Ripple’s XRP has recently taken the spotlight due to an analyst’s insights hinting at a potential surge in its market value. Amidst its ongoing consolidation phase, Ripple exhibits promising signals that could lead to a substantial price increase, potentially reaching $3.70.

Presently valued at $0.6282, XRP is navigating a consolidation period along a slanted trend line, reminiscent of past cycles where the asset experienced noteworthy growth following similar patterns. In 2021, XRP recorded an impressive 500% gain, peaking at $1.60. Leveraging this historical precedent and considering current market conditions, the expert’s forecast envisions a potential surge.

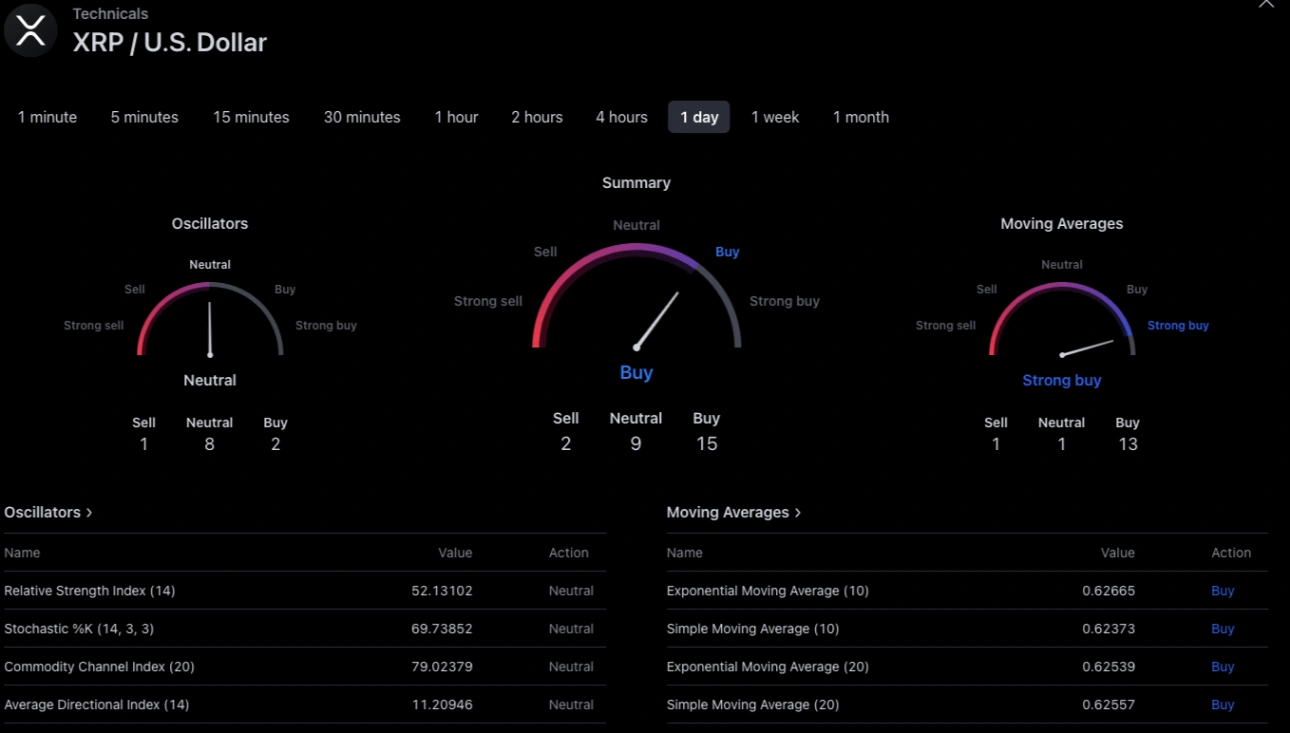

Technical analysis sourced from TradingView reflects a robust bullish sentiment, supported by a ‘strong buy’ rating backed by moving averages and oscillators. The trading volume for Ripple has surged by 38%, reaching $1.9 billion, reinforcing the optimistic outlook. Additionally, the emergence of a vibrant green Super Guppy, a cluster of moving averages indicating trend strength, signals a bullish trajectory for XRP.

XRP’s Legal Clarity and Market Outlook

Following Ripple’s recent legal victory against the Securities and Exchange Commission (SEC), where XRP was deemed not a security, market anticipation has intensified. Despite the newfound legal clarity, XRP has yet to witness a substantial rally aligned with the broader market movements. Nonetheless, experts remain confident in the asset’s growth potential, particularly considering Ripple’s foundational technology and the escalating rates of adoption.

Related: XRP Price Surges with 39 Million XRP Whale Move

Strategic Ripple Price Forecast

Renowned analyst Egrag Crypto anticipates a pivotal period for XRP between December 2023 and February 2024, foreseeing substantial price movements that could present lucrative opportunities for investors. The analysis recommends consolidating both dollars and other cryptocurrency gains into XRP during this window, potentially amplifying portfolios by six to seven times.

XRP’s pursuit of the $1 milestone is contextualized within the competitive landscape, particularly against assets like Cardano (ADA). With a robust position in this race, backed by underlying factors and technical indicators, XRP’s trajectory, market trends, and technology adoption rates will play pivotal roles in determining its potential for skyrocketing prospects.

An examination of Ripple’s technical analysis from TradingView reveals prevailing optimistic sentiments, aligning with a ‘strong buy’ rating at 13. This sentiment is reinforced by moving averages supporting a rating of 11 and oscillators signaling a ‘buy’ at 2. The current positioning of the 20-EMA above the 50-EMA indicates a bullish trend in the near term.