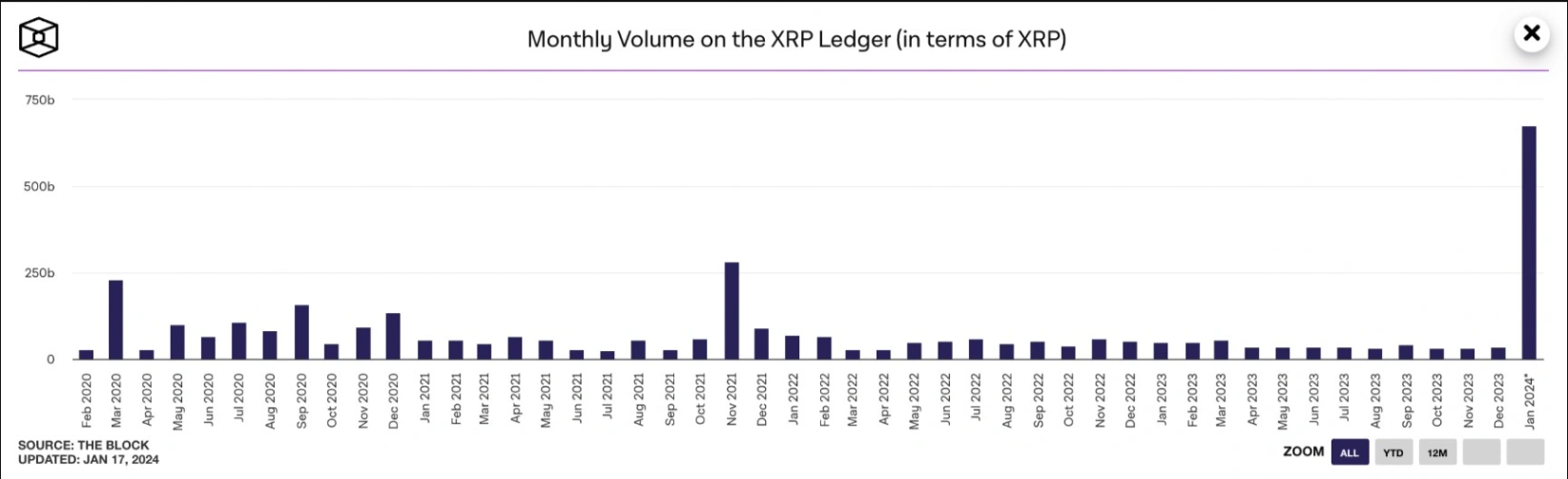

The XRP Ledger (XRPL) has recently marked an unprecedented milestone in monthly transaction volume, setting an all-time high, as reported by The Block Data dashboard. In the first eighteen days of January alone, the total value transacted on the open-source and decentralized blockchain reached an impressive 673.49 billion XRP.

Security Challenge Spurs XRPL Network Activity

This surge in XRPL’s network activity coincides with a noteworthy security incident. On January 14th, an attempted hack on the Bitfinex cryptocurrency exchange unfolded. The attacker sought to exploit the “Partial Payments Exploit” feature to transfer 25.6 billion XRP tokens. Fortunately, Bitfinex’s robust software configuration thwarted the exploit, preventing any unauthorized transfers.

Impact on XRP Sentiment and Demand

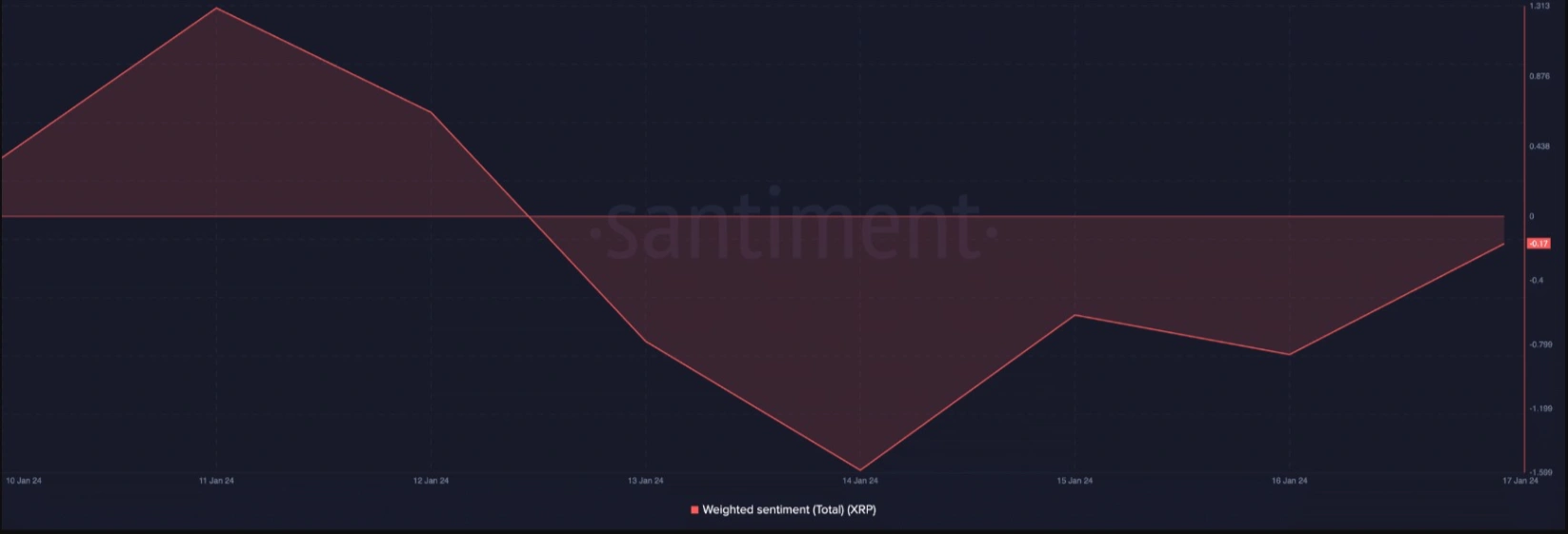

However, the aftermath of the security incident has cast a shadow on XRP’s sentiment and demand. According to AZC News, XRP experienced a significant downturn in sentiment, reaching a multi-month low of -1.58 on January 14th, based on Santiment’s data.

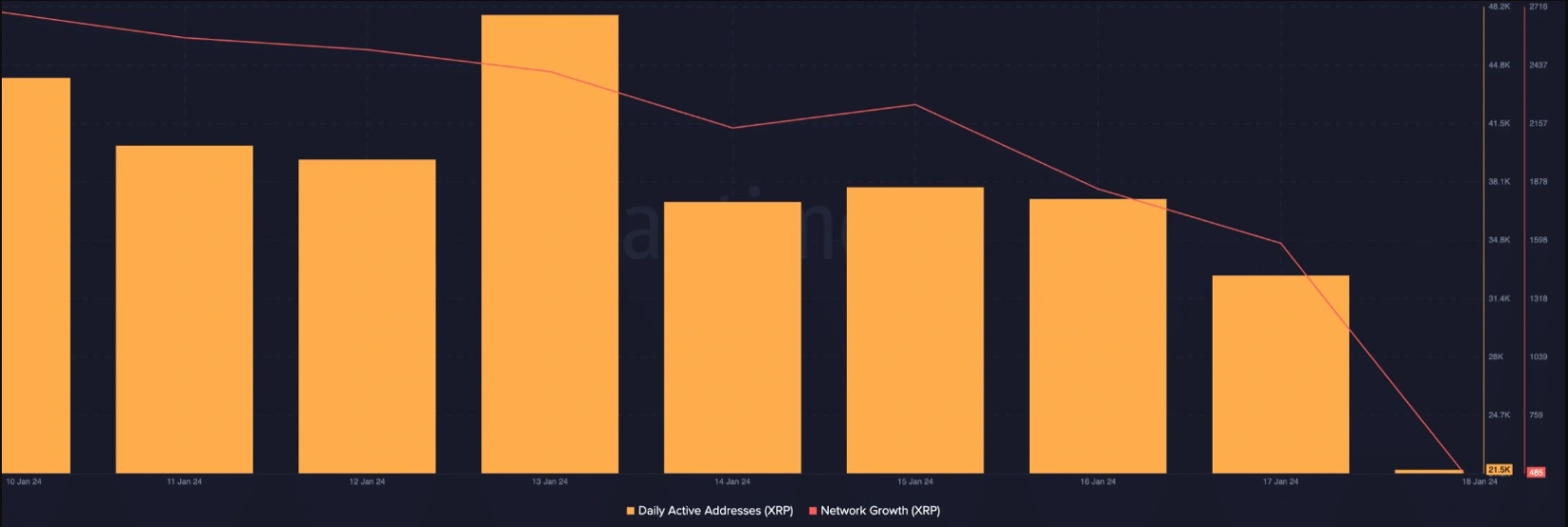

Since the incident, daily demand for XRP has witnessed a substantial decline. On-chain data indicates a 31% drop in the number of daily unique addresses participating in XRP transactions, with 32,779 active addresses recorded as of January 17th.

Declining Momentum and New Demand

The impact extends to the cryptocurrency’s overall network activity and new demand. Over the past five days, the daily creation of new addresses for XRP transactions has declined by 34%, according to Santiment’s data.

This decline in network activity is evident in the dwindling momentum indicators on the daily price chart for XRP in recent days. The community is closely monitoring the situation, assessing both the security resilience of XRPL and the potential implications for the token’s market dynamics.

XRP’s Market Indicators Reflect Growing Negative Sentiment and Profit Loss

As of the latest update, XRP’s Relative Strength Index (RSI) stands at 40.71, while the Money Flow Index registers at 41.01. These values underscore a prevailing scenario where sell-offs in XRP surpass accumulation, particularly among daily traders, intensifying the negative sentiment within the market.

Moreover, the decline in XRP’s on-balance volume (OBV) substantiates the waning accumulation trend. Since the attempted exploit, XRP’s OBV has experienced a notable 1.4% decrease. At present, the altcoin’s OBV is recorded at 30.14 billion.

CoinMarketCap data reveals a 4.26% drop in XRP’s value over the past week. This decline, in conjunction with the diminishing OBV, confirms the presence of a downtrend and highlights the prevalence of substantial selling pressure.

Related: High-Risk Profit Levels in the Supply of BTC, ETH, and XRP

As a consequence of the downward price trajectory and escalating negative sentiment, a noteworthy shift has occurred in XRP transactions—more are now resulting in losses than gains.

AZC News analysis discloses a seven-day moving average indicating a ratio of 0.96 for XRP’s daily transaction volume in profit to loss. In practical terms, for every XRP transaction concluding in a loss, only 0.96 transactions conclude with a profit. This statistical insight underscores the current challenges and bearish dynamics facing the XRP market.