After a series of significant declines, Ripple (XRP) seems to have shown signs of recovery in the past week. Despite positive fluctuations, the road to recovery is still quite arduous because the current price level poses many obstacles.

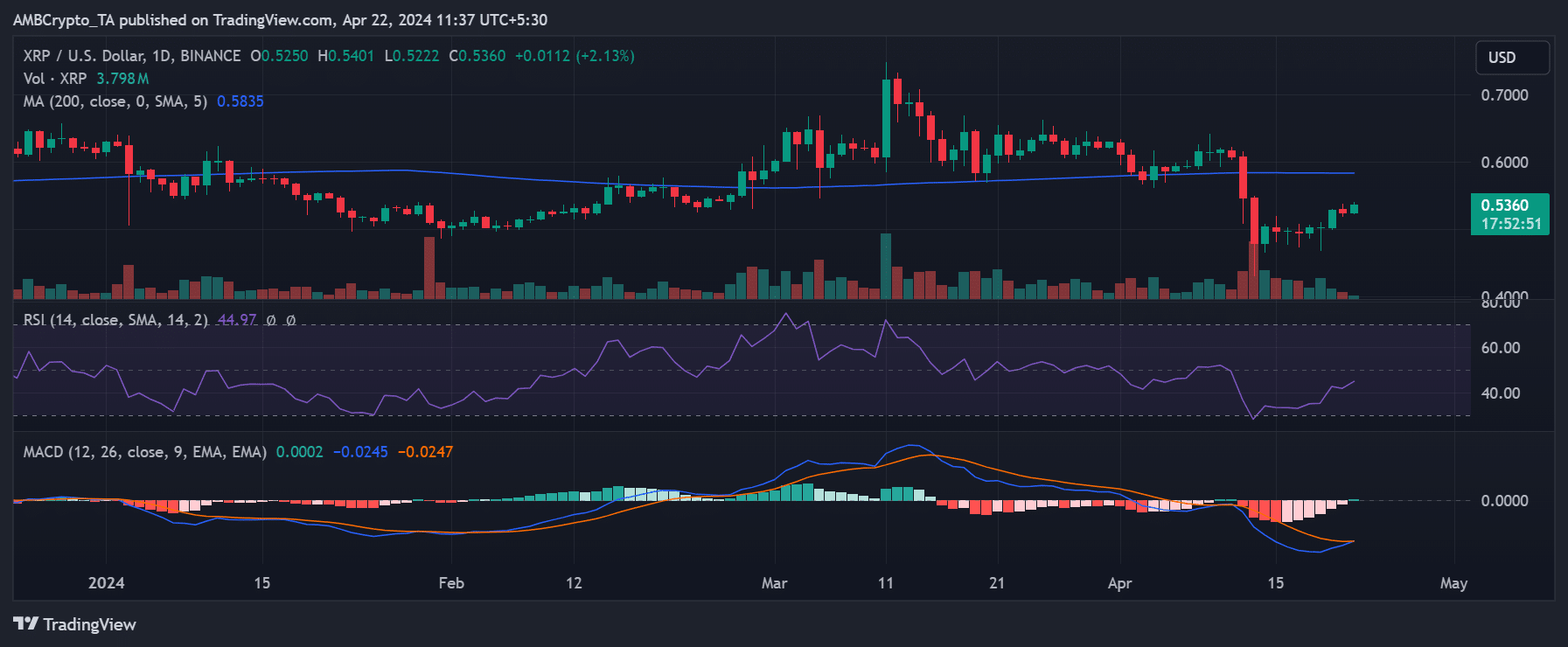

On XRP’s daily chart, we see that on April 20, it ended the trading session with significant gains, surpassing 5%. This brought the closing price to around $0.52. While this price increase might not be too impressive under normal circumstances, it comes after a volatile week in which XRP plummeted 22% within 48 hours. The price drop pushed XRP from around $0.60 to around $0.48.

Source: TradingView

Currently, XRP is trading at around $0.53, up another 1%. The chart shows immediate resistance defined by the Long Moving Average (blue line), at around $0.58. If XRP breaks above this level, it will be a breakthrough signaling a potential recovery. However, facing long-term resistance around the $0.65 and $0.70 price range suggests that a fresh rally is only possible once XRP breaks above these levels.

Despite the recent price increase, the XRP price trend remains bearish. The RSI shows that XRP remains below the neutral line at press time, suggesting that there is ongoing bearish pressure.

Traders’ sentiment is still at a low level.

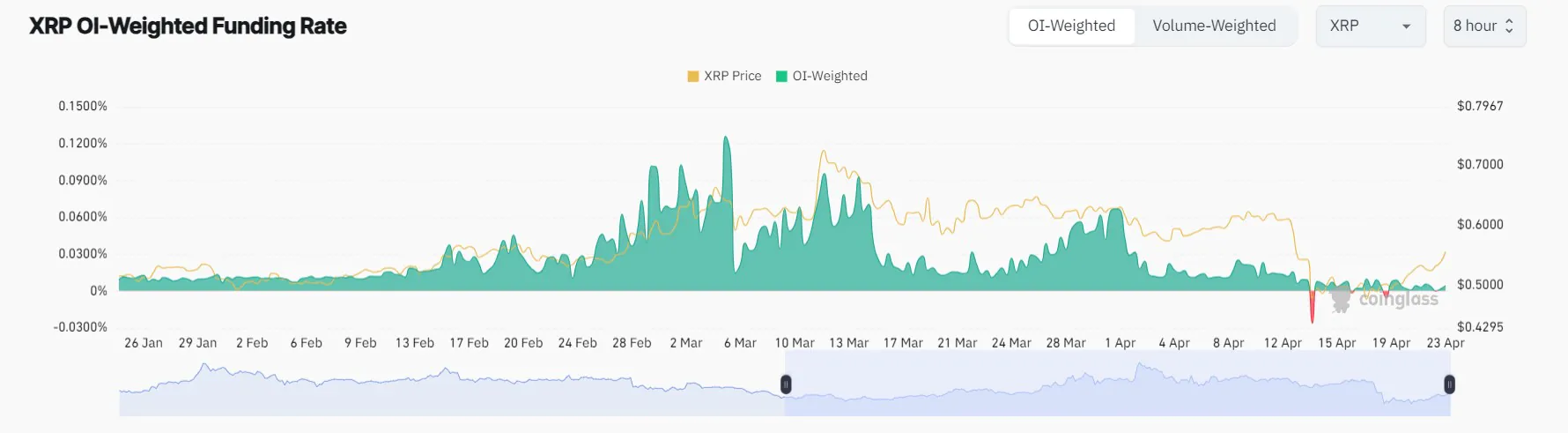

Two weeks ago, not only did Ripple’s price drop; The amount of money flowing into the cryptocurrency market also decreased. Data from the Open Interest chart on Coinglass shows a sharp drop in coins coinciding with a drop in the price of XRP. The amount of money dropped from more than $1 billion to about $500 million during that period. According to the latest data, Open Interest is currently at around 522 million USD.

The decline in inflows suggests a decline in investor sentiment towards XRP, reflecting a lack of confidence among traders. More positive sentiment could pave the way for more upside for XRP.

Related: Bitcoin Hits $67,000 as BlackRock Grows for 70 Consecutive Days

XRP has a profit of nearly 78 billion

In addition to the rising price, several other metrics are also increasing, namely the profit from Ripple’s supply. Data shows that with the recent price increase, the profit from supply has surpassed 77%, equivalent to nearly 78 billion XRP in profit. This trend is expected because high prices often result in large portions of profitable supply.

V