Cardano (ADA) has shown signs of recovery, gaining 2% within 24 hours of trading, according to data from CoinMarketCap. This comes after the cryptocurrency recorded a massive decline in April, with a loss of more than 23% compared to the previous month.

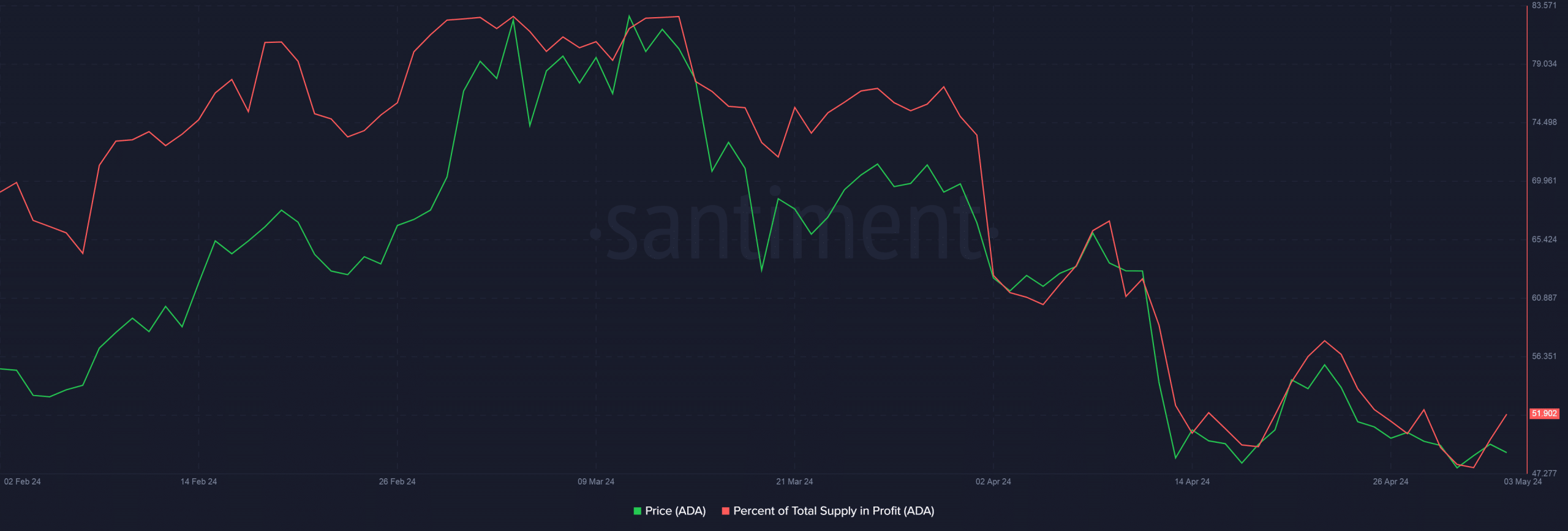

According to data analysis from Santiment, the decline in the market has narrowed the profit margin in the total supply of ADA, from 73% at the beginning of the month to 51% at the end of the month.

Source: Santiment

The Restoration of the ADA

However, there are positive signs that the adjustment period may be coming to an end, according to analyst Ali Martinez’s forecast. On ADA’s daily chart, Martinez has seen a buy signal on the TD Sequential indicator, suggesting a recovery is possible within the next 1-4 days.

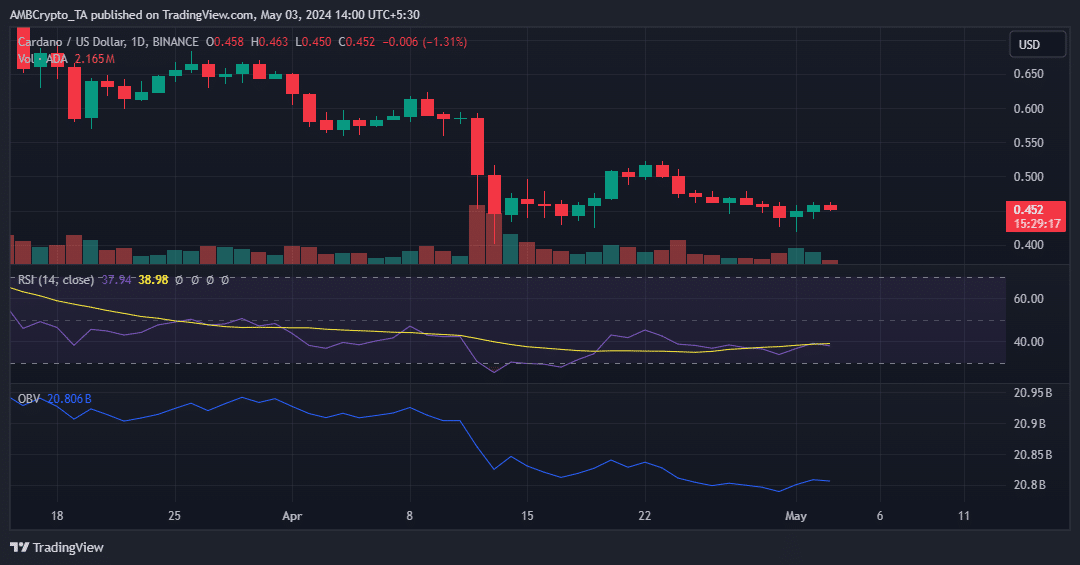

To better understand this forecast, let’s examine ADA’s other key technical indicators. For example, the relative strength index (RSI) has been rising steadily over the past 2-3 days, showing that selling pressure is gradually decreasing. Even so, the overall sentiment remains negative and the RSI needs to break above 40 to show the prospects for a steady rally. At the same time, overcoming the neutral threshold of 50 will strengthen the optimistic sentiment.

Source: Trading View

The increase in On Balance Volume since the beginning of May has clearly shown the buying pressure in the market. By this point, On-Balance Volume reflected ADA’s price action on the chart, strongly stimulating hopes for a steady price increase.

Whale reaction

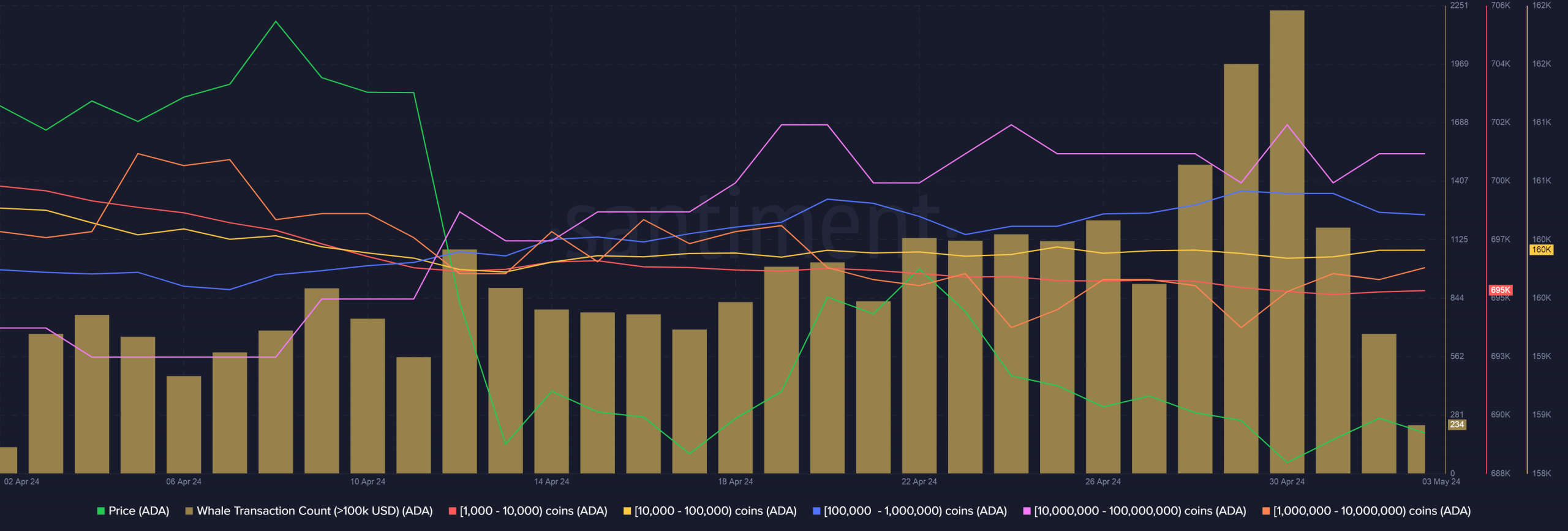

Source: Santiment

As for the reaction of whale investors, Cardano’s price drop has caught their attention. During April 30, transactions above $100K increased to their highest level since November 2023.

Related: NFTs on Cardano Experience Decline Following Last Month’s Dominance

When analyzing different groups of whales, interesting observations were revealed. Smaller whales, holding between 1,000 and 1 million ADA, have decreased in number, suggesting they have sold.

However, larger whales are accumulating, as the number of addresses holding ADA between 1 million and 100 million increases. Therefore, it is clear that there is a significant shift in capital from small whales to large whales.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  DOGE

DOGE  TRX

TRX