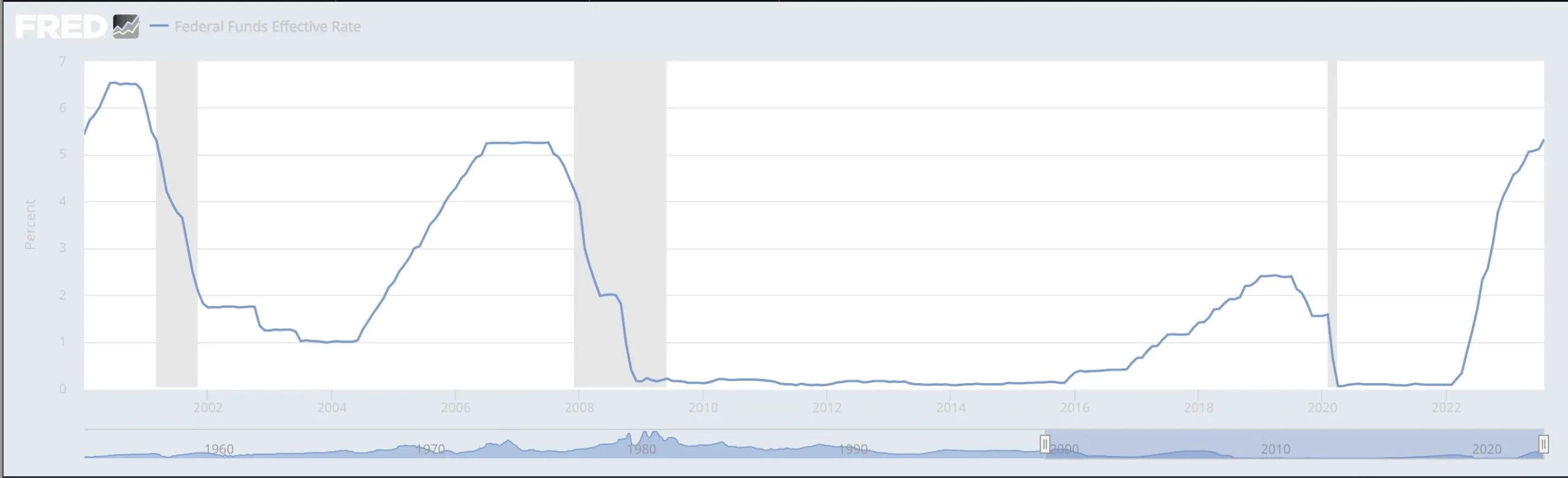

What was further of a surprise, still, is the fact that the Fed raised its long- term cast for the Federal finances Rate, which they now see as standing at5.1 by the end of 2024 — over from June’s vaticination of4.6 — before falling to3.9 at the end of 2025, and2.9 at the end of 2026. These figures are specially advanced than former vaticinations and indicate a “ advanced for longer ” script forU.S. interest rates that not too numerous request actors were awaiting.

As similar, we saw requests pull back slightly, with the S&P 500 trading down0.80 shortly after the advertisement, followed by the NASDAQ, which fell1.28 — a big spill for these caption indicators. Cryptocurrency requests also responded negatively, with Bitcoin( BTC) falling below$ 27,000 and Ether( ETH) falling nearly 2 to just further than$ 1,600 shortly after Powell wrapped up his press conference.

Eventually, the data shows theU.S. frugality is returning to a state we have n’t seen since before the fiscal extremity of 2008- 09, one in which profitable growth and affectation remain fairly harmonious. AU.S. interest rate comprising around 4 over three times would be no surprise in this old world, nor would periodic affectation lesser than 2.

Related: Bitcoin price may reach all-time high before Having

The trouble is that investors have come addicted to central banks pumping presto, free plutocrat into our husbandry to battle concurrent heads. We’re now in a intelligence as investors where strong profitable growth and stable affectation are interpreted as bad news — and crypto requests feel to feel the same way. This is particularly intriguing considering Bitcoin was innovated during the fiscal extremity in direct notice of the loose financial policy opinions of the Federal Reserve, Bank of England, and others.

The Federal finances Rate from January 2000 through August 2023. Source Board of Governors of the Federal Reserve System.

What now seems apparent is that we ca n’t calculate on central banks to give our investment authorizations. Rather, we must concentrate more nearly on the factual health of companies and the mileage, products, and services they’re furnishing to their guests. In the crypto world, we will have to concentrate precisely on the viability of the crypto ecosystem, and what it can offer to its druggies as an volition or reciprocal fiscal business.

In the short- to-medium term, of course, this means that we will each be sitting and staying for theU.S. Securities and Exchange Commission to make its ruling on the teetering pile of Bitcoin spot ETF operations it has sitting on its office, submitted by the world’s largest asset directors.

Franklin Templeton — one of the oldest asset directors in theU.S. — has joined BlackRock, Fidelity, Invesco, and others in the race to launch a mass- request fund for the world’s biggestcryptocurrency.However, this really will mark Bitcoin’s immurement into the hall of fame for global means, and we can anticipate cryptocurrency to join portfolios around the world as an indispensable investment in the coming bull request, If indeed one is approved. Should the SEC favor one assiduity mammoth over another, however, we can prognosticate numerous uncomfortable Upper East Side regale parties.

still, Bitcoin and other cryptocurrencies will remain borderline means, If the SEC stays true to form and does n’t authorize any of these operations. That does n’t mean they wo n’t find new price motorists and head back toward former each- time highs. But we clearly wo n’t see important action in crypto requests until this issue is resolved in one way or another.

Inversely, the FOMC decision and Powell’s commentary indicate we wo n’t see important excitement on the macroeconomic side for the foreseeable future moreover. But if theU.S. and global frugality do return to commodity like the old normal — strange home to any investor under 40 — it may well be exactly what the world, and indeed cryptocurrency requests.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of AZC News.

BTC

BTC  ETH

ETH  USDT

USDT  SOL

SOL  BNB

BNB  USDC

USDC  XRP

XRP  DOGE

DOGE  TON

TON  ADA

ADA