Challenges Unfold in the World of XRP

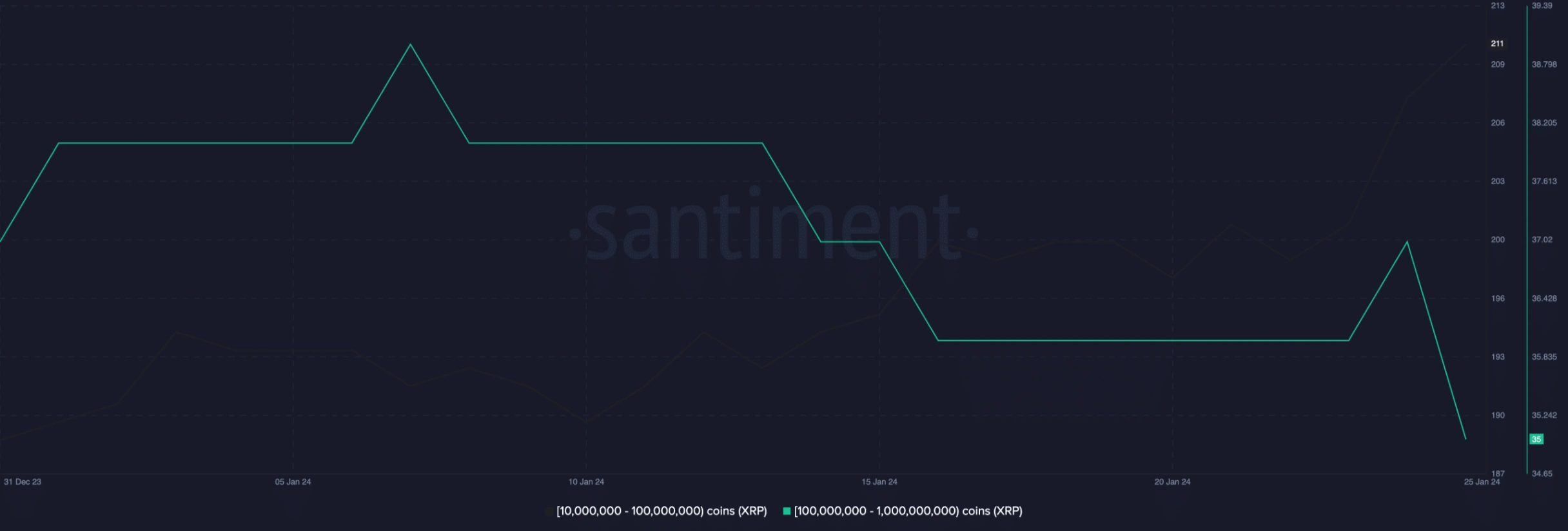

While Ripple (XRP) continues to maintain its position among the top 10 cryptocurrencies by market cap, recent performance has raised doubts among significant investors regarding its long-term prospects. However, it’s not just questions circulating; notable changes have occurred in the XRP Ledger (XRPL) ecosystem. Between the 24th and 25th of January, a noticeable decline was observed in the number of addresses holding 100 million to 1 billion XRP tokens.

This drop hints at a loss of confidence among some major stakeholders, leading to a subsequent liquidation of their XRP assets. The decision to exit the XRP market seems to be correlated with its recent price actions, with XRP currently priced at $0.50, reflecting a 19.18% decrease in value over the last 30 days.

The challenges faced by XRP extend beyond recent weeks. Following Ripple’s victory over the SEC last year, XRP experienced a surge, almost reaching $1. The current decline signifies a nearly 50% depreciation since that peak.

Lower Lows or Stagnation

XRP’s struggles prompted a response from prominent Bitcoin (BTC) maximalist Max Keiser. On January 23rd, Keiser, known for his critical stance on altcoins, referred to XRP as “centralized garbage.”

Despite the price downturn, there remains a positive sentiment surrounding the cryptocurrency. This optimism is reflected in the Weighted Sentiment Metric, which, at the time of reporting, had risen to 0.71. This metric evaluates the unique social volume associated with a project, and a negative value indicates a predominantly bearish sentiment in discussions about the asset.

Despite the positive Weighted Sentiment, indicating an overall optimistic sentiment in discussions about XRP, it’s crucial to recognize that this bullish outlook doesn’t guarantee an immediate recovery in XRP’s price. While a rebound is possible, it would require more than just positive market perception.

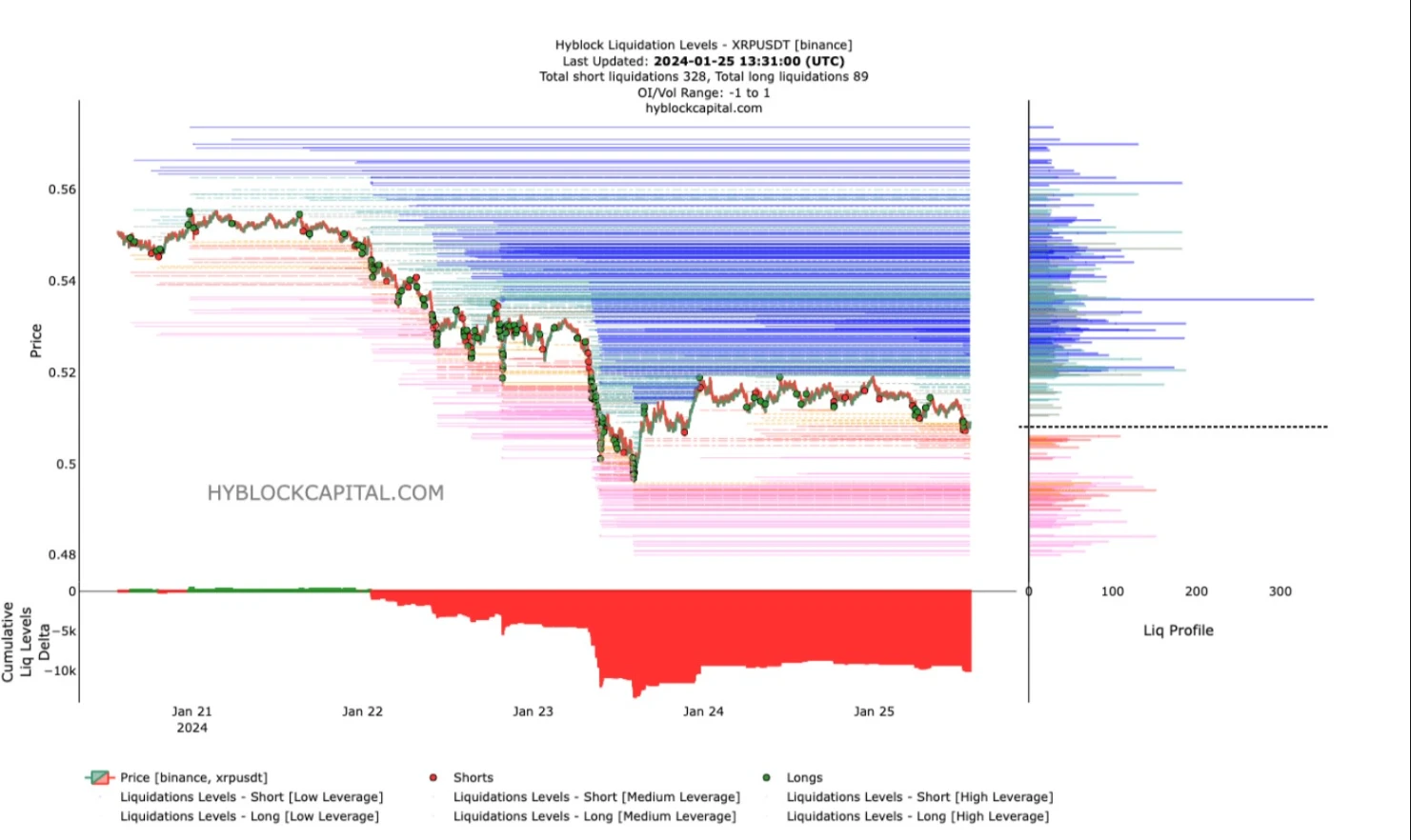

To assess potential market movements, we delved into Liquidation Levels and scrutinized the Cumulative Liquidation Levels Delta (CLLD). Liquidation Levels represent estimated points that could trigger the automatic closure of existing positions. Hyblock Capital’s data revealed multiple liquidity clusters from $0.51 and above. This implies that traders opening long positions with high leverage might face the risk of easy liquidation. Conversely, shorts targeting the range between $0.48 and $0.49 carried a lower risk of liquidation.

Related: Gemini Unveils New XRP Trading Product Amid Community Excitement

Meanwhile, the CLLD exhibited a spike in the negative direction. In this scenario, latecomers to short positions aiming to capitalize on the price decline could face potential liquidation risks.

While the possibility of XRP dropping to $0.48 exists, a swift recovery might be on the horizon. However, it’s essential to consider various factors beyond current market sentiment for a comprehensive understanding of the potential price trajectory.