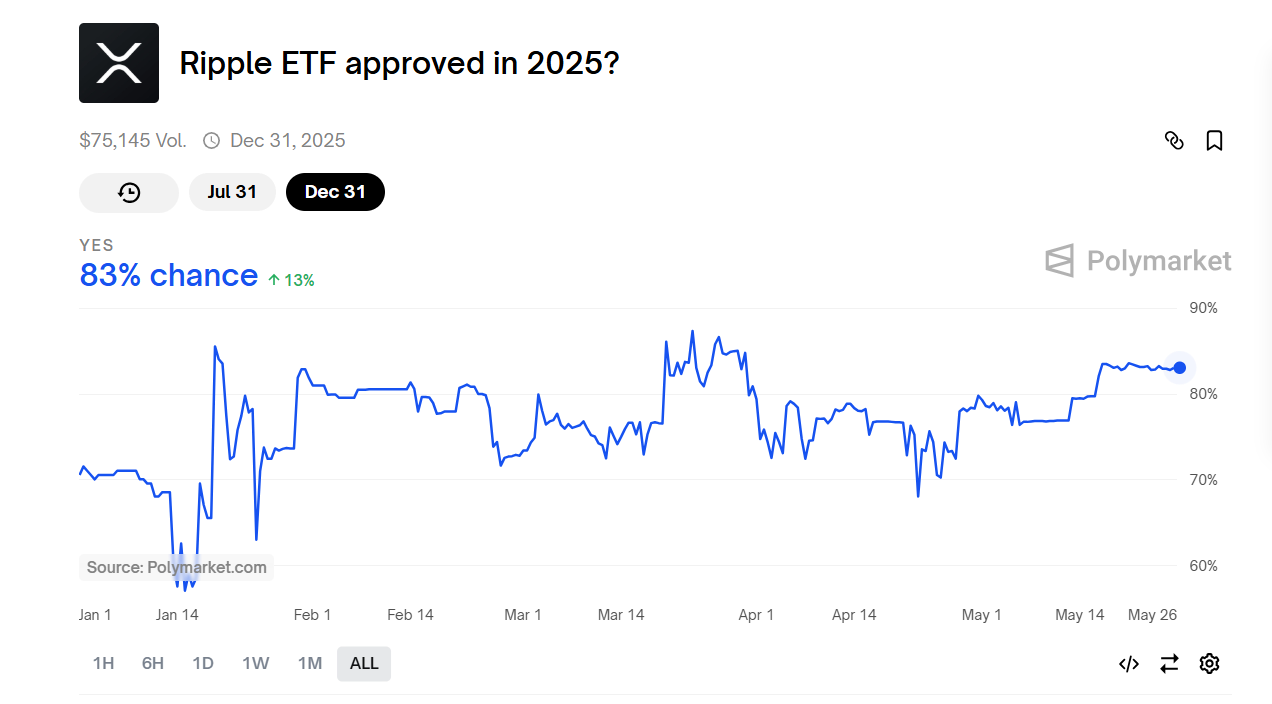

The approval odds for a spot XRP ETF have unexpectedly jumped to 83%, reflecting growing investor optimism even as the SEC continues to delay its decision.

The probability of a spot XRP ETF being approved has risen sharply by 13% this week, reaching 83%, according to prediction market platform Polymarket. This surge in confidence comes amid increasing institutional interest in digital assets, despite ongoing delays from the U.S. Securities and Exchange Commission (SEC).

Major asset managers such as Bitwise, CoinShares, Franklin Templeton, and Grayscale are currently awaiting the SEC’s final verdict. While the delays are considered routine in the regulatory review process, analysts now expect decisions to be made by October.

Meanwhile, Ripple CEO Brad Garlinghouse has voiced strong support for the growth of crypto ETFs. Speaking on the company’s podcast Crypto in One Minute, he emphasized that ETFs offer institutional investors a regulated and more accessible way to enter the crypto market. He pointed to the rapid rise of Bitcoin ETFs, which reached $1 billion in assets quickly and surpassed $10 billion faster than any ETF in history. Garlinghouse believes this momentum will pave the way for more crypto ETFs, including one for XRP.

While the spot ETF is still under review, the market saw a notable milestone last week: the launch of the first-ever XRP futures ETF on the Nasdaq, under the ticker XRPI, by Volatility Shares. This followed a similar XRP futures product introduced by CME in May. Additionally, Tectrium launched a 2x Long Daily XRP ETF, a leveraged product that provides further exposure to XRP for institutional traders.

These developments highlight the growing demand for XRP-related investment products and reinforce the belief that a spot XRP ETF approval may be just around the corner.