When the price of Bitcoin (BTC) unexpectedly reached a new peak, Bitcoin mining companies also reaped record profits. According to blockchain data, the daily revenue of Bitcoin mining companies has hit a new all-time high since April 2021.

Bitcoin Miner Daily Revenue Skyrockets

According to CryptoQuant data, the daily revenue of miners reached $78.6 million on March 7, surpassing the previous peak recorded during the last bull run in April 2021. The income of Bitcoin miners stems from minting new coins to verify transactions on the blockchain and from fees paid by users.

This rapid revenue growth is in line with the impressive price surge of Bitcoin, up by 70% since the beginning of the year. The cryptocurrency recently reached a historic high of $72,881 on Monday and continued trading at $72,668.

However, the increase in Bitcoin revenue also translates to higher energy consumption. According to the latest report, Bitcoin mining companies have consumed a record amount of energy in the past month. This increased mining activity coincides with a reduced supply, contributing to the stable and sustainable rise of BTC.

Based on Coin Metrics’ estimates, the total electricity consumption of mining machines reached 19.6 gigawatts last month, a significant increase compared to the 12.1 gigawatts recorded during the same period in 2023. This figure represents a growth rate of up to 61%.

The U.S. Treasury is proposing a special consumption tax targeting companies engaged in digital asset mining, with the tax rate potentially reaching up to 30% of the electricity cost for mining activities. If this proposal is accepted, mining enterprises will be required to disclose details about the quantity and source of electricity consumption, as well as the related costs for externally purchased power.

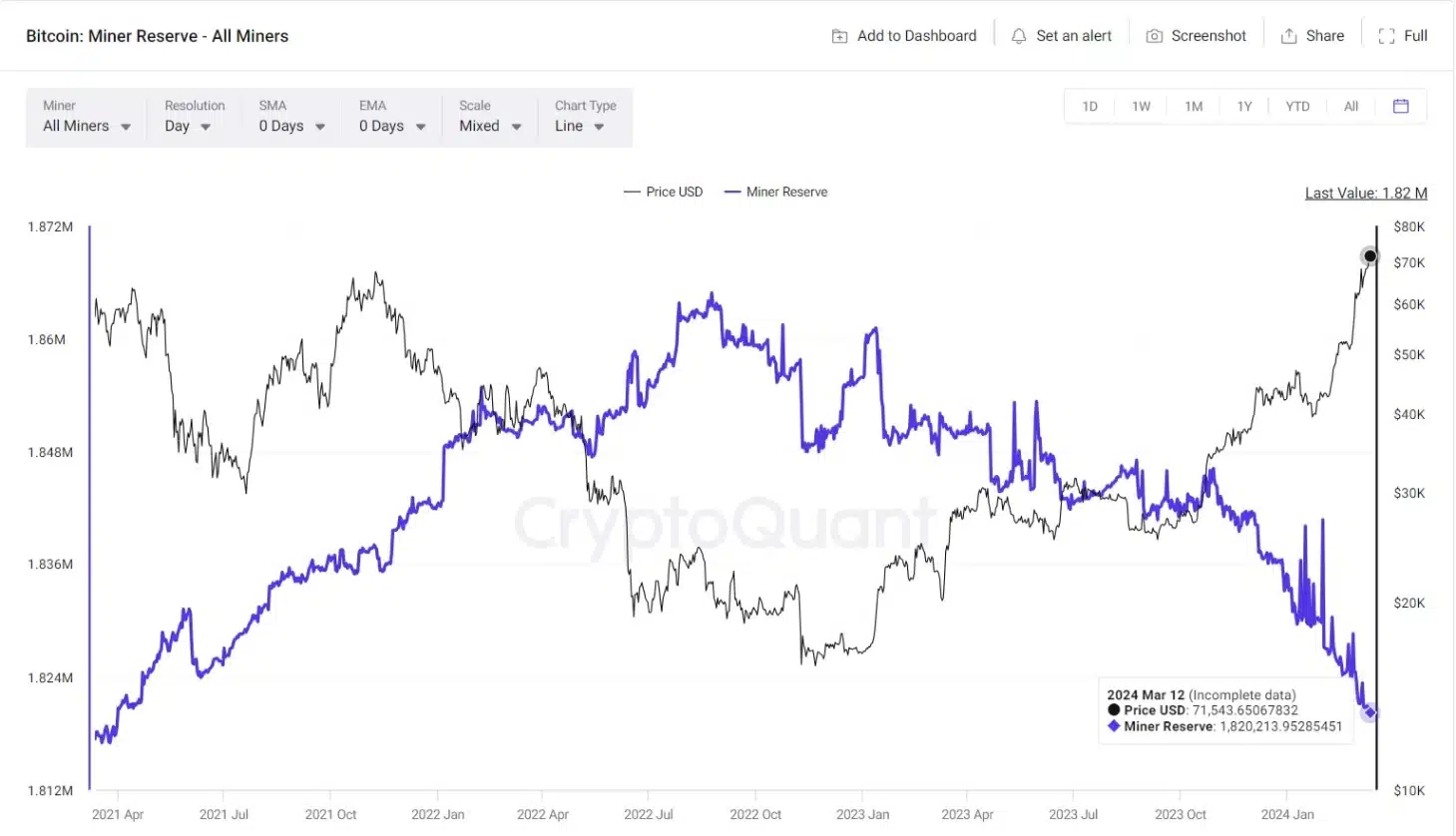

Treasury Amount at ATH Despite Miner Selling

Despite the sale of mining machines, the amount of Bitcoin held by mining companies has significantly decreased, totaling a reduction of 14,128 BTC, equivalent to 1 billion USD, since the beginning of the year. Recent data indicates that most days in the past month have witnessed an outflow of funds from Bitcoin mining companies. However, these businesses still retain a considerable amount of Bitcoin, up to 1.82 million BTC, with a value of up to 131 billion USD – the highest value recorded in U.S. dollars.

Related: Bitcoin Surges to $72,000 as ETF Funds Continue Breaking Records

An interesting development is that Bitcoin mining companies are taking actions contrary to exchange-traded funds (ETFs), as they appear to be reducing the amount of Bitcoin held, while institutional investors are purchasing digital assets on behalf of ETF shareholders.

The anticipated Bitcoin halving event in April, designed to halve the reward for miners and reduce the coin’s supply growth rate, is fueling rumors of an imminent price increase.

These fluctuations mark a notable shift for Bitcoin mining companies away from the challenging conditions of the cryptocurrency winter, where some businesses faced the risk of bankruptcy. Notably, the Valkyrie Bitcoin Miners ETF, comprising companies such as CleanSpark Inc. and Marathon Digital Holdings Inc., has surged by over 100% in the past year.

Sebagai pemula perlu banyak belajar dan butuh banyak bimbingn

I am new here hope am welcome

Good

I’m a new member

I’m happy with my participation in Bitcoin

Your article helped me a lot, is there any more related content? Thanks!