As of the end of 2024, twelve U.S. states have reported holding shares in Strategy—formerly known as MicroStrategy—through state pension funds or treasuries, with a combined total investment of $330 million.

On February 17, Fahrer noted that pension and treasury funds in California, Florida, Wisconsin, and North Carolina have the most significant exposure to Strategy.

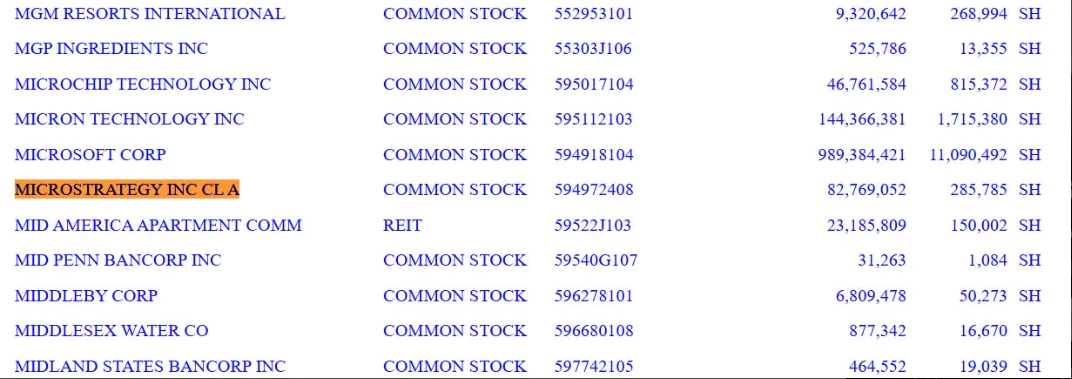

California’s Teachers’ Retirement Fund holds the largest stake in Michael Saylor’s business intelligence software firm, owning 285,785 shares valued at approximately $83 million, according to a Form 13F filing submitted to the U.S. Securities and Exchange Commission (SEC) on February 14.

The California State Teachers’ Retirement System (CalSTRS), managing a total of $69 billion across various stocks, also holds a significant position in Coinbase (COIN), with 306,215 shares worth $76 million at the time of filing.

Similarly, the California Public Employees’ Retirement System (CalPERS) maintains a strong position in Strategy, with 264,713 shares valued at around $76 million, along with a $79 million stake in Coinbase. The state pension fund oversees approximately $149 billion in investments.