Negative sentiment around the altcoin is growing, putting it on track to drop to a two-month low of around $0.47. This analysis explains why this scenario is likely.

Ripple Faces Challenge from SEC

In a recent notice of appeal, the SEC expressed its intention to appeal the ruling in its case against Ripple. The move follows Judge Analisa Torres’ decision on August 7 to impose a $125 million fine on Ripple.

The court found that Ripple’s XRP transactions with institutional investors were securities in nature, but there was no evidence of fraud or malice. Judge Torres also emphasized that while some XRP transactions may be considered securities, XRP itself is not a security.

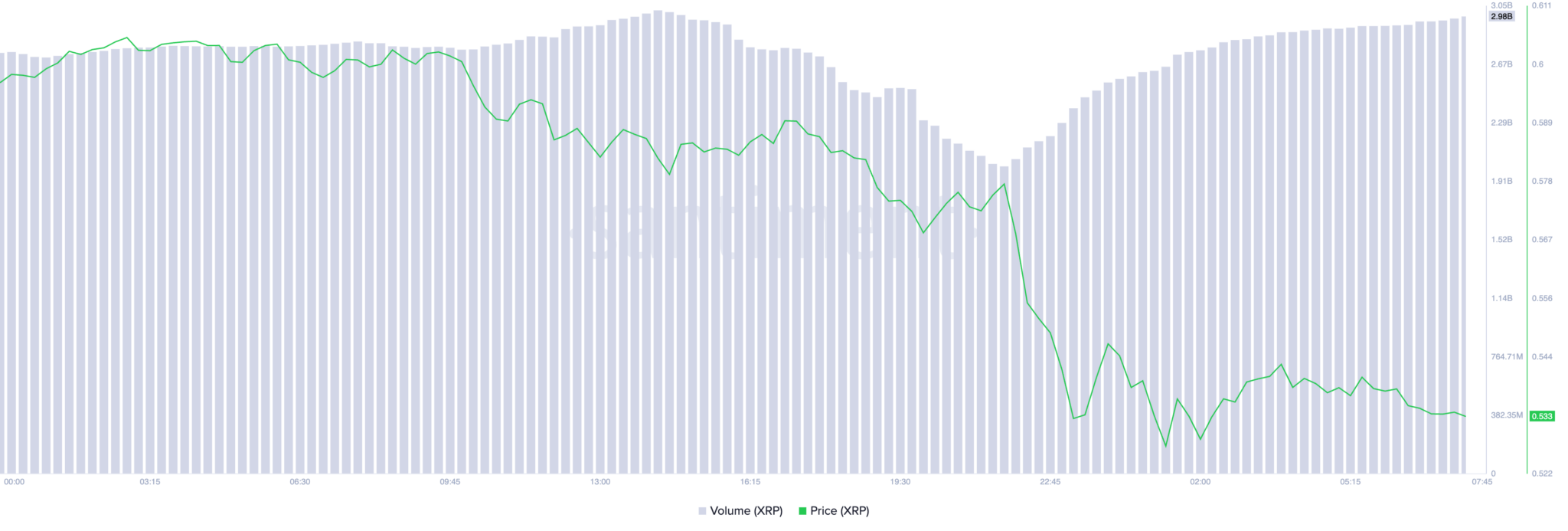

The SEC’s appeal decision, combined with the general market decline, has fueled a sell-off in XRP. The altcoin is currently trading at $0.53, down 11% over the past 24 hours. Its trading volume has also increased by 5% over that time.

When an asset’s price falls while its trading volume increases, this typically reflects strong bearish sentiment in the market. The combination of falling prices and rising trading volume suggests that many investors are selling, leading to a decline in price. While high trading volume suggests significant investor interest, the trend is largely negative.

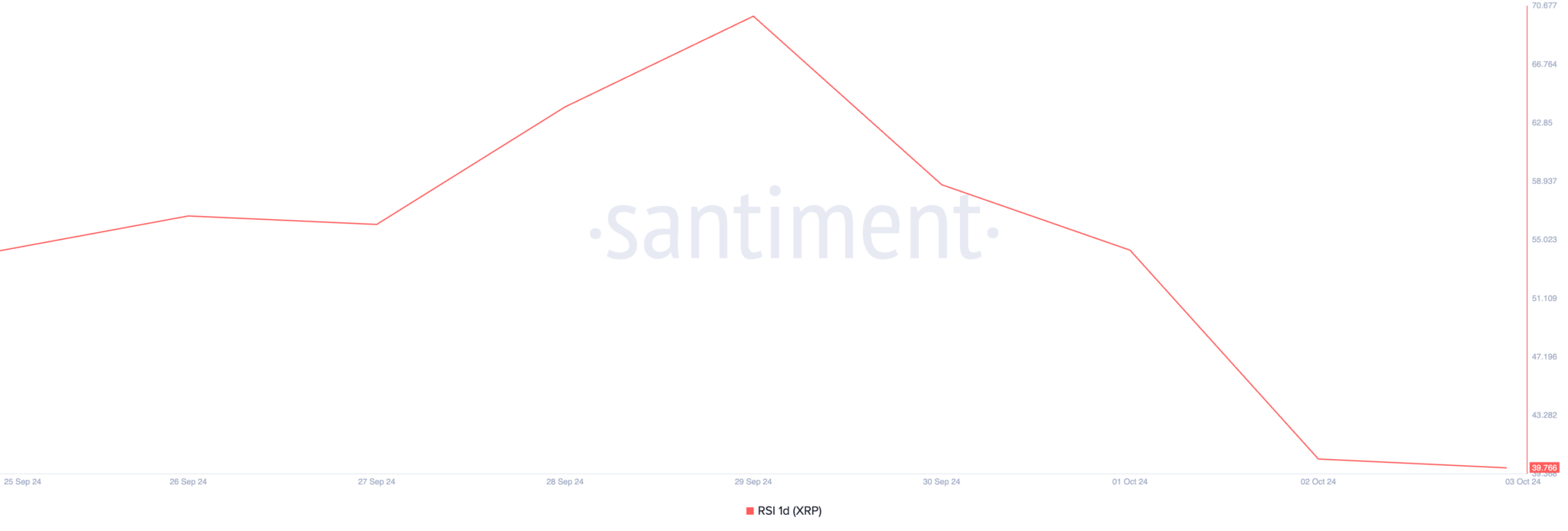

Additionally, XRP’s Relative Strength Index (RSI), an indicator that measures whether an asset is overbought or oversold, also reinforces the bearish outlook. RSI ranges from 0 to 100, with readings above 70 indicating overbought conditions and a potential correction, while readings below 30 indicate oversold conditions and a potential recovery.

Currently, XRP’s RSI is at 39.76 and continues to decline, indicating that selling pressure is still dominant and the market’s buying demand is not strong enough to counterbalance it.

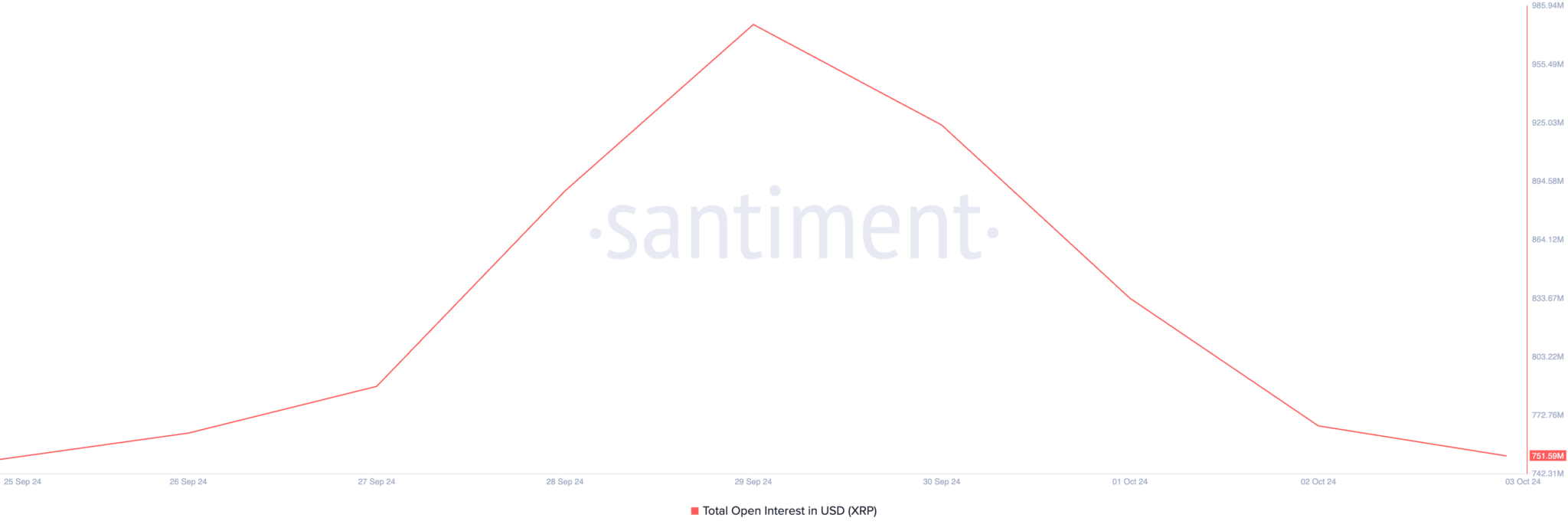

In addition, the decline in XRP’s open interest further highlights the declining demand for the altcoin, a trend that has been evident over the past few days. XRP’s open interest is currently at $752 million, down 23% since September 29.

Open interest is a measure of the total number of futures or options contracts outstanding in the market. A decline in open interest indicates that investor participation is decreasing, indicating a decline in confidence in the token.

XRP Price Prediction: Token Nears Two-Month Low

XRP has been falling over the past week, pushing it close to a key resistance level of $0.51, and it is currently just above that level. If selling pressure continues to increase, this level may not hold, potentially sending XRP to a two-month low of $0.46.

If the token fails to hold this level as support, its price could continue to fall to $0.38. However, this bearish scenario would be refuted if market sentiment turns positive. In that case, XRP price could recover and head towards $0.66 in the next uptrend.