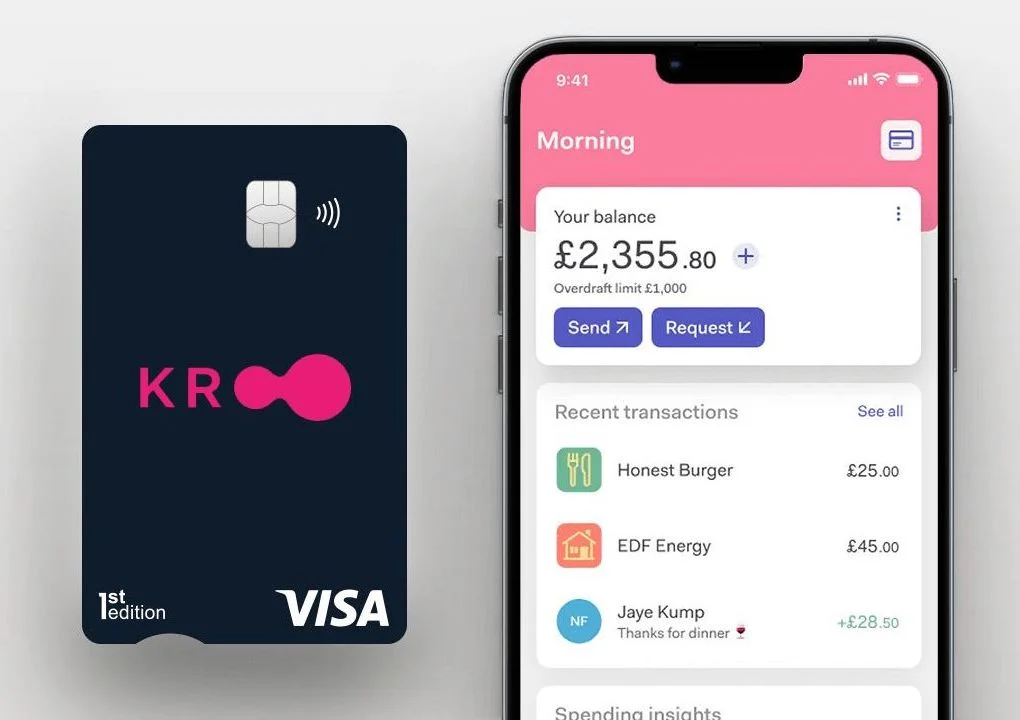

Kroo, a digital bank based in London, has announced its decision to prohibit customers from engaging in cryptocurrency transactions. This move is a response to the rising number of online fraud cases and scams linked to cryptocurrencies.

As per Kroo’s updated terms and conditions, the bank will impose restrictions on accounts involved in cryptocurrency activities. Specifically, if an account is used to purchase or trade cryptocurrencies, or if credits from cryptocurrency transactions are received, Kroo will block the payments. Persisting in such activities may lead to the closure of the account. Additionally, the bank reserves the right to freeze accounts if any suspicion of crypto-related use arises.

Effective from May 30, 2024, Kroo will no longer support bank transfers or card transactions associated with cryptocurrencies, as stated by the bank.

Kroo positions itself as a challenger bank, striving to compete with established giants in the banking industry. This decision aligns with actions taken by other U.K. challenger banks, such as Starling Bank and Chase UK, which have also banned cryptocurrency transactions.

Concerns about cryptocurrency fraud are echoed by many global banks. They argue that the safety of cryptocurrencies is often overestimated and that they are not as anonymous as commonly believed.

Related: Ethereum Approaches ATH as Fund Market Premium Peaks

For instance, in February, the Central Bank of Russia revealed that nearly half of the financial fraud schemes in the country in 2023 involved the use of cryptocurrency and foreign currencies for payments. In the United States, Federal Reserve officials have warned about the potential for increased fraud and scams if banks adopt cryptocurrencies and Central Bank Digital Currencies (CBDCs).

The global banking community’s caution reflects growing apprehension about the security risks associated with cryptocurrency transactions, prompting banks like Kroo to take preventive measures to protect their customers.