BlackRock CEO discusses Bitcoin surge due to fake ETF news

While the company’s CEO claimed that their Bitcoin spot ETF application only performed better after the events on Monday, others remain skeptical.

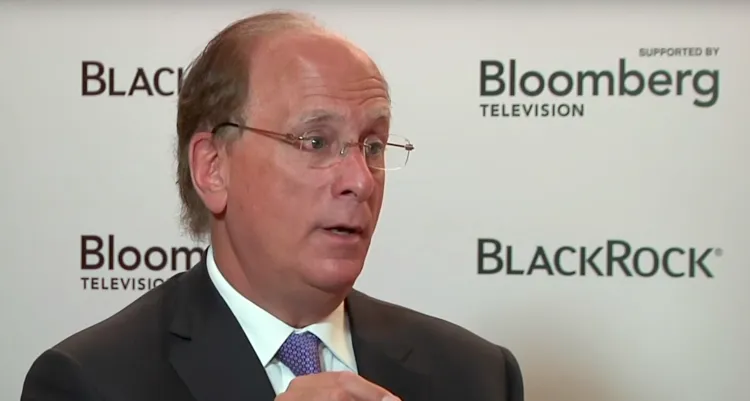

Larry Fink, CEO of BlackRock, addressed the notable controversy that erupted earlier today when a false report falsely claimed that the company’s application for the iShares Bitcoin Trust ETF had been approved by the U.S. Securities and Exchange Commission (SEC). The hoax created a frenzy on social media, causing Bitcoin’s price to surge by 10%.

“That’s just an example of the intense interest in cryptocurrencies,” Fink said during a recent appearance on Fox Business. “I think today’s rally is about a flight to quality.”

His perspective marks a noteworthy shift in how the day’s events unfolded, triggered when cryptocurrency news outlet Cointelegraph tweeted that the highly anticipated Bitcoin ETF application from BlackRock had been approved without citing any sources for this claim.

Both BlackRock and the SEC promptly refuted this rumor, and Cointelegraph retracted the post, but not before Bitcoin’s price had surged to nearly $30,000 for the first time since July. Ultimately, the world’s leading cryptocurrency earned $29,483 on the rumor but plummeted to below $28,000 within 15 minutes following its debunking.

Bitcoin currently stands at $28,340, according to TradingView.

Fink, who claimed to have discovered the situation a few hours later due to being “busy all day,” emphasized that Monday’s events only underscore the global demand and interest in a Bitcoin spot ETF, particularly in the context of ongoing international uncertainties.

However, others view the situation differently.

Many Bitcoin supporters took to Twitter to lament the Monday mishap, fearing that SEC Chairman Gary Gensler might use it as evidence of market volatility and susceptibility to manipulation. They suggest this could dash hopes for the swift approval of a Bitcoin spot ETF in the United States in the short to medium term.

And we’ve just handed this guy the right to deny all Bitcoin spot ETFs.

Gary Gensler is poised to deny all spot ETFs by citing this blatant market manipulation as proof of market manipulation potential.

What will happen if Gary Gensler now uses this blatant market manipulation to further delay ETF approval?

While the SEC continues to keep BlackRock’s application under wraps, the federal regulatory agency alluded to Monday’s events in a concise tweet.

SEC Rejects Grayscale Bitcoin ETF Court Appeal: Report

The U.S. Securities and Exchange Commission (SEC) has missed the mid-October deadline to deny a court ruling on the approval of a physically-backed Bitcoin spot exchange-traded fund (ETF).

The financial agency will not appeal this decision to court, Reuters reported on October 13, citing a source familiar with the matter.

SEC versus the Grayscale

The legal dispute between the U.S. regulatory agency and the asset management company began last year. Grayscale had submitted an application to the SEC, seeking to convert its flagship product, the Grayscale Bitcoin Trust (GBTC), into a Bitcoin spot ETF. The conversion plan is part of the investment firm’s strategy to transform its main Trust products into ETFs.

Approval of the application would enable Grayscale to offer Bitcoin-backed assets that track Bitcoin’s price more efficiently than GBTC. Right after the agency rejected Grayscale’s request last year, the investment company filed a lawsuit against the SEC.

Following a year-long legal battle, Grayscale secured a breakthrough victory in a federal court presided over by three judges in August. The judges directed the SEC to consider Grayscale’s Bitcoin spot ETF request, deeming its prolonged delays as “extraordinary.”

Following the court’s decision on August 29, supporting Grayscale, the financial regulatory agency had a 45-day deadline to file for en banc rehearing, a type of hearing in which all the court’s judges collectively decide an issue instead of just one judge or a small group of judges presiding over a case.

>>> Whales Accumulate 3.2 Million Dollars in Bitcoin and Embrace MicroStrategy’s Bold Stance

Approval in sight?

It must be acknowledged that the SEC’s decision to reject the August court ruling related to Grayscale’s Bitcoin ETF allows the financial watchdog to consider the company’s application.

However, this does not directly imply that the long-awaited Bitcoin spot ETF will be greenlit. Jennifer Schulp, director of financial regulation at the Cato Institute’s Center for Monetary and Financial Alternatives, reiterated this when she said:

“That doesn’t mean that approval will come quickly, and it’s still far from certain because the SEC can reconsider and reject for various reasons and fundamentally restart this legal battle.”