A frigid spell in Texas likely contributed to a 34% decline in the Bitcoin hash rate, with miners compelled to scale back operations due to strain on the state’s energy infrastructure. Commencing on January 14, temperatures in various Texas regions plummeted below freezing, reminiscent of the massive ice storm in February 2023.

YCharts data reveals a sharp drop in the total Bitcoin network hash rate from over 629 exahashes per second (EH/s) on January 11 to around 415 EH/s on January 15. This constituted a 34% reduction, although the hash rate rebounded to over 454 EH/s on January 16 as temperatures briefly rose above freezing in Austin.

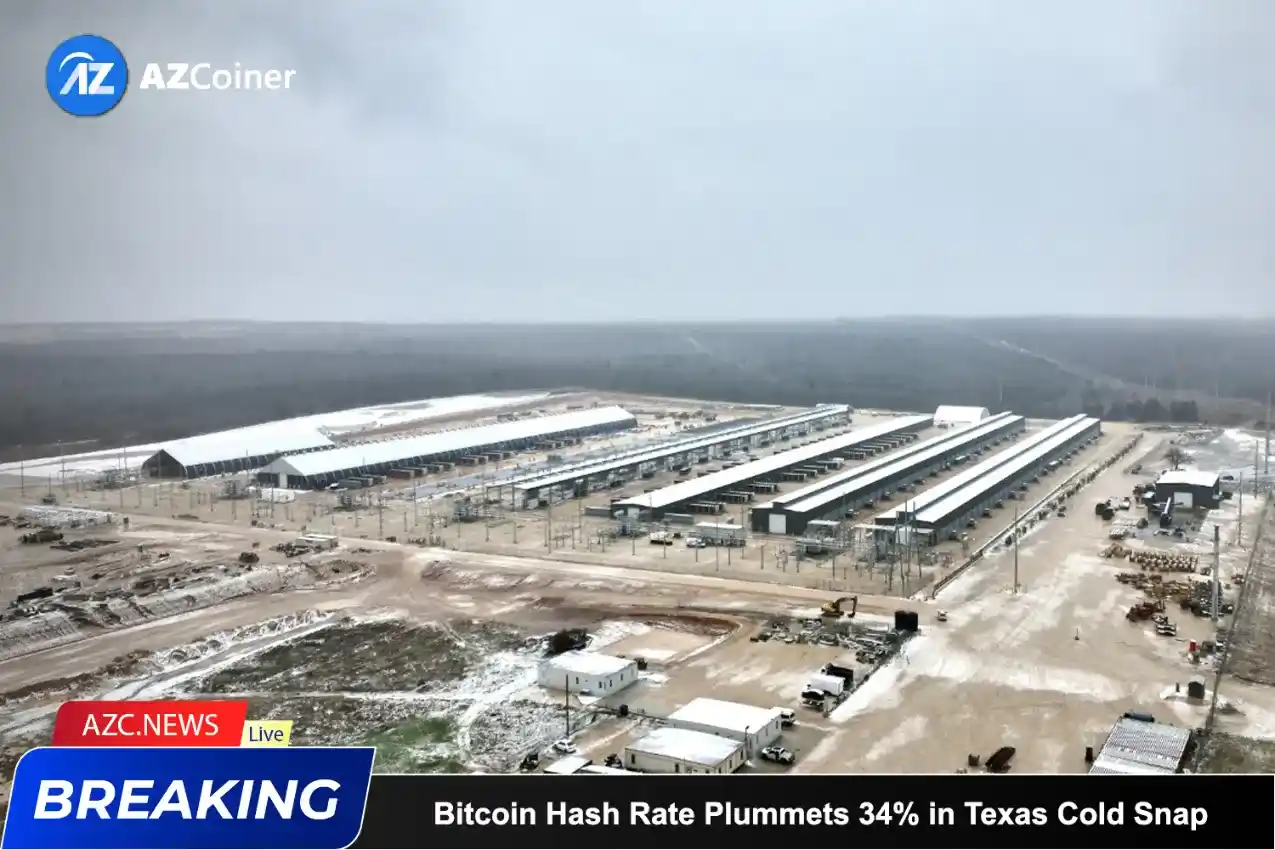

Foundry’s data pool indicates that Texas contributed approximately 29% of the Bitcoin hash rate in the United States, attracting mining firms relocating from China following the country’s crackdown on BTC miners. Notable companies with operations in Texas include Marathon Digital, Riot Platforms, Bitdeer, and Core Scientific.

In contrast to the winter of 2021, which witnessed widespread power outages during a severe storm, this recent freeze resulted in fewer significant disruptions to Texas’ power grid. Many mining firms have aligned with a program organized by the Electric Reliability Council of Texas (ERCOT), compensating them for adjusting their load on the state’s power grid during periods of high demand.

Marathon, along with other Bitcoin miners, has proactively scaled back operations to support the Texas electric grid during the state’s struggle with sub-zero temperatures. Charlie Schumacher, the vice president of corporate communications at Marathon Digital, emphasized the role of Bitcoin miners as a flexible base load that can be adjusted during extreme weather events. This practice enhances energy availability and affordability for residents in need within minutes.

A spokesperson from Riot explained that the company actively engages in demand response programs, allowing ERCOT to manage their load during critical periods to balance the grid amidst challenging weather conditions.

Related: Sudden Surge in Bitcoin Spot ETF Trading Volume

In Texas, the demand for energy often peaks during extreme heat in the summer and severe winter conditions, posing a potential threat to the state’s energy infrastructure. In December 2022, Argo Blockchain reported a significant decrease in activity at its Texas Helios facility due to winter conditions, mining approximately 25% less Bitcoin than in November. As of January 17, ERCOT reported that “grid conditions are expected to be normal” starting at midnight local time.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE