While the altcoin market is weakening as capital flows into Bitcoin — which is just 1.2% away from its all-time high — XRP appears to be decoupling from the general trend. This may be due to strong whale accumulation and the repetition of a bullish pattern that previously led to a 500% surge in 2024.

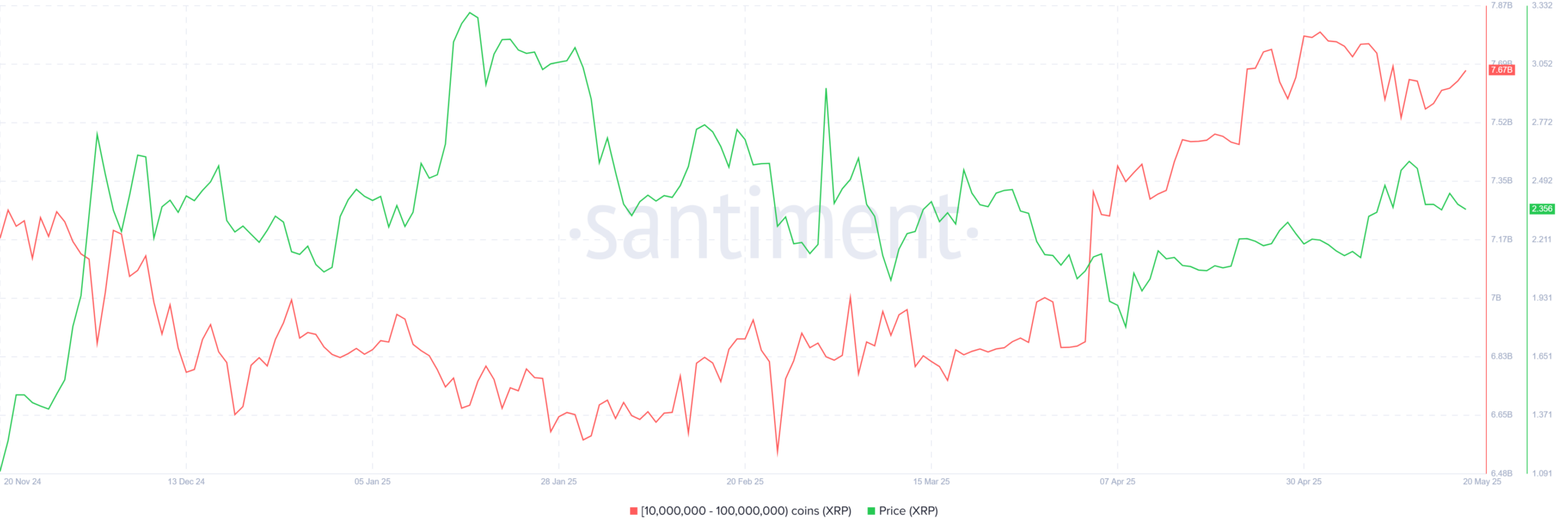

Currently, XRP is trading around $2.38, moving sideways within a narrow range of $2.32 to $2.39 over the past 24 hours. Despite low volatility, on-chain data shows that large holders (wallets with 10 to 100 million XRP) have bought an additional 110 million XRP in just five days, bringing their total holdings to 7.67 billion tokens. This accumulation is often a bullish signal, indicating that these investors are positioning themselves ahead of a potential breakout.

On the weekly chart, XRP is testing the resistance line of a descending triangle — a pattern similar to the one in late 2024, before the token surged more than 500%. If XRP can break above this level, it’s likely to climb past $3 and possibly set new all-time highs.

The RSI currently sits at 55, suggesting moderate bullish momentum. However, the downward sloping ADX indicates that the trend is still weak, meaning XRP may continue to consolidate before gaining the strength needed for a breakout.

In the derivatives market, data from Coinglass shows mixed sentiment. Futures trading volume has dropped by 24%, and XRP’s open interest has fallen by $930 million in just five days, indicating caution among new traders.

Still, Binance data shows a long/short ratio of 2.97, suggesting a bullish bias with more traders betting on price increases. However, nearly $3 million in long positions were liquidated over the past 24 hours, adding to sell-side pressure.

In summary, while XRP faces short-term challenges, the current price pattern and whale accumulation signal a potential for another strong rally. If open interest picks up again and the price breaks above the $3 mark, XRP could enter a new bullish phase similar to that of 2024.