Binance [BNB], one of the leading cryptocurrency trading platforms, has announced plans to expand its lending assets through the Binance Loans (Flexible Rates) and VIP Loan services. This initiative is designed to cater to the diverse borrowing needs of users, enhancing their flexibility on the platform.

What is the purpose?

By introducing new lendable assets, Binance aims to maintain its position as a versatile provider in the evolving digital finance landscape.

Interestingly, this move by Binance comes amidst its ongoing legal battle with the SEC, and the recent verdict involving CEO Changpeng Zhao marks a significant development.

To provide more details on the plan, the team released a press statement, noting, “Binance has added the following lending assets to Binance Loans (Flexible Rates) and VIP Loan.

Binance Loans (Flexible Rates) – Bittensor (TAO), LayerZero (ZRO), and Lista (LISTA)”

VIP Loan – Bittensor (TAO), COTI (COTI), LayerZero (ZRO), Lista (LISTA), Portal (PORTAL), Sleepless AI (AI), and Vanar (VANRY).”

To further clarify their new initiative, the team added:

“To place a new Binance Loans (Flexible Rates) order through the Binance App, please upgrade the App to iOS v2.78.0 or Android v2.78.0 or higher. Older app versions no longer support placing new Binance Loans (Flexible Rates) orders.”

Impact on BNB?

This development has reversed the downward trend observed in BNB for quite some time. According to the latest update, BNB is trading at $530.70 with a 1.39% increase over the past 24 hours.

However, it is important to note that while the new initiative has boosted BNB’s price, the Relative Strength Index (RSI) remains at 44, indicating a bearish sentiment below the neutral level at press time.

Therefore, for BNB to reach and surpass the $600 mark, it must break the immediate resistance at $559, paving the way for a sustainable bullish phase and anticipated price surge.

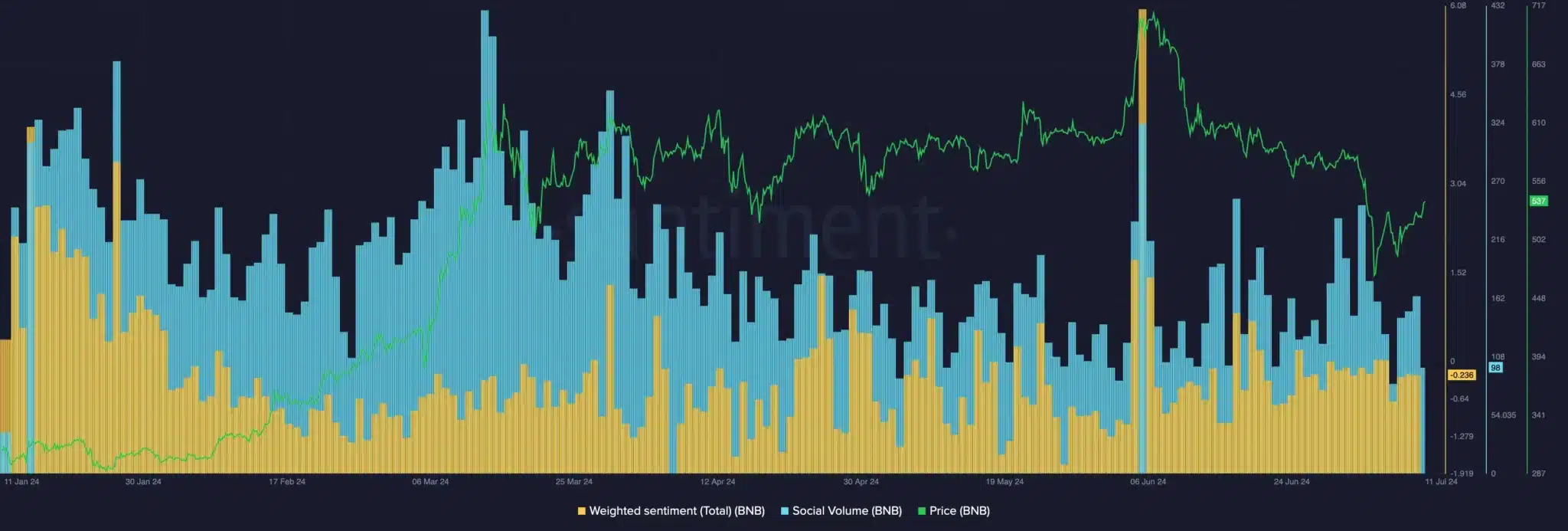

This is further corroborated by Santiment data analysis, which shows a significant decline in Social Volume and Weighted Sentiment.

This highlights an increase in negative comments surrounding the BNB token, reflecting growing bearish sentiment.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

Okay 👌

Great 👍