Let’s examine the current state of ETH to determine if its launch could benefit the “king” of altcoins and potentially allow it to surpass Bitcoin [BTC] in the coming days.

Is the hype surrounding the Ethereum ETF insufficient?

Investors and the broader cryptocurrency market have been patiently awaiting the release of the ETH ETF. According to the latest data, the launch of the Ethereum ETF might happen on July 15th.

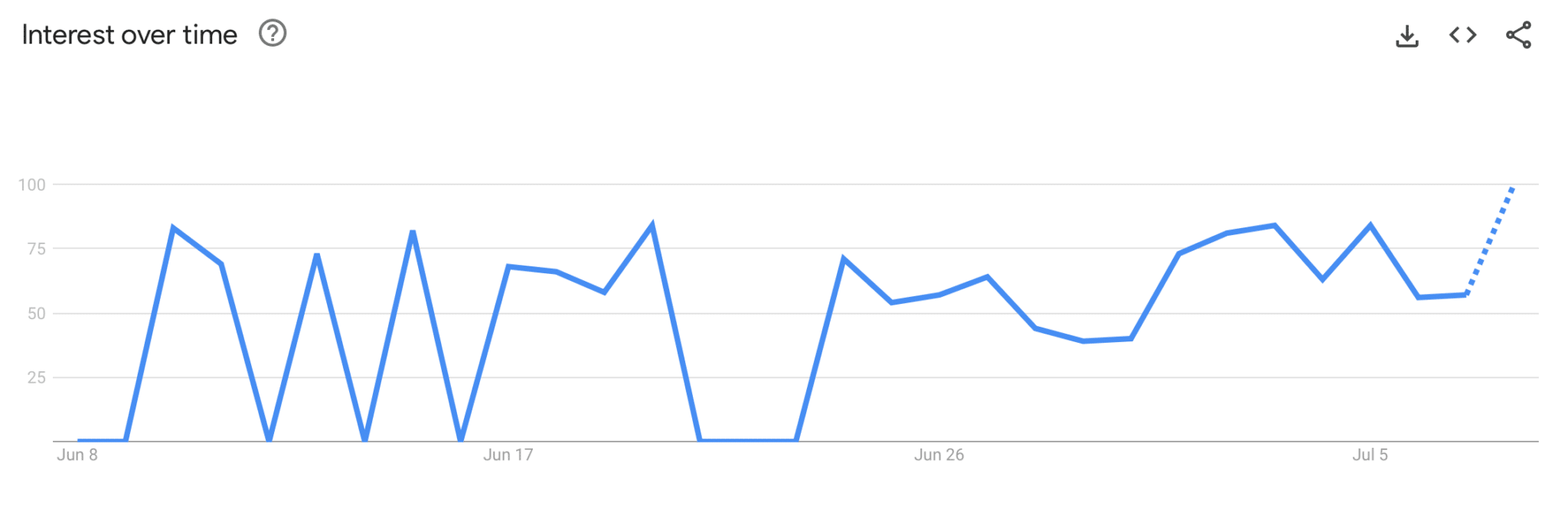

An analysis of Google Trends data shows that interest in the Ethereum ETF has remained steady over the past 30 days in the United States, reflecting the excitement surrounding it.

Despite the approaching launch date and market enthusiasm, Ethereum continues to struggle with price increases.

According to CoinMarketCap, ETH has dropped over 12% in the past seven days. At the time of writing, the token is trading at $3,045.32 with a market capitalization exceeding $366 million. One possible reason for this downward trend is a lack of investor confidence in ETH.

Santiment data analysis reveals that ETH’s weighted sentiment index has significantly declined over the past week. This clearly indicates a prevailing pessimistic sentiment around the token.

Bitcoin vs. Ethereum ETF

As ETH continues to trend downwards despite the imminent ETF launch, we’ve compared the status of both Ethereum and Bitcoin prior to their respective ETF launches.

Related: Bitcoin Trades at $56,500 as ETF Inflows Return

Our analysis shows that BTC’s price began to rise sharply before the ETF launch date. Specifically, BTC’s price started to fluctuate in November 2023 and peaked around the BTC ETF launch on January 10, 2024. However, shortly after the launch, BTC’s price began to decline.

In this regard, Bitcoin is clearly outpacing Ethereum. To determine if ETH is planning a price surge a week before its ETF launch, we analyzed ETH’s daily chart.

We observed that Ethereum’s Relative Strength Index (RSI) has increased after hitting the oversold zone. Additionally, the Money Flow Index (MFI) is following a similar upward trend. This suggests that ETH might see a price increase in the coming days.

However, the Chaikin Money Flow (CMF) is moving southward, and the MACD also indicates a bearish advantage in the market.