A new report from Aspen Digital estimates that 76% of Asia’s private wealth has experimented with digital assets, with another 18% planning to invest in the future.

Interest in digital assets in Asia’s private wealth management sector has been growing since the Hong Kong-based wealth management platform conducted its survey in 2022, when only 58% of respondents had entered the digital assets space.

The report surveyed 80 family offices and high-net-worth individuals in Asia, the majority of whom manage assets between $10 million and $500 million.

Of those who have invested in crypto, 70% have allocated less than 5% of their portfolio to digital assets, although some have increased their allocation to over 10% by 2024.

Personal wealth in Asia appears to be increasingly attracted to the profit opportunities offered by blockchain technology applications.

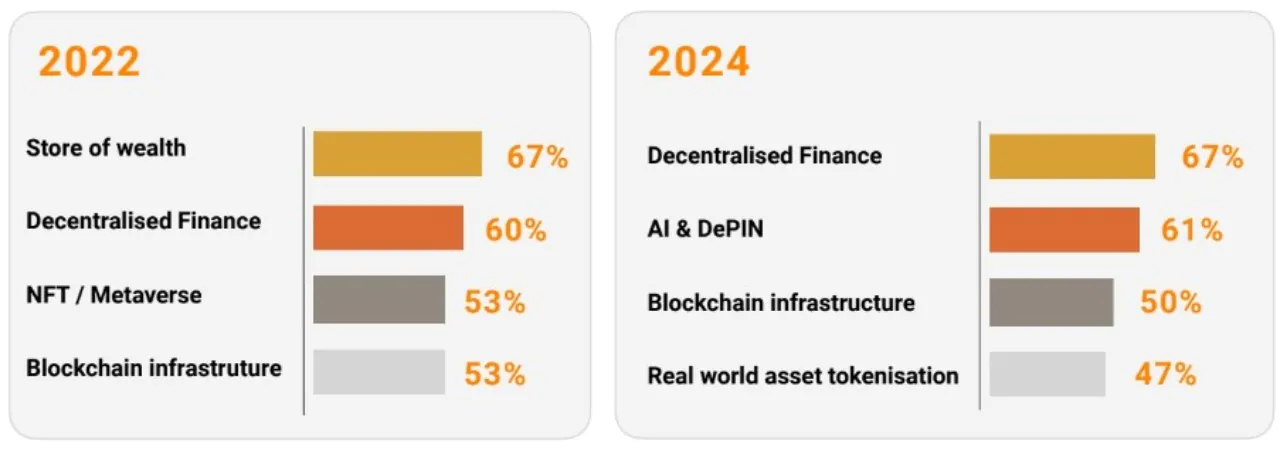

Two-thirds of respondents expressed interest in decentralized finance (DeFi), while 61% were interested in artificial intelligence and decentralized physical infrastructure networks (DePIN).

Aspen Digital also noted that respondents were generally optimistic about Bitcoin’s prospects for the remainder of 2024, with 31% predicting the price will reach $100,000 by the end of the year.

Increased Investment Through ETFs

The approval of Bitcoin spot exchange-traded funds (ETFs) has increased interest in digital assets among Asian investors, with 53% of survey respondents saying they have exposure through funds or ETFs.

This trend is consistent with global developments, as noted in AIMA and PwC’s recent Global Crypto Hedge Fund Report.

Their survey of nearly 100 hedge funds across six regions, managing a total of $124.5 billion, found that the share of investment in crypto has increased from 29% in 2023 to 47% in 2024, driven by regulatory clarity and the launch of crypto ETFs in the US and Asia.

Spot Bitcoin ETFs will start trading in the US from January 2024, while spot Bitcoin and Ether ETFs launched in Hong Kong in April.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE