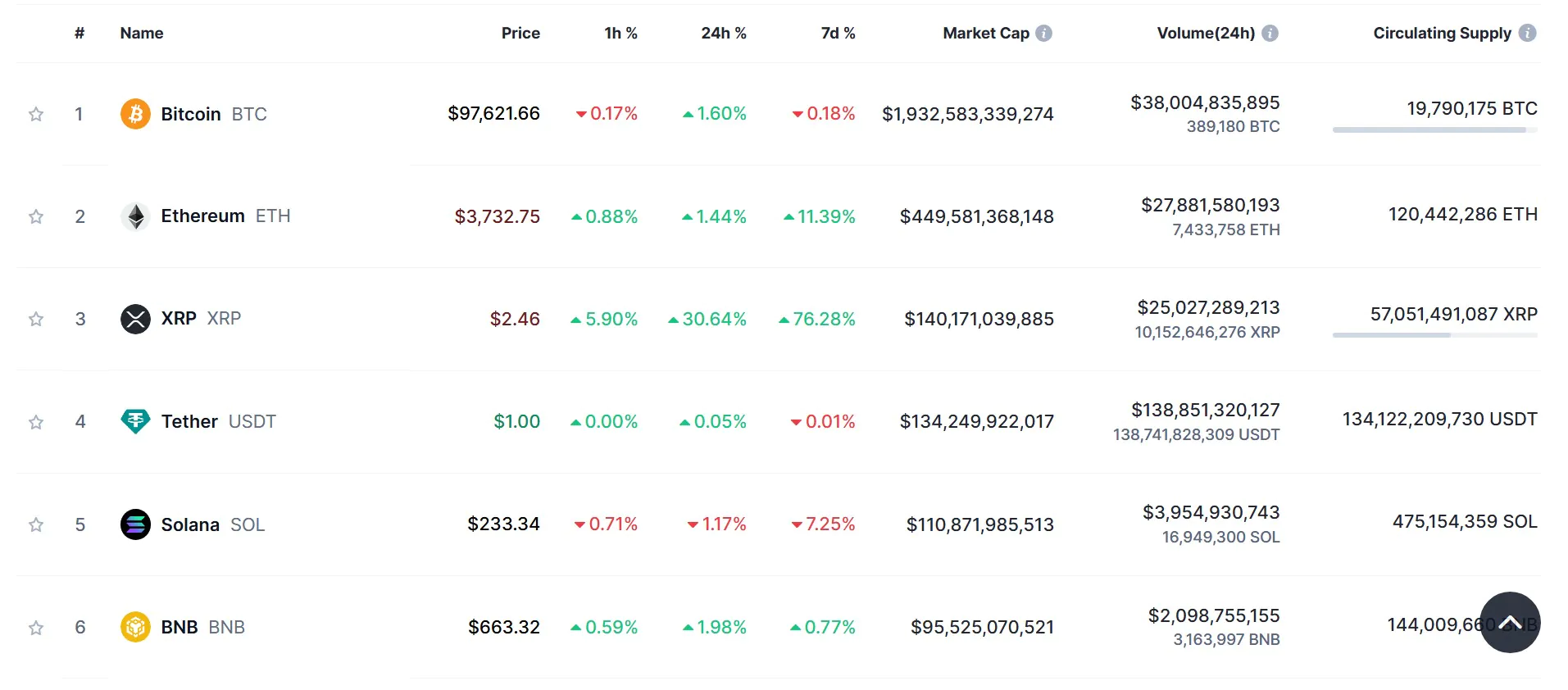

XRP, a utility-based altcoin, boasts a market capitalization of around $140 billion and a fully diluted value of over $240 billion. Its average daily trading volume has also increased by 45%, reaching around $23 billion.

Why is XRP so bullish?

XRP has benefited greatly from the election of pro-crypto leaders in the United States, led by President-elect Donald Trump. The long-standing legal hurdles related to the charges from the US Securities and Exchange Commission (SEC) are likely to be cleared once the new SEC chairman is officially appointed early next year.

XRP’s remarkable rally in the past 24 hours was also fueled by a surge in short liquidations. According to data from Coinglass, XRP’s derivatives market has recorded more than $50 million in liquidations in the past 24 hours, of which more than $36 million were short orders. As a result, the possibility of a “short squeeze” has added to the bullish outlook for XRP in recent times.

Whales’ Activity Increases in the Past 24 Hours

On-chain data over the past 24 hours shows a significant increase in whale trading activity, led by Ripple. Specifically, Ripple unlocked 1 billion XRP from its escrow account but then locked up more than 800 million units.

Meanwhile, several large transactions from whale investors have withdrawn large amounts of XRP from exchanges, notably Upbit and Binance.

Where will XRP go next?

After a 280% increase in November, XRP price has officially broken out of a multi-year accumulation triangle pattern. The veteran altcoin is approaching a retest of its all-time high (ATH) set in 2018, after surpassing the peak of its 2021 bull cycle.

Read more: Will Bitcoin Reach $100K This December?

From a technical analysis perspective, XRP price has entered a long-awaited parabolic phase, promising potential gains in the coming months. The Relative Strength Index (RSI) on the weekly chart has risen above 85% for the first time since 2021, signaling that buyers are in complete control of the market.

However, XRP traders need to be cautious of the risk of a short-term correction after a strong bullish breakout, before the uptrend resumes.