Bitcoin (BTC) is a digital currency, so it doesn’t have a physical form. Bitcoin is similar to all traditional fiat currencies like USD, Euro, VND, but it is encoded electronically.

What sets Bitcoin apart can be attributed to the following factors:

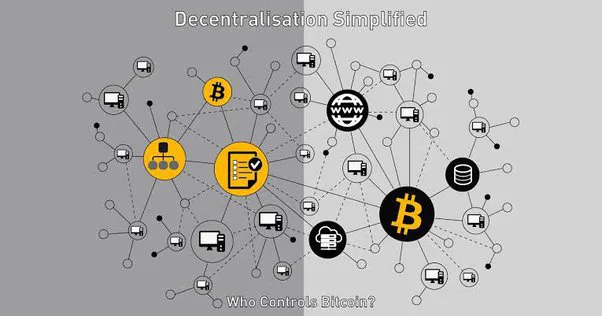

Decentralization

In traditional financial markets (CeFi – Centralized Finance), fiat currencies like USD, VND, EUR, are controlled by organizations such as Central Banks or Governments. However, Bitcoin is not. Instead, for transactions to occur and be verified, they require the consensus of numerous nodes participating in the Bitcoin network.

Nodes in the network are controlled by various individuals/organizations (referred to as miners), and they are located all over the world. When more than 50% of the nodes in the network agree on a transaction, creating a consensus, that transaction becomes successful.

The Bitcoin network is not excessively controlled by any entity; the most powerful organization, Foundry USA, only holds a 22% share of the Hashrate market. Therefore, Bitcoin is considered a decentralized blockchain that is resistant to attacks.

Security

In theory, one could attempt to hack the Bitcoin network to reverse transactions or engage in malicious activities for personal gain. However, in practice, no one has been able to achieve this due to Bitcoin’s robust security system.

Bitcoin’s security is ensured by two factors:

Decentralization: To compromise the Bitcoin network, you would need to control 51% of the network’s Hashrate at a given time. However, this is virtually impossible because the cost of acquiring such computational power would be prohibitively high.

Estimates suggest that the cost of attacking Bitcoin for just one hour would exceed $700,000, not accounting for additional risks and expenses.

SHA-256 Algorithm: This is a secure hashing algorithm used to create irreversible hash functions. According to calculations by experts from the University of Sussex, for a quantum computer to potentially break Bitcoin in one hour, it would require 317 million qubits, while the most powerful current computers only have 127 qubits.

This is also the reason why once a transaction is executed, you cannot reverse or retrieve the funds because the information is recorded on the network and cannot be altered or edited by anyone.

Transparency

One of the most significant advantages of Bitcoin compared to other currencies is its transparency. With the U.S. dollar in circulation, we cannot accurately determine the exact amount issued. All figures are only disclosed by the government, and there can be discrepancies due to the inability to track the integrity of paper money over time.

However, with Bitcoin, all information is recorded on the blockchain ledger. This means that anyone can become a miner, and anyone can read the network’s data.

Therefore, when using the Bitcoin blockchain, all information is transparent.

Low Transaction Fees

When compared to transferring money via electronic wallets or banks with fees at 0 VND, Bitcoin does have relatively high fees. However, these fees are significantly lower than the costs associated with international money transfers through institutions like banks. Each institution may have different fee structures, but if you were to send about 10,000 USD abroad, the fees would likely be no less than 100 USD, not to mention the time spent on paperwork and procedures. With Bitcoin, the transaction fee is only 1 USD per transaction with a one-hour wait time.

For small amounts like 10,000 USD, the fee is negligible. However, banks typically charge a percentage of the amount you need to send rather than a fixed fee per transaction like the blockchain. Therefore, Bitcoin can significantly reduce transaction fees for participants.

>>> What is Bitcoin? Why was Bitcoin created?

Limited Supply and Increasing Difficulty of Mining

These are two characteristics that make Bitcoin a digital gold. Just as gold is a finite resource on Earth, Bitcoin is limited to a maximum of 21 million Bitcoins.

Not only is it limited, but the scarcity and difficulty of mining both assets are increasing. In the past, when gold was not mined by many, the quantity was higher, and the level of competition was lower. However, as more people recognized the potential and started mining, the amount of gold decreased significantly, accompanied by high competition.

Similarly, to mine Bitcoin, miners must continuously upgrade their mining equipment because the difficulty of the Bitcoin network (Hashrate) has been steadily increasing since Bitcoin was introduced. This also demonstrates that the Bitcoin network is attracting more participants in the mining process over time.