What is Cronos (CRO)?

Cronos is a cryptocurrency created with the goal of simplifying the process of staking and earning rewards. The project is designed with an intuitive and easy-to-use interface, focusing on providing a great user experience. This token is built on the Ethereum blockchain, allowing for transactions on the Ethereum network.

Cronos is also a utility token, helping to power the Monaco cryptocurrency platform. The platform allows users to buy, sell and trade cryptocurrencies, as well as use them for everyday transactions such as shopping and travel. The more Cronos tokens you hold, the higher the rewards you receive.

https://cronos.org/

CRO token plays an important role in the Monaco ecosystem. It is used to pay transaction fees and contribute to powering the network. When you hold CRO in your Monaco wallet, you will earn interest on the funds you have deposited.

Cronos Fundamental Analysis (CRO)

Crypto asset Cronos (CRO) has attracted significant attention in recent months, becoming one of the leading assets in the crypto space. In this article, we will look at the fundamental factors that could push CRO prices higher.

1. Growth of the Cryptocurrency Market:

Over the past year, the cryptocurrency market has experienced a significant growth. The expansion of this market has attracted a lot of attention and investment, and not just CRO but many other cryptocurrencies as well.

2. Cronos Platform Development:

The continued growth of the Cronos platform could also be an important factor pushing up CRO prices. New innovations and features from the Cronos team could make it attractive to users and investors.

3. Strong community support:

CRO benefits from strong support from the community. The Cronos team has been actively building a committed community around the project, which could contribute to pushing up the token price.

In summary, there are several fundamental factors that can positively impact CRO prices. With the cryptocurrency market still in its early stages of development, the growth potential for CRO and other cryptocurrencies is huge in the near term.

Cronos Technical Analysis (CRO)

The Cronos (CRO) token has been experiencing a strong uptrend over an extended period of time, breaking out of a stable trading range. This breakout was driven by increased demand from buyers, as manifested through increased trading volume and bullish price action.

Traders use various technical tools to predict the Cro coin price using historical market data. Some popular technical indicators include:

Oscillators:

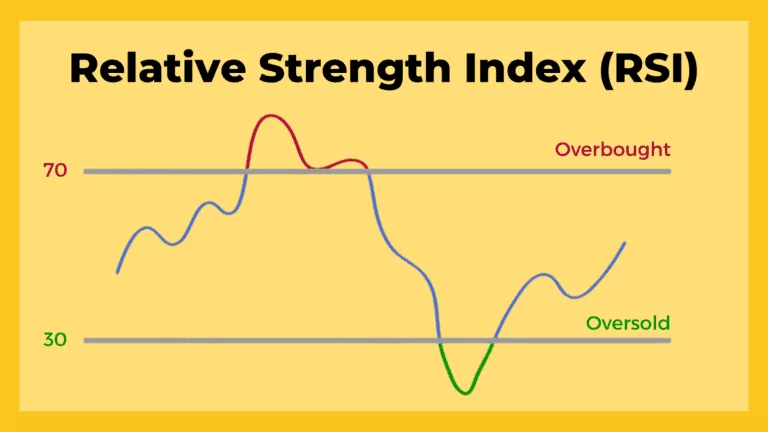

A technical analysis tool used to measure momentum. Momentum measures the rate of change in price over time. The most popular Oscillators are the Relative Strength Index (RSI), Stochastic Filter, and MACD (Moving Average Divergence/Convergence).

Oscillators are useful in determining whether the market is overbought or oversold. When an Oscillator is overbought, it means the market will have a price correction (temporary price decrease). When an Oscillator is oversold, it means the market will have a price recovery (temporary price increase).

Relative Strength Index (RSI):

RSI is an Oscillator that measures price speed and variation. RSI oscillates between 0 and 100. Values below 30 indicate an oversold market, while values above 70 indicate an overbought market. Like other momentum indicators, RSI can generate fake signals, especially in fluctuating markets. The deviation between RSI and price action can also be used to predict changes in trend.

Moving Average:

Is a technical indicator used to determine the direction of the market. This is done by taking the average price of an asset over a fixed period of time.

There are many types of moving averages, but the most common are the simple average (SMA) and the extended moving average (EMA). SMA is calculated by summing the prices of all price histories for a fixed period and dividing by the number of prices in that period. EMA is similar to SMA, but it puts more weight on more recent prices. A moving average is a trailing indicator, which means it is based on past price values and cannot predict future price movements. However, it can be used to identify trends and confirm other technical indicators.

Extended Moving Average (EMA):

A type of moving average that places more weight on recent prices to create a more reactive average. EMA is also used in crossover trading strategies, where a fast EMA crosses a slow EMA.

Cronos Price Prediction November 2023

The CRO price exhibited a breakthrough, surpassing a crucial resistance at $0.06244 and gaining substantial momentum to breach the upper resistance at $0.08370. Despite achieving breakthroughs at multiple resistance levels, it faced rejection at $0.1196 shortly thereafter.

Subsequently, the price experienced a loss of momentum, leading to a notable correction and a descent to test the lower support level at $0.08370. Since then, the price has been trading within a consolidated range.

TradingView: CRO/USDT

The MACD has consistently displayed a green histogram throughout the month, signaling a robust bullish influence in the market. Additionally, the moving averages exhibit an upward trajectory, suggesting a continued increase in value in the upcoming days.

In the event that the bulls strengthen their position and propel the price above the $0.10423 level, a bullish trend is anticipated. Furthermore, if the coin maintains stability around this level, it is likely to prepare for a test of the $0.11963 resistance by month-end.

Conversely, if the bears seize control, triggering a trend reversal, the price may face a decline in momentum, testing the support level of $0.09140 in the near term. Furthermore, a sustained dip could prompt a test of the lower support level at $0.08370 in the coming days.

Cronos Price Prediction for 2023

With trading volume reaching exceptionally low levels, bears exerted complete control over the charts, resulting in a significant reduction in market cap. Since the market surge in January, the coin has consistently lost value, erasing all gains made during that period.

Following a period of consolidation between $0.04869 and $0.05028, the price experienced a surge in momentum, breaking through multiple resistance levels. Judging by market sentiments, there is an anticipation of a new yearly high in the near future.

The MACD exhibited considerable volatility throughout the year. After the market surge in October, the price gained substantial momentum, registering a remarkable 62% surge in the past month alone, indicating significant price action.

If the bulls successfully propel the price beyond the $0.095 mark, a bullish trend could be triggered, potentially pushing the price towards its resistance level of $0.1. Sustaining at this level could pave the way for the CRO price to reach as high as $0.106 by the end of the year.

However, in the face of potential threats such as inflation or regulatory concerns, the CRO coin’s price might experience a decline to the $0.0697 level. Under a more conservative scenario, guided by a linear perspective, the average value could hover around $0.0878.

Related: Solana (SOL) Price Analysis: Bulls Take A Break, Key Support Intact

azc.news’s Cronos Price Prediction

Cronos is poised to become a strong contender in the cryptocurrency space, offering diverse functionalities such as trading, financial services, and payments, as per azc.news’s formulated CRO price prediction. The altcoin is anticipated to gain momentum, driven by its goal of accelerating global cryptocurrency adoption.

The community is expected to actively pursue strategic collaborations to enhance the platform. By the close of 2023, the projected high for CRO’s price is $0.106. Conversely, if bearish trends prevail, there is a possibility of the price dropping to $0.0697. This results in an average trading price of approximately $0.0878 for this cryptocurrency.