XRP Surged Significantly

XRP’s price is surging, reaching a three-month high as large investors, known as whales, show increasing interest in the token. This upward momentum is posing a threat to Binance Coin’s fourth-place position in the cryptocurrency market. It’s quite likely that XRP could hit the $1 mark later this week.

Over the weekend, while Bitcoin was consolidating below $35,000, XRP continued its impressive rally, outperforming other altcoins. In just one week, the market value of this cross-border money remittance token surged by 23%, hitting a price of $0.73, a level not seen since late July.

The XRP price has displayed a remarkable 61.8% recovery from its lowest point in August, as indicated by Fibonacci retracement levels. This suggests that a pullback might be on the horizon as traders look to secure their gains.

However, the Moving Average Convergence Divergence (MACD) indicator implies that the uptrend still has momentum. As long as the blue MACD line remains above the red signal line and the green histograms stay above the neutral area, traders are likely to remain optimistic about the bullish trend.

A significant development bolstering the positive outlook for XRP is the appearance of a bullish cross on the chart. When the 50-day Exponential Moving Average (EMA) crosses above the 100-day EMA, a golden cross pattern emerges, encouraging traders and investors to continue buying XRP without fear of sudden reversals.

The next moves XRP makes will determine its course – whether it will aim to breach the $1 mark or consolidate its gains before a potential breakout. If XRP manages to break past the immediate resistance at $0.75, traders will likely support the uptrend, confident that it won’t abruptly reverse.

On the other hand, if XRP fails to surpass the $0.75 hurdle, it could disrupt the uptrend as traders rush to secure their profits, adding to selling pressure. If XRP corrects below the short-term support at $0.7, investors may need to brace for more losses, potentially bringing the local support around $0.61 into play.

Notably, large investors or “whales” have been increasing their exposure to XRP, with wallets holding between 100k and 1 billion XRP tokens at their highest levels in 2023. This renewed interest by significant players is contributing to XRP’s surge, temporarily displacing Binance Coin to become the fourth-largest cryptocurrency in terms of market capitalization, signifying the growing strength behind XRP.

Related: Ripple (XRP) Price Could Increase by 15% in the Coming Week

XRP has Become The Most Favored Cryptocurrency in the United States.

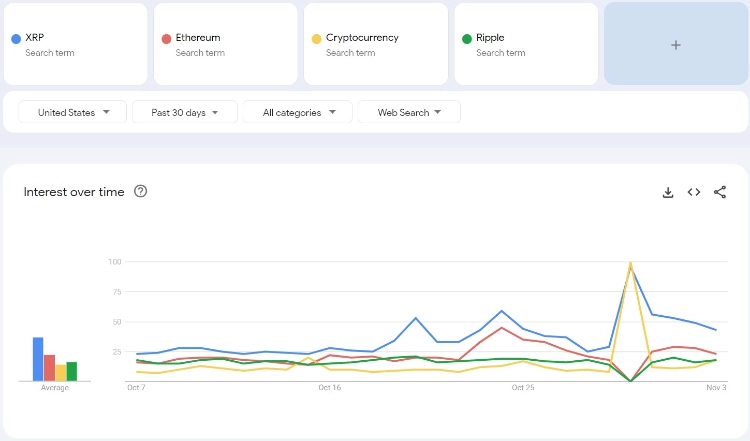

Recent data from Google Trends reveals that XRP has captured the attention of Americans more than Ethereum in 48 out of 50 states across the country. This heightened interest in XRP is particularly pronounced in regions such as Nevada, Delaware, Montana, Louisiana, and Arizona.

Part of this surge in interest can be attributed to the regulatory clarity that XRP obtained in the United States. This clarity came when Judge Analisa Torres ruled that XRP did not qualify as a security, dispelling a cloud of uncertainty that had surrounded the token.

XRP had faced challenges when the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple in 2020, leading to numerous cryptocurrency exchanges in the country delisting the token.

This legal predicament had undoubtedly affected XRP’s market presence, with only a few exchanges like Uphold continuing to support the token. However, following Judge Torres’ ruling, many exchanges relisted XRP, making it more accessible to U.S. residents for investment.

Anticipations are high for a surge in institutional interest in XRP within the U.S. This is expected because one of the primary reasons many financial institutions hesitated to collaborate with Ripple was the ongoing legal battle with the SEC. With the legal dispute now seemingly resolved, it is likely that more American firms will partner with Ripple in the near future.

The increasing institutional involvement in XRP could significantly impact its price, especially if major U.S. banks adopt the token for cross-border transactions, aligning with Ripple’s vision. Until then, Ripple and XRP are poised to continue building on their impressive track record abroad.

It’s worth noting that XRP enjoys substantial popularity in the Asian region, particularly in Japan. Japan has played a pivotal role in contributing to XRP’s trading volume. This popularity is largely attributed to the adoption of Ripple’s payment services by major financial institutions, which utilize XRP to facilitate cross-border transactions.