Bitcoin SV (BSV), a derivative of the Bitcoin Cash (BCH) blockchain resulting from a hard fork, is experiencing remarkable gains, with its price surging by more than 65% at the time of this writing. While the prevailing positive market sentiment contributes to this surge, there are additional factors at play.

One driving force behind the upward momentum of Bitcoin SV is its increasing demand within the cryptocurrency landscape. Over the past 24 hours, BSV’s trading volume has seen an astonishing surge of 615.98%, reaching a substantial value of over $612.40 million. Notably, the surge is predominantly fueled by South Korean traders.

Recent statistics from CoinGecko reveal that Upbit, a prominent South Korean cryptocurrency exchange, has accounted for $513.81 million in BSV trades over the past day, capturing an impressive 67.25% share of the total trade volume. This indicates a heightened interest in Bitcoin SV among South Korean investors.

South Korea has recently taken steps to establish a regulatory framework for cryptocurrencies, aiming to address illicit activities in the sector. Additionally, in an update on December 27, it was announced that public officials are now required to report their cryptocurrency assets, marking a significant move towards regulatory oversight. These developments likely attract investors seeking a regulated environment for added security.

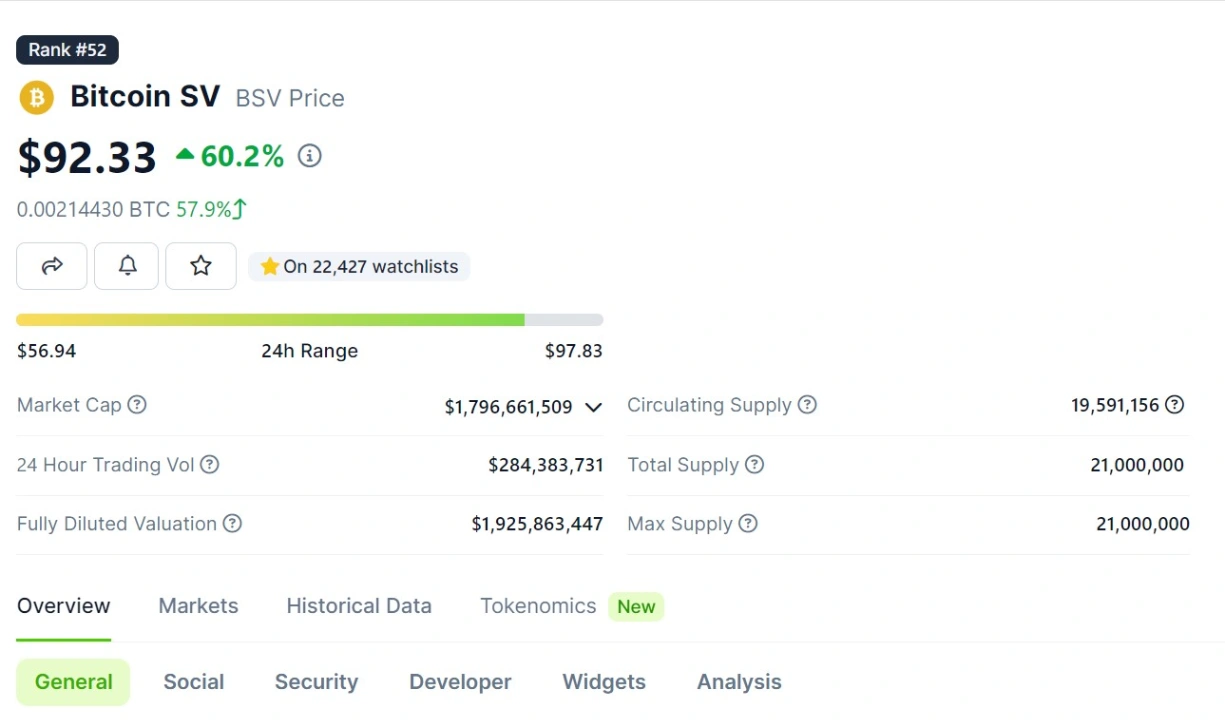

As of the latest update, Bitcoin SV is trading at $92.33 on Thursday, December 28, 2023, marking a price increase of 67.97%. Furthermore, the market capitalization of BSV has surged by 65.73% to reach $1.7 billion, reaching a new 52-week peak with a high of $89.50 during the current trading session.

The recent surge in Bitcoin SV is notable as the cryptocurrency has rebounded significantly from its historical low of $23.30 recorded on June 10, 2013, registering an impressive surge of over 271%. Additionally, the one-month returns for the crypto have witnessed a remarkable increase of over 120%.

Related: MicroStrategy Acquires Significant Bitcoin Holdings

However, it’s worth noting that the current price remains considerably lower than its all-time high in 2021. Bitcoin SV reached its peak at $491.64 in April 2021, indicating a decline of over 82% in value since reaching its highest point.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE