Potential gains for XRP buyers hinge on specific conditions. Analyzing the cryptocurrency’s price movements reveals a pattern of steady gains in October and November, followed by a less robust rally in the latter part of November and December. Over the last four weeks, prices retraced to a significant level before rebounding.

Crucial Significance of the $0.6 Region in the Past Month

Aside from the crucial higher timeframe support zone ranging from $0.57 to $0.6, long-term investors should also monitor the $0.528 and $0.549 levels as key support levels. The $0.6 region has played a critical role in the past month’s dynamics.

Examining XRP’s rally from $0.4729 to $0.7324 through Fibonacci retracement levels (pale yellow), the 61.8% retracement level at $0.572 emerged as a noteworthy support on November 21. Subsequently, there was a bounce to $0.7 on December 9, although XRP dipped lower along with Bitcoin’s losses. Notably, the On-Balance Volume (OBV) forming a higher high while prices formed a lower high indicates increasing buyer strength despite selling pressure.

Although the Relative Strength Index (RSI) sits at 48, suggesting a potential bearish shift in momentum, XRP’s overall market structure remains bullish. A shift to bearish territory would only occur with a daily session close below $0.572.

Related: Blockchain.com’s Adoption of XRP Sparks Cryptocurrency Renaissance

MVRV Ratio Decline Indicates Favorable Trend

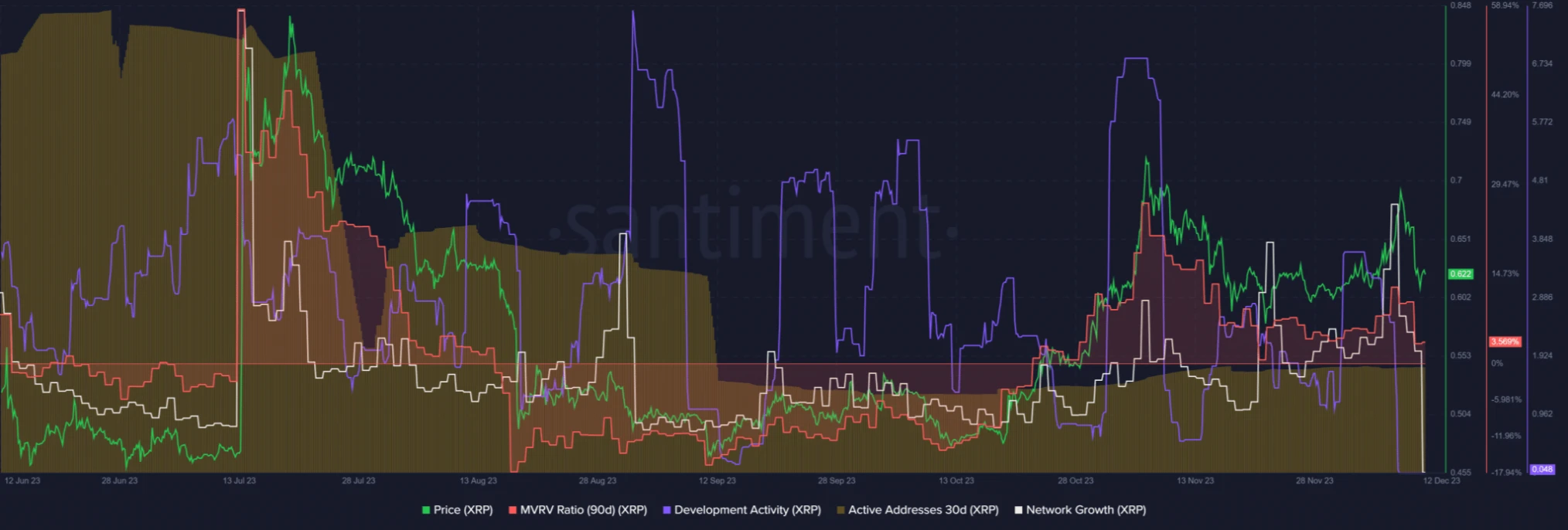

A positive sign comes from the decline in the MVRV ratio, indicating a decrease in profit-taking activity. While development activity experienced a recent dip, attributed to the festive season, network growth has been on the rise since October. However, 30-day active addresses have trended downward since July, with a minor uptick in late October and early November.

Notably, the MVRV ratio, which reached near late-July highs during the October rally past $0.7, has retreated closer to the zero-mark. Despite this, the XRP price approaching the $0.7 area again suggests that profit-taking activity may not be as intense as during the previous push above $0.7.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE