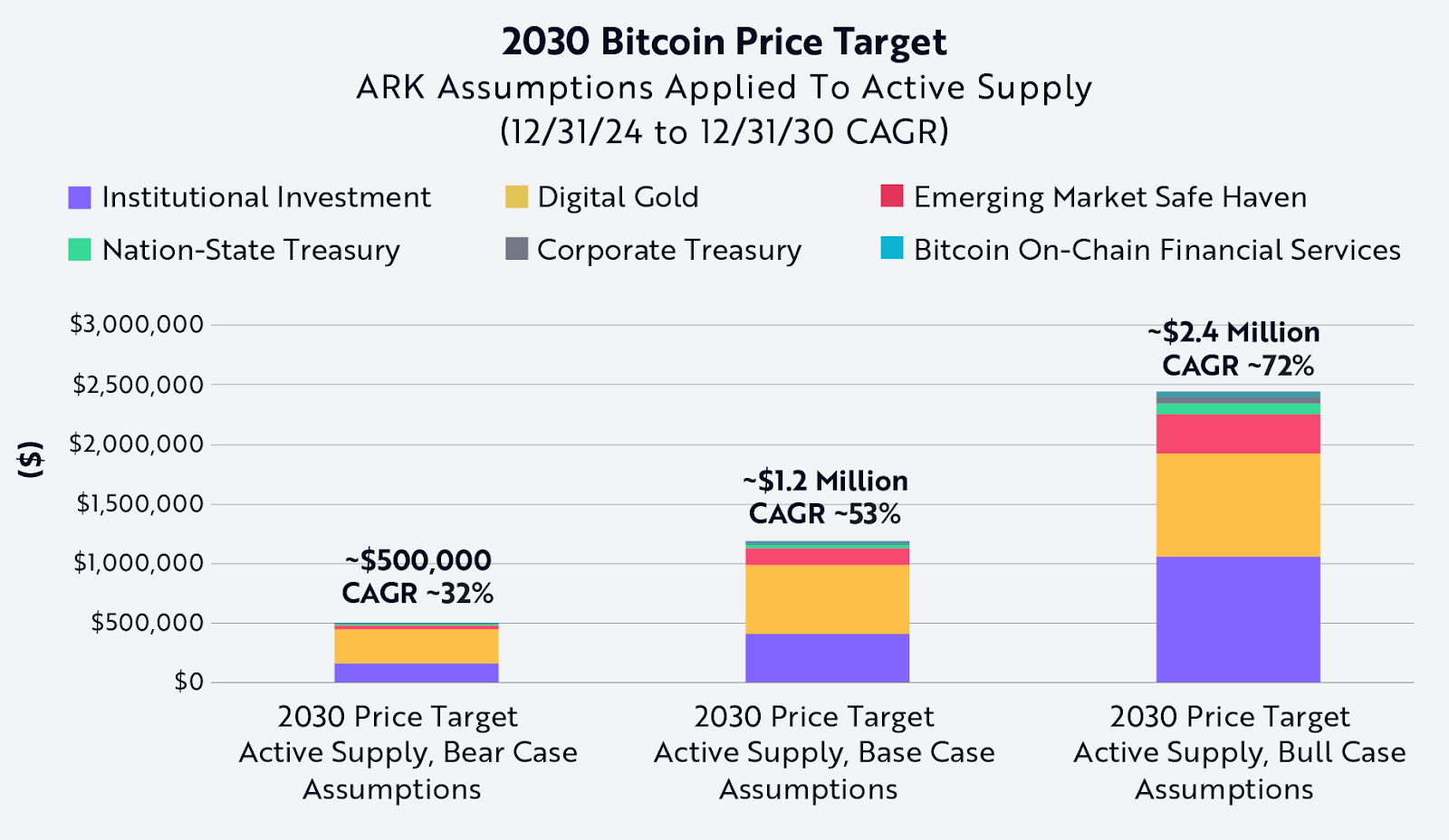

In a report released on April 24, ARK analyst David Puell noted that not only has the optimistic scenario been adjusted upward, but the “base” and “bear” case projections have also been raised to $1.2 million and $500,000, respectively. Previously, on February 11, ARK had forecast these figures at $710,000 and $300,000.

ARK’s price models are based on three main factors: Bitcoin’s total addressable market (TAM), the penetration rate — i.e., the share of that market Bitcoin might capture under different scenarios — and Bitcoin’s supply schedule.

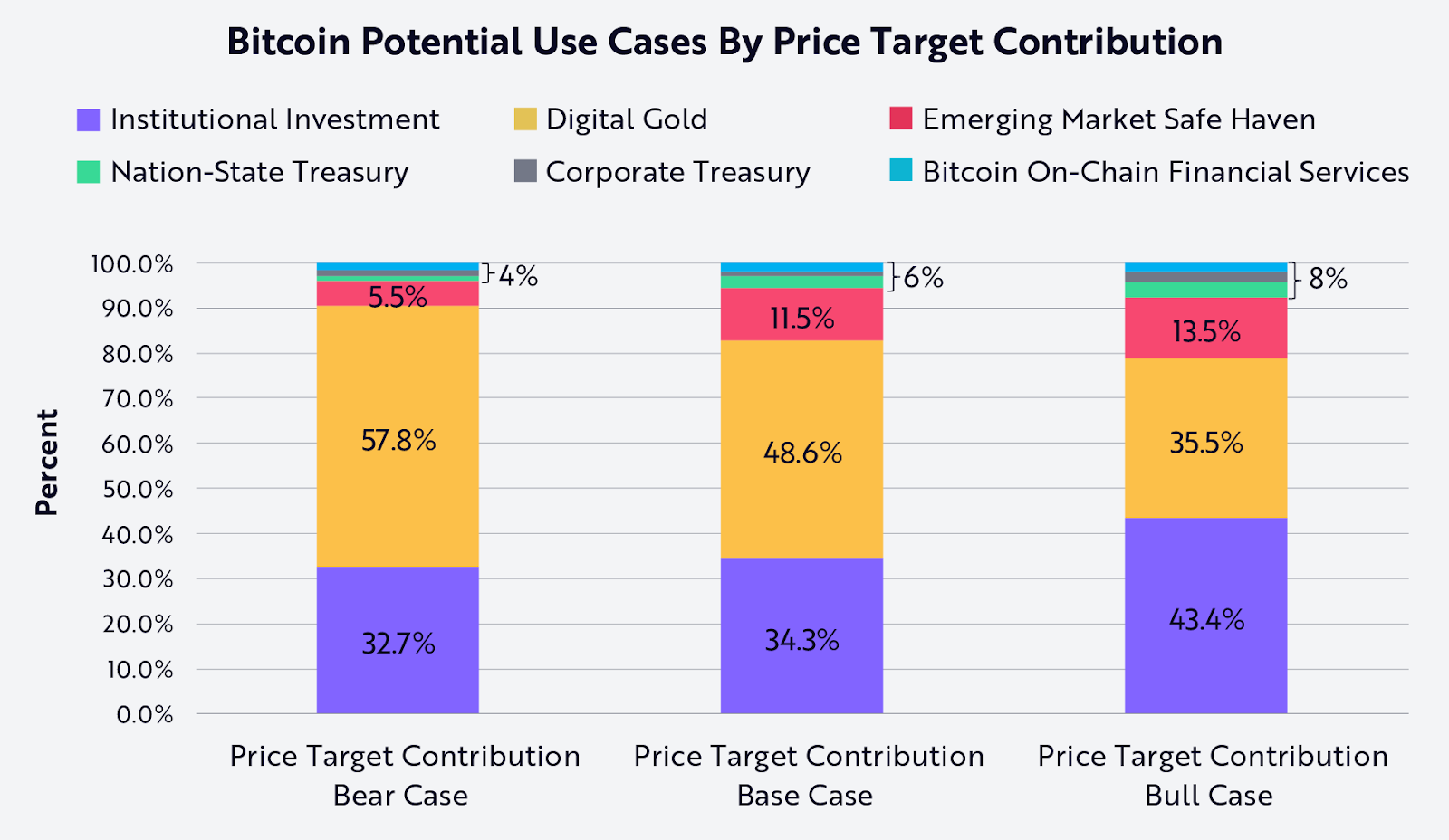

“Institutional investment contributes the most to our bull case,” said Puell, estimating that Bitcoin could capture about 6.5% of the $200 trillion global financial market in a best-case scenario — excluding gold.

Bitcoin’s increasing status as “digital gold” is another major factor in this ambitious forecast. In the bullish case, ARK projects Bitcoin could seize up to 60% of gold’s $18 trillion market capitalization (based on 2024 figures).

Additionally, Bitcoin’s role as a “safe haven” asset in emerging markets is expected to contribute about 13.5% to the $2.4 million bull case. Puell noted that this use case holds the greatest potential for capital accumulation, as Bitcoin helps protect wealth from inflation and currency devaluation in developing nations.

Nation-state and corporate Bitcoin treasury strategies, along with Bitcoin-based financial services, were also factored into ARK’s valuation models.

ARK’s Bitcoin Forecasts Are Bold

Should Bitcoin reach $2.4 million, its total market capitalization would hit approximately $49.2 trillion, assuming the total supply reaches 20.5 million coins by 2030.

Such a valuation would rival or even surpass the combined gross domestic product (GDP) of the United States and China. It would also position Bitcoin to overtake gold as the world’s most valuable asset — gold currently holds a market cap of around $22.5 trillion.

Even in ARK’s more conservative base and bear scenarios, where Bitcoin hits $1.2 million or $500,000, the cryptocurrency would still need to grow at a compound annual growth rate (CAGR) of 53% and 32%, respectively, through the end of 2030 — an exceptional rate of return for an asset that has already reached trillion-dollar valuations.

At present, Bitcoin has rebounded from a low of $75,160 in 2025 and climbed back to the $94,000 range, amid the Trump administration’s establishment of a Strategic Bitcoin Reserve.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE