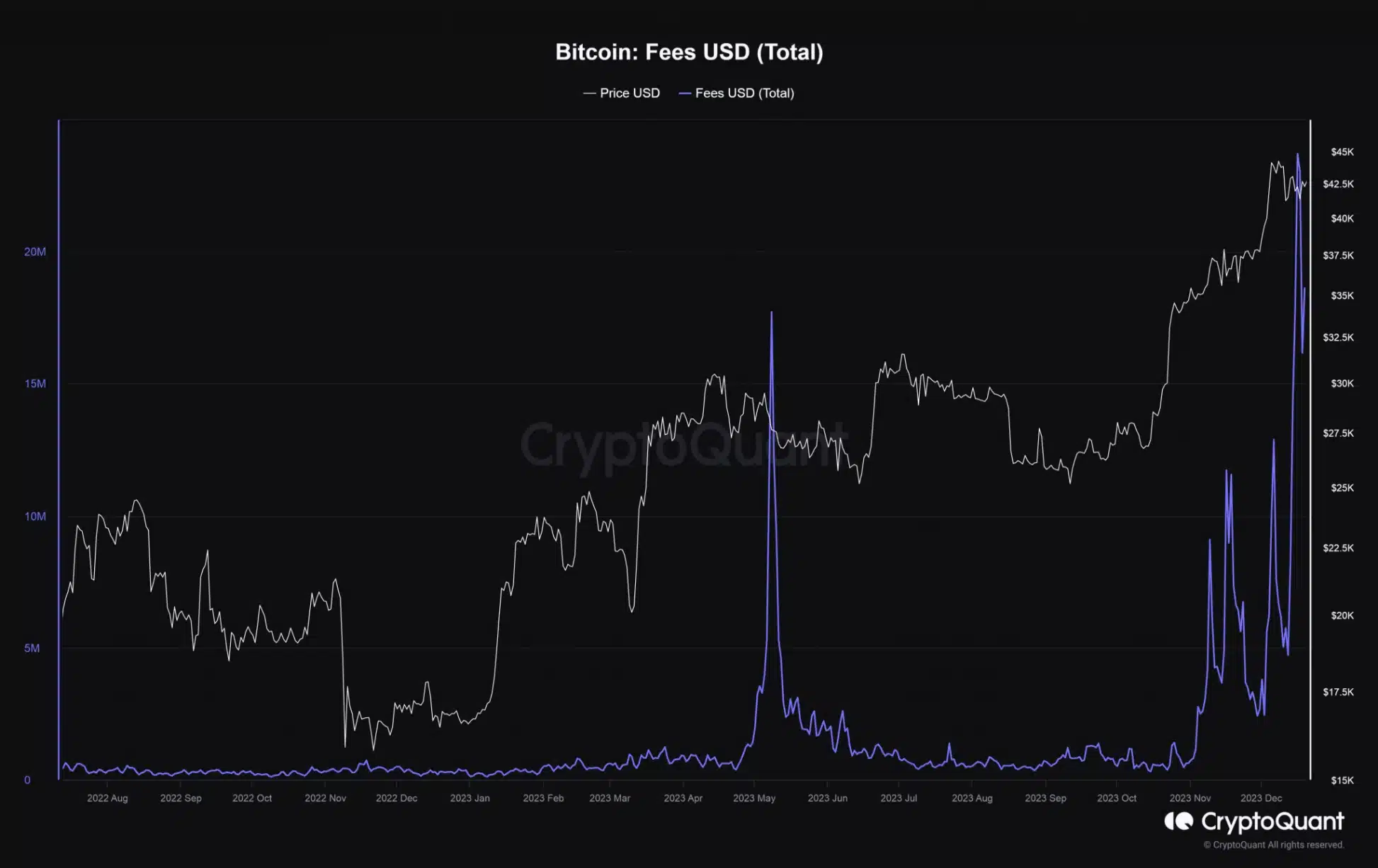

Bitcoin miners found themselves celebrating an early Christmas as transaction fees soared to unprecedented levels on December 16th, accumulating a staggering $23.7 million. The surge in Bitcoin’s transaction fees, fueled by the ongoing Ordinals frenzy, contributed to an all-time high in fee revenue, according to on-chain analytics firm CryptoQuant.

Miners’ Profits Skyrocket

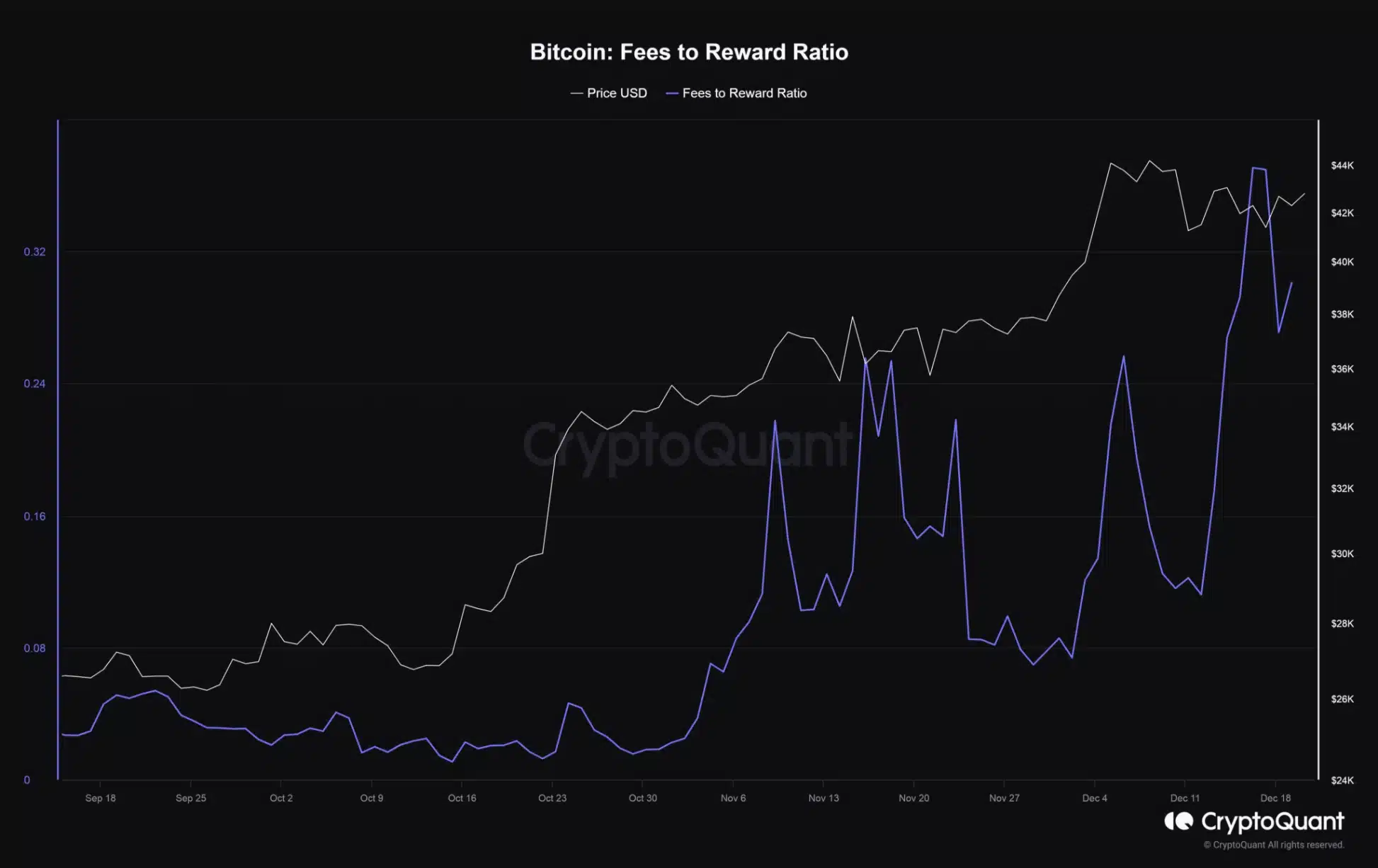

On that particular day, Bitcoin miners witnessed a remarkable boost in their overall earnings, encompassing the fixed block subsidy of 6.25 BTC. The cumulative revenue for miners reached over $63 million, marking the highest figure since the peak of the bull market in November 2021. Transaction fees played a significant role in this financial windfall, constituting nearly 37% of the miners’ total revenue—a striking statistic that ranks as the second-highest since the preceding Ordinals frenzy in early May.

The substantial increase in transaction fees not only bolstered miners’ financial gains but also showcased the robust demand for blockspace within the Bitcoin network. This surge in demand for blockspace has become a driving force behind the impressive financial performance of miners.

Miners Holding Firm on Assets

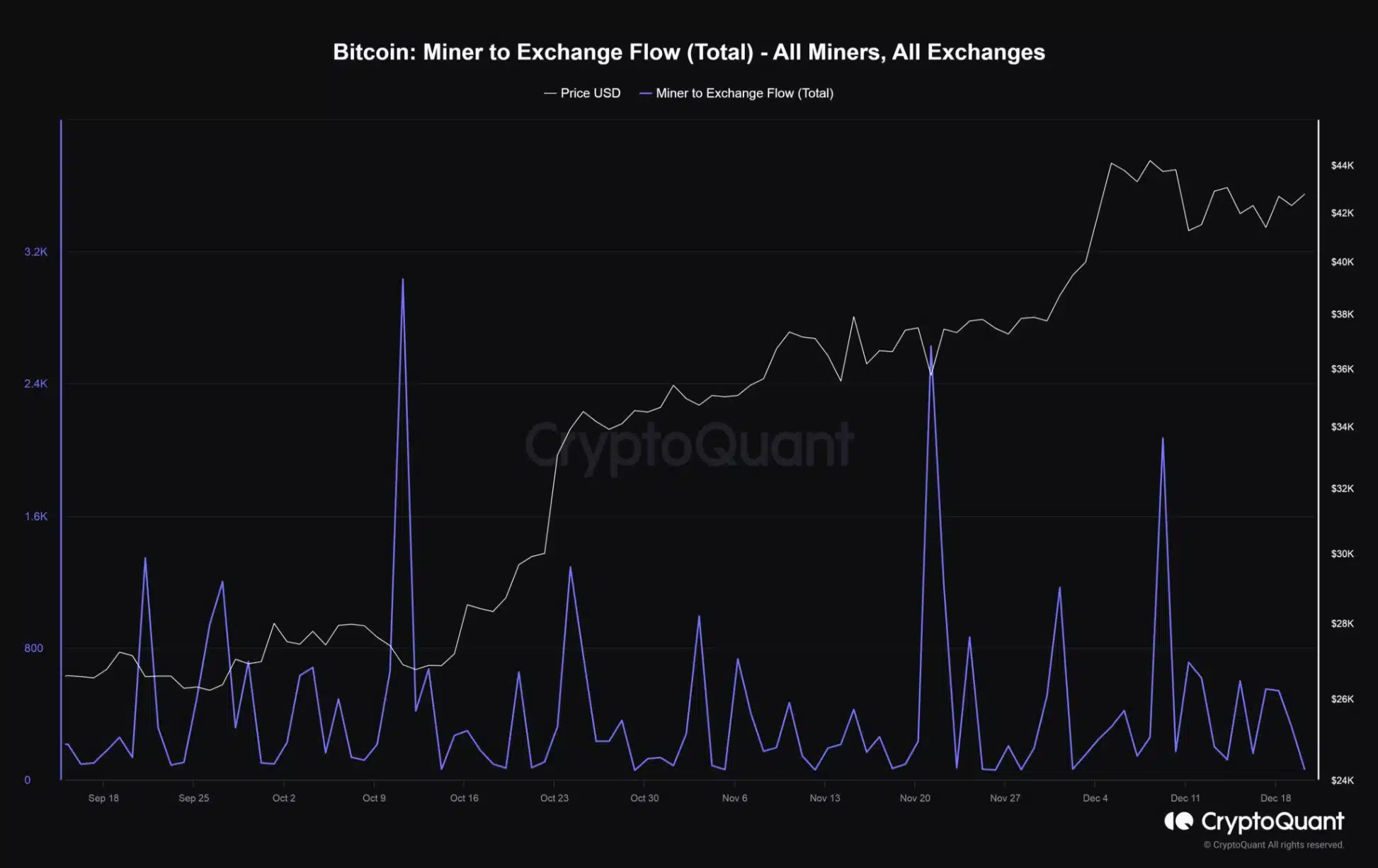

It’s worth noting that miners, who invest substantial sums in establishing sophisticated infrastructure to create blocks and secure the Bitcoin network, heavily rely on mining revenue to offset the exorbitant costs associated with their operations—costs that often reach into the thousands of dollars. Despite the lucrative earnings from transaction fees, miners have yet to liquidate their holdings, highlighting their strategic approach to managing and maximizing their profits in the current market conditions.

Contrary to expectations, miners did not promptly liquidate their holdings despite the substantial surge in their earnings. Observations from AZC News revealed a lack of significant spikes in coin movements from miners to exchanges. This suggests that miners might be strategically holding onto their assets, anticipating more profitable days before considering any sell-offs.

Bitcoin Dominates as Leading NFT Blockchain

In a noteworthy development, Bitcoin has emerged as the foremost NFT (non-fungible token) chain, marking a paradigm shift in the blockchain landscape in 2023. The Ordinals concept, introduced by Bitcoin earlier in the year, has sparked a trend that other chains, both EVM (Ethereum Virtual Machine) and non-EVM, have eagerly adopted, launching their own iterations.

Ordinals function by directly embedding images or other data onto the blockchain, facilitating the creation of digital assets such as NFTs and even fungible tokens through the BRC-20 standard.

Related: December Witnesses Soaring NFT Trade Volumes

The primary application of Ordinals has been in the NFT space, propelling Bitcoin into the upper echelons of NFT-friendly networks. Cryptoslam data indicates that Bitcoin has dominated the NFT trade landscape over the past month, with sales exceeding an impressive $700 million.

This achievement puts Bitcoin ahead of traditional leaders like Ethereum (ETH) and Solana (SOL), which managed sales of $389 million and $245 million, respectively. The substantial success of Bitcoin in the NFT market underscores its growing influence and adoption within the blockchain ecosystem.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE