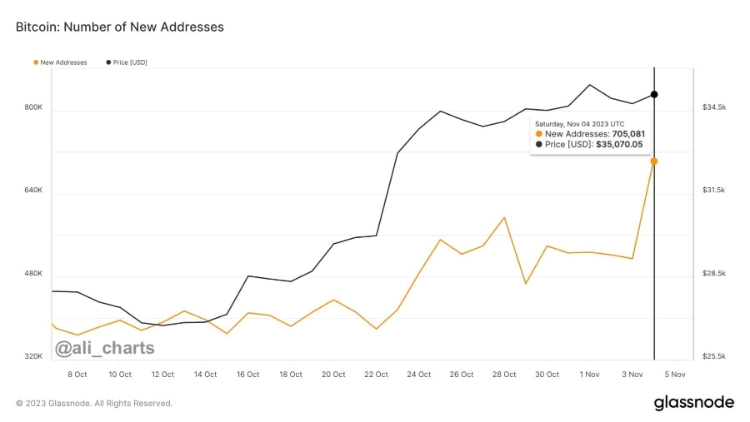

Over the weekend, the cryptocurrency market saw a surge in investor confidence, with more than 700,000 new Bitcoin addresses created. Bitcoin (BTC) has been trading relatively steadily around the $35,000 mark, while altcoins took the lead in driving the crypto market’s recent upswing.

The prospect of Fed interest rate cuts has gained momentum following the release of the US jobs data for October 2023, which fell short of expectations. This has led analysts to believe that the Federal Reserve may change its monetary policy earlier than initially anticipated in 2024.

Some experts are now suggesting a higher likelihood of the first rate cuts occurring as early as March 2024. If this prediction holds true, it could trigger a significant rally in risk-on assets, including equities and cryptocurrencies. Notably, the next Bitcoin halving is also expected to coincide with April 2024, which could further fuel the upward momentum in Bitcoin’s price.

According to the CME FedWatch Tool, the probability of the central bank reducing the headline interest rate by 25 basis points before the March meeting increased to 25.9% on Friday, up from 12.9% on Thursday. Nevertheless, Fed-fund futures indicate a 66.5% probability that the Fed will maintain interest rates unchanged throughout the March meeting.

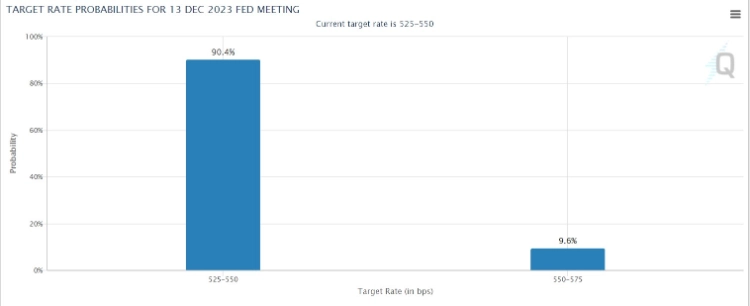

The chances of interest rates remaining unchanged are currently high, with a 90.4% probability for the December meeting. There is no possibility of a rate cut at either of these meetings, but there is a 9.6% chance of a rate hike in January.

According to Charlie Ripley, senior investment strategist at Allianz Investment Management, the recent employment report could signal a turning point in the US economy. Moreover, it underscores the effectiveness of monetary policy and should reduce the debate surrounding whether policy is adequately restrictive.

Bitcoin may be on the brink of a significant price rally. Despite its recent consolidation around $35,000, there are positive signs on the horizon. Notably, over 700,000 new Bitcoin addresses were generated in a single day, a milestone that often serves as a reliable indicator for price predictions.

Related: Bitcoin Surges Over 100% Since the Beginning of the Year, Outperforming Most Other Assets

With Bitcoin maintaining a favorable short-term momentum, CrediBull Crypto is optimistic that the cryptocurrency could continue its upward trajectory, potentially reaching the psychologically significant threshold of $40,000. In the event of such a milestone, there’s a possibility of Bitcoin making a new All-Time High (ATH).

Furthermore, the crypto market has witnessed capital inflows exceeding $10 billion over the past month, indicating strong investor confidence in the asset class.

A lot of capital is flowing into #crypto right now, signaling strong investor confidence.

In fact, we spotted nearly $10.97 billion in positive capital inflows, the highest level in 2023! pic.twitter.com/XfXz6aaVOK

— Ali (@ali_charts) November 5, 2023