According to data, the circulating supply of USDe (Ethena) has grown by 70% to $9.49 billion, making it the third-largest stablecoin by market capitalization. Meanwhile, USDS (Sky) recorded an impressive 23% increase, pushing its supply to nearly $4.81 billion, ranking fourth among all stablecoins, according to DeFiLlama.

What’s notable is that both USDe and USDS offer yield through internal staking mechanisms — a feature that many investors are now turning to after the GENIUS Act banned stablecoin issuers from offering direct yield to holders in the U.S.

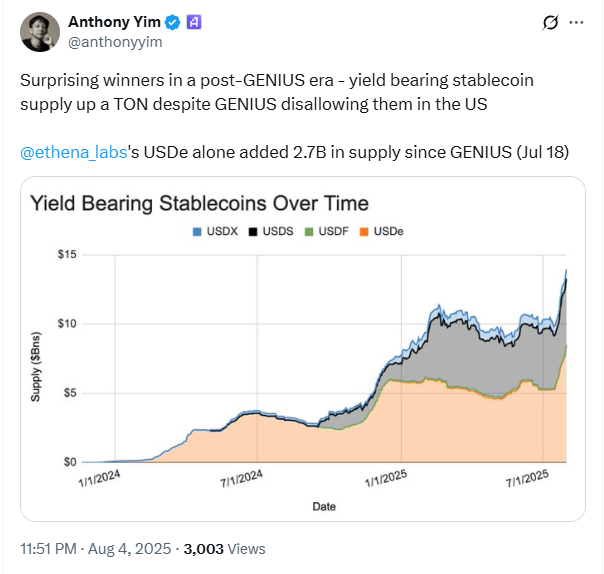

Yield-Bearing Stablecoins Rise in the Post-GENIUS Era

Anthony Yim, co-founder of analytics firm Artemis, commented in a post on X:

“Surprising winners in the post-GENIUS era — yield-bearing stablecoin supply up significantly despite being disallowed in the U.S.”

Julio Moreno, Head of Research at CryptoQuant, noted that investors are increasingly shifting to USDe and USDS as they continue to offer yield via staking in their respective protocols.

“Precisely because the GENIUS Act prohibits issuers from directly paying yield to holders, investors are turning to staked or yield-bearing stablecoins as an alternative,” Moreno explained.

“That’s why stablecoins like USDe and USDS are expanding — they offer yield in a more native way, through staking within their own ecosystems.”

Notably, the surge in USDe supply has also driven up the price of ENA, Ethena’s governance token, which has rallied nearly 60% since mid-July and is currently trading at $0.58, according to CoinGecko.

Stablecoin Market Could Reach $300 Billion by Year-End

The total stablecoin market capitalization has grown from $205 billion at the start of the year to $268 billion currently, marking a 23.5% increase. Moreno predicts that the market could approach $300 billion by year-end, assuming the current growth trend continues.

However, not all experts share this optimistic view. Temujin Louie, CEO of Wanchain, warned that tokenization efforts by traditional financial institutions may slow the growth of stablecoins.

“Tokenization allows money market funds to adopt the speed and flexibility that made stablecoins unique, without sacrificing safety or regulatory compliance,” he said.

A report released in July also suggests that demand for decentralized finance (DeFi) applications on the Ethereum network could rise in the aftermath of the GENIUS Act, as investors seek alternative sources of yield.

Yield-Bearing Stablecoins and Real Rate of Return

Yield-bearing stablecoins generate income through staking, lending, or investing in real-world assets such as U.S. Treasury bonds — thereby offering passive income to tokenholders. This structure allows holders to earn a real rate of return, which is the yield adjusted for inflation.

As of June, the U.S. headline inflation rate stood at 2.7%. In comparison:

- Staked USDe (sUSDe) offers an APY of 10.86%, equating to a real return of 8.16%;

- Staked USDS (sUSDS) offers an APY of 4.75%, yielding a real return of 2.05%.

These figures demonstrate that yield-bearing stablecoins are becoming an increasingly attractive option for investors seeking passive income, particularly in an environment where monetary policy remains uncertain and regulatory scrutiny is intensifying.