Bitcoin could reach $45,000 by January

The asset manager has indicated that Bitcoin could reach $45,000 by January after the U.S. Securities and Exchange Commission (SEC) approves a direct investment exchange-traded fund (ETF) for cryptocurrencies.

According to digital asset manager 3iQ, Bitcoin has the potential to reach $45,000 by January following SEC’s approval of a direct cryptocurrency trading fund.

A report mistakenly published on Monday by the cryptocurrency news service Cointelegraph stated that the approval of a Bitcoin ETF in the United States caused a brief 10% surge in Bitcoin’s price to nearly $30,000, before it retraced to its initial level.

Bitcoin was trading at around $28,724 on Monday afternoon, up 6% from 24 hours earlier.

Steven Lubka, head of the individual client and family office division at Swan Bitcoin, noted that although the report has been proven false, Bitcoin’s short-lived recovery provided evidence that the approval of a Bitcoin ETF still remains underpriced in the market.

Lubka said, “I think it’s a strong sign that when we do get that approval, we’re going to see the price increase. Perhaps it will happen more slowly as people begin to realize the winds are changing.”

SEC had previously approved several Bitcoin futures ETFs but had yet to give the green light to anything based on actual Bitcoin, citing concerns about market manipulation.

Market participants are expecting the SEC to approve the registration of Bitcoin ETFs from ARK Invest and 21Shares before January 10, 2024, the final deadline for a decision.

Lubka added, “If you get the approval for a spot Bitcoin ETF, it’s opening up a whole new pool of money that can now buy Bitcoin that couldn’t before. It will also paint a clearer picture of regulatory clarity in the United States.”

Mark Connors, head of research at 3iQ Corp, based on analysis of Bitcoin’s 200-day moving average and 200-week moving average, believes that the approval of a Bitcoin ETF could drive the cryptocurrency to a range of $35,000 to $45,000.

Bitcoin-related funds also surged on Monday, with Grayscale Bitcoin Trust rising 7.9% to about $21.83. The fund was trading at around 14% below its net asset value, the narrowest discount since 2021. The ProShares Bitcoin Strategy ETF, which invests in Bitcoin futures contracts, rose 6.5% to $14.51, according to MarketWatch data.

>>> What is Bitcoin ETF? The Importance of Bitcoin ETF

Whales buying additional Bitcoin

Positive signals for Bitcoin’s potential price surge emerged as large investors holding 100-1,000 BTC, known as “whales,” and whales buying additional Bitcoin.

Bitcoin started the new week positively, surpassing the $28,000 mark on Monday. This upward momentum also affected other cryptocurrencies, with Ethereum, Solana, Cardano, and other alternative coins experiencing notable gains.

According to data from cryptocurrency analytics company Coinglass, this rapid price increase caught short sellers off guard, resulting in significant losses of up to $26.1 million in the past 24 hours.

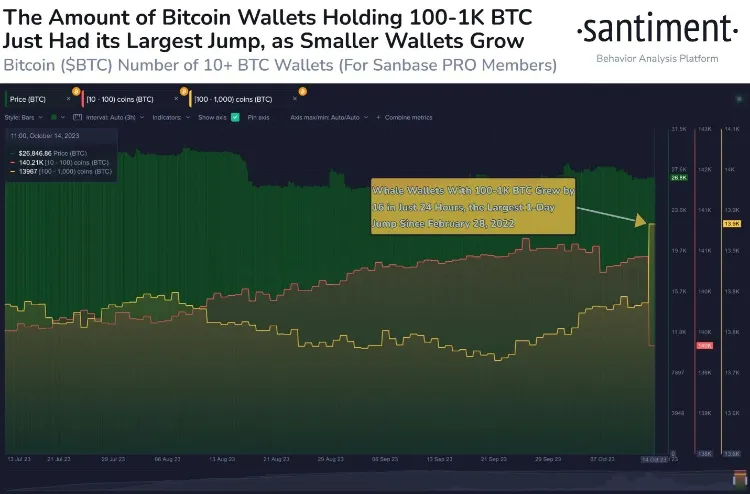

Notably, Bitcoin’s surge coincided with positive news from cryptocurrency analysis firm Santiment. In a tweet, the company announced that on Sunday, 16 additional wallets joined the group of holders of 100-1,000 BTC, marking the largest single-day growth since February 28, 2022.

Furthermore, data from the company indicated that Bitcoin whales had acquired approximately 117 BTC in the past 48 hours, reinforcing confidence in Bitcoin’s future price increase.

The company wrote: “As major players continue to accumulate, the bullish case strengthens.”

In another tweet, Santiment suggested that the sudden increase in price is a result of the movement of dormant coins, signaling a potential price reversal.

“Bitcoin’s return to the $27,000 range may be supported by a large amount of old coins finally being moved. The largest change in inactive BTC since July, these sudden spikes in our HODLer Age Consumed index indicate a reversal in price direction.”

>>> BlackRock CEO Addresses Bitcoin Price Surge Caused by False ETF News

Elsewhere, in a lengthy tweet, renowned market analyst Scott Melker pointed out the significance of the increasing number of large Bitcoin wallets. Remarkably, the number of large wallets has been steadily growing since February 2022, reaching a record-high of 157,400 on September 26, 2023, surpassing the previous all-time high set in 2019.

In the world of cryptocurrency, “whales” typically hold from 100 to 1,000 Bitcoins, while “whales” hold even larger amounts. Experts note that the accumulation of Bitcoin by these large holders signifies increasing optimism and solidifies Bitcoin’s position as a mature asset, attracting a diverse range of investors, including high net worth individuals and organizations.

Amidst these developments, analysts are searching for clues that Bitcoin is on track for further price increases.

Market analyst Ali Martinez emphasized that the Bollinger Bands on Bitcoin’s 4-hour chart are tightening, indicating an impending increase in volatility. According to her, the closing price above $27,000 or below $26,690 in the 4-hour candle will be crucial in determining Bitcoin’s future trend.

Cryptocurrency trader Nebraskangooner echoed Ali’s sentiment, highlighting the importance of Bitcoin breaking through the $27,000 resistance. He tweeted, “The interesting thing is that Bitcoin has reclaimed the $27,000 resistance. We may consider looking for price increase scenarios above that level.”

At the time of writing, Bitcoin is trading at $28,469 after a 5.35% increase in the past 24 hours.