In recent trading sessions, XRP has fluctuated between $2.81 and $2.85, leaving investors frustrated as the token lost its crucial $3 support level and has yet to recover.

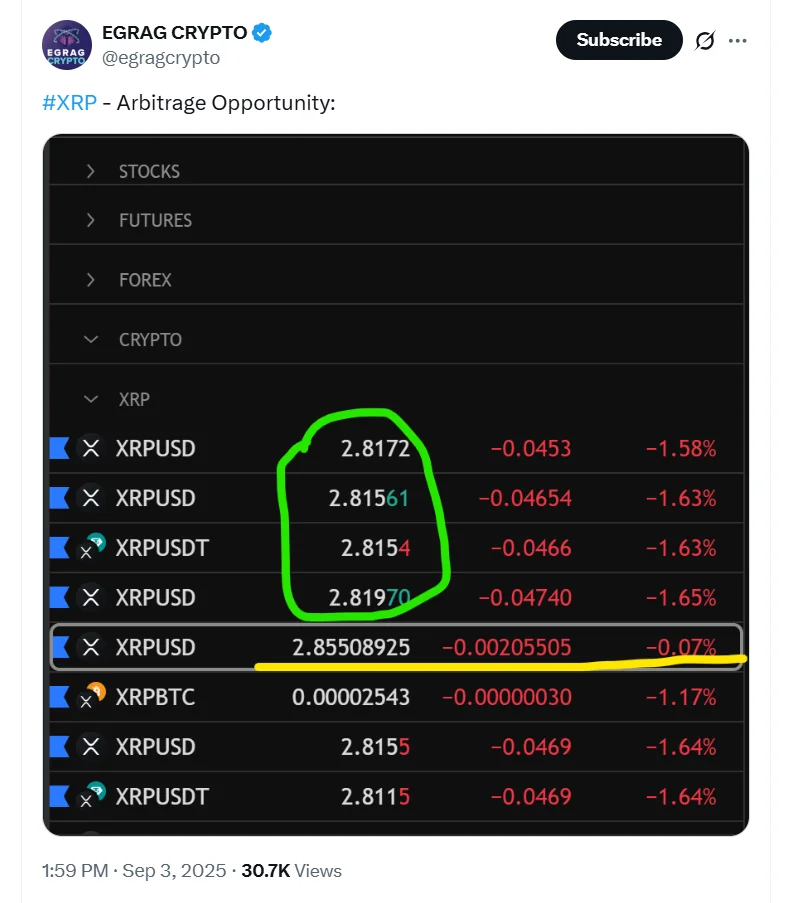

However, these fluctuations and small discrepancies across exchanges have created opportunities for arbitrage trading. Popular analyst EGRAG CRYPTO (@egragcrypto) highlighted this in a chart comparing multiple XRP trading pairs, particularly XRP/USD and XRP/USDT.

The chart revealed that while some platforms listed XRP at $2.811, others showed $2.855. At first glance, a difference of just a few cents may seem insignificant, but for traders operating with high volumes, it can represent a substantial profit opportunity.

Arbitrage – A Profit Strategy in the Crypto Market

Arbitrage refers to buying an asset on one exchange at a lower price and selling it on another exchange at a higher price, aiming to “lock in profit” from the price gap without being exposed to market direction—if executed quickly.

This strategy is not new in traditional finance but is especially common in crypto markets due to their fragmented nature worldwide. For XRP, even small discrepancies can generate meaningful gains, particularly for “whales” trading at scale.

Implications for XRP Investors

The presence of arbitrage opportunities highlights the strong demand for XRP across multiple platforms, reinforcing the token’s deep integration within the global crypto ecosystem.

In the long run, increased arbitrage activity could help create a more mature trading environment, narrowing spreads and providing greater stability and transparency for both short-term traders and long-term holders.

According to EGRAG CRYPTO’s analysis, XRP is currently trading between $2.811 and $2.855, depending on the platform. For professional traders, a gap of just four cents can be enough to capture profit through arbitrage. While these windows are often short-lived, with the right speed and volume, they represent a lucrative opportunity for the XRP community.