XRP has surged 30% in the past two days as the broader market has shown signs of recovery, especially after news that Gary Gensler is expected to step down as SEC Chairman.

XRP whale collects $124 million worth of tokens

Amid this strong price increase, on November 20, a crypto whale made a large transaction, transferring nearly 111 million XRP (equivalent to $123.59 million) from Binance to an unknown wallet.

This large-scale withdrawal may stem from the bullish sentiment of the market and the impressive growth of XRP.

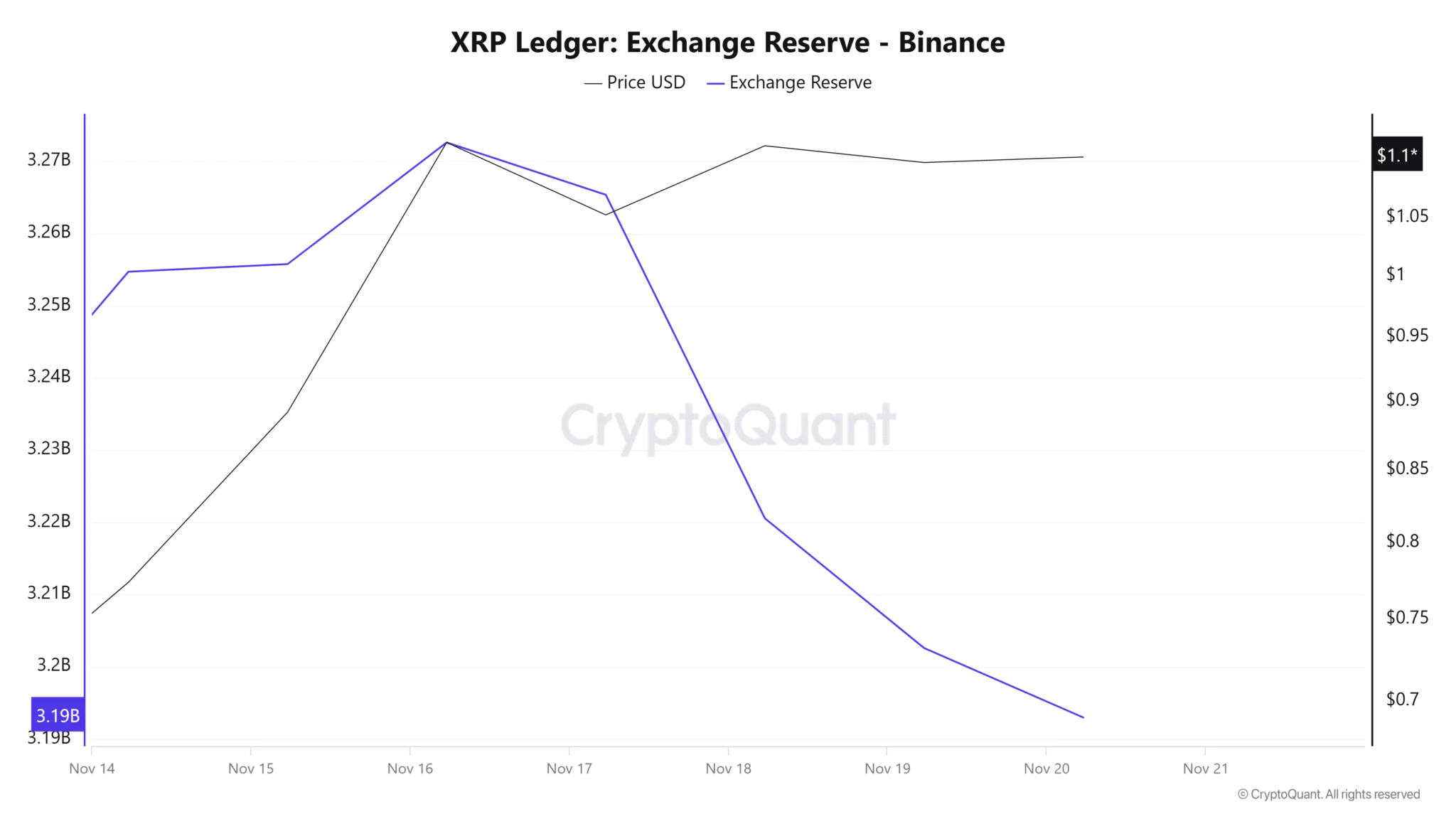

At the same time, XRP reserves on exchanges have been continuously decreasing, which shows that not only individual investors but also whales and institutions are withdrawing large amounts of tokens from exchanges. This is considered a positive signal, because when the supply on the exchange decreases, there is usually less selling pressure, giving the asset a chance to increase in price.

XRP Technical Analysis and Key Milestones

The current technical analysis shows that XRP is forming a “bullish pennant” pattern on the 4-hour timeframe, a sign that a price breakout is imminent.

If XRP breaks through this pattern and closes above $1.15, the price could surge as much as 63% to $1.90 in the short term.

Indicators such as the Relative Strength Index (RSI) and the 200 Exponential Moving Average (EMA) are both showing solid bullish momentum, reinforcing expectations that XRP will continue to move higher in the coming days.

Strongly Rising Open Interest

On-chain metrics continue to reinforce the positive outlook for XRP. According to data from analytics firm Coinglass, trading activity on the market is increasing significantly, leading to a noticeable increase in Open Interest (OI).

Over the past 24 hours alone, XRP’s OI has increased by 4.5%, with a 2.78% increase in the last 4 hours. This increase reflects growing investor interest in the altcoin, reinforcing the bullish trend.

Key Liquidation Levels and Market Sentiment

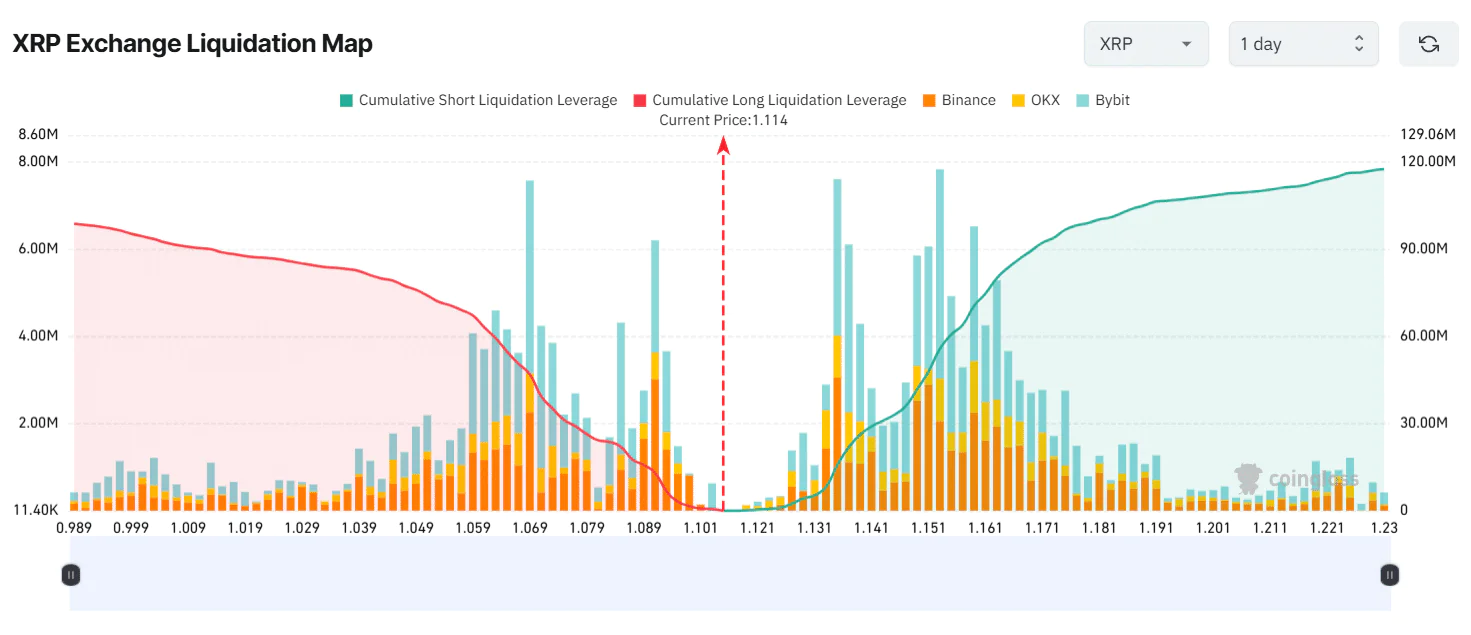

Analysis of market data shows that traders are currently focused on two key XRP price levels:

- Low Liquidation Level: $1.069.

- High Liquidation Level: $1.135.

According to Coinglass, many traders are using high leverage at these levels, creating a high risk of liquidation.

- If the price rises above $1.135, nearly $15.76 million worth of short positions could be liquidated.

- Conversely, if the price falls below $1.069, approximately $49 million worth of long positions could be liquidated.

Liquidation data also shows that buyers have clearly dominated sellers over the past 24 hours, underscoring the bullish sentiment and strength of buying power in the market.