Bitcoin has been holding steady at the $35,000 level for the past 24 hours, driven by a shift in sentiment regarding Federal Reserve policies. Weaker U.S. jobs data released on Friday has raised expectations that the Fed’s rate hikes might be coming to a halt, as reported by Bitfinex.

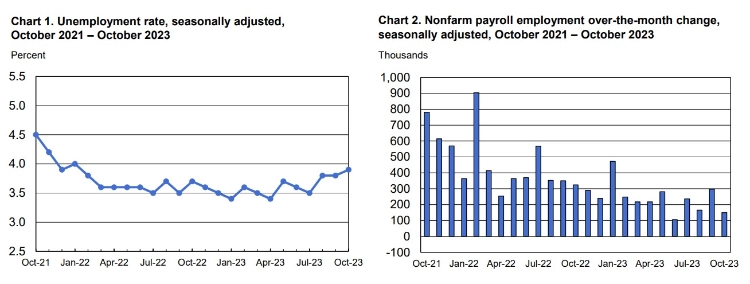

The U.S. Labor Department’s employment report revealed that only about 150,000 new job positions were added in October, a significant drop from the approximately 297,000 added in September. This disappointing jobs data has contributed to the growing belief that the Fed is adopting a more dovish stance.

Bitfinex’s Alpha report on Monday cited the weaker jobs data as further evidence that the Fed may be done with its rate hikes. The report pointed to tightening financial conditions, particularly the rise in bond yields over recent months, as a key factor influencing this change in sentiment.

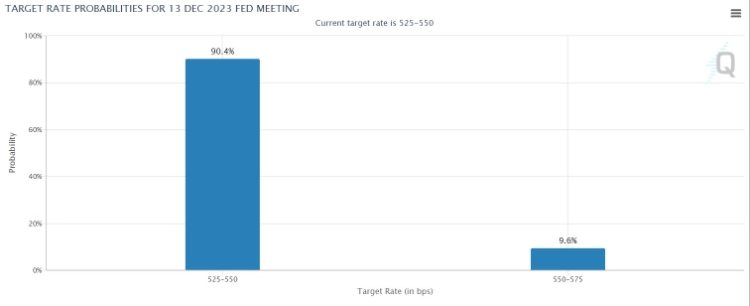

Traders have adjusted their expectations, now pricing in a 90.4% chance that the Fed will maintain interest rates in December, up from the 80% estimate prior to the release of the payroll data, according to the CME FedWatch tool.

Bitfinex analysts also noted that the jobs data from Friday indicated a potential decrease in wage-driven inflation pressures. The softer job growth and higher productivity reports aligned with the Fed’s decision to pause interest rate hikes.

These developments follow the Federal Open Market Committee’s decision last Wednesday to keep the benchmark federal funds rate within the current range of 5.25% to 5.50%. The policy statement accompanying this decision revealed a cautious approach by Fed officials, considering the time it takes for monetary policy to impact economic activity and inflation, as well as monitoring economic and financial developments.

CTF Capital concurred with Bitfinex’s outlook on interest rates, suggesting that the market is pricing in an extended pause in rate hikes in the coming months. Additionally, interest rate futures are pointing toward the possibility of the first rate cut by mid-2024. The overall sentiment that the Fed might be finished with rate hikes is likely to further bolster the positive performance in the cryptocurrency space and U.S. equities.

Related: Anticipated Fed Interest Rate Cuts Signal Impending Bitcoin Price Surge

Bitcoin’s price has been holding steady around the $35,000 mark for an extended period, signaling a temporary pause in its recent bullish run. However, several indicators now suggest potential challenges ahead for BTC.

Investors have found relief in Bitcoin’s ability to stay above a crucial level, but its rapid ascent has slowed in recent weeks. According to TradingView, BTC only saw a 0.5% decrease today, trading at $34,857.78 with a market capitalization exceeding $680 billion.

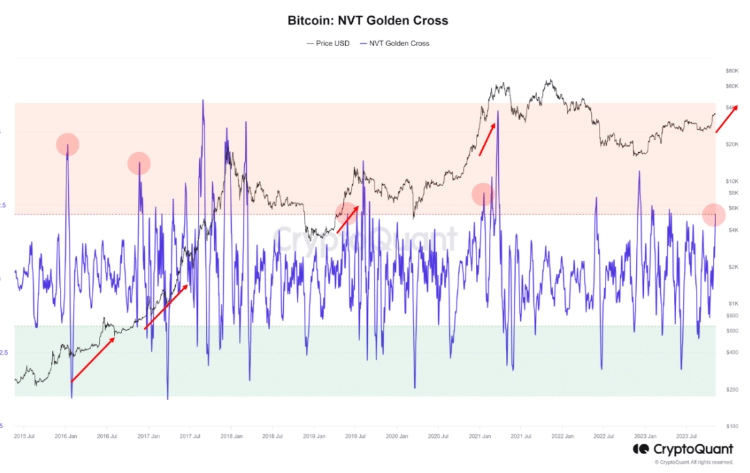

Amid this period of price consolidation, a key indicator has taken a bearish turn. MAC_D, an analyst at CryptoQuant, highlighted that Bitcoin’s Network Value to Transactions (NVT) signal has reached a seemingly overvalued level. Specifically, the NVT ratio, which describes the relationship between market capitalization and transfer volume, stood at 2.19 at the time of the analysis.

It’s worth noting that such episodes of NVT reaching overvalued levels have occurred during previous recovery phases for Bitcoin. In many instances, this has led to further price gains and a transition to a bull market.

Despite the NVT signal’s history, it’s important to consider other metrics to assess the potential for a price correction.

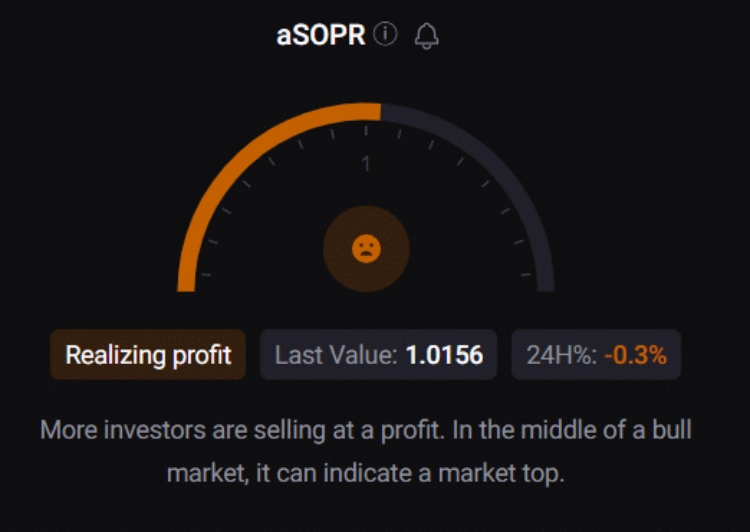

Data from CryptoQuant reveals that BTC’s exchange reserves are on the rise, indicating heightened selling pressure on the coin. The aSORP (Amplified Supply Overhang Percentage) is also in the red, suggesting that investors are selling their holdings for profit, potentially signaling a market top during a bull market.

In addition to these metrics, several market indicators appear bearish for the leading cryptocurrency. The Moving Average Convergence Divergence (MACD) has displayed a bearish crossover, while Bitcoin’s Relative Strength Index (RSI) has entered the overbought zone. Furthermore, the Money Flow Index (MFI) has shown a decline and is trending toward a neutral position, increasing the likelihood of a price correction.