In South Korea, XRP Reigns Supreme

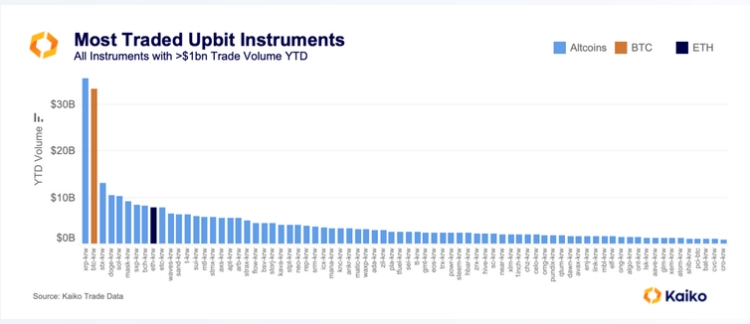

In South Korea, XRP, the native currency of the XRP Ledger (XRPL), has emerged as the dominant cryptocurrency, surpassing even Bitcoin (BTC). Recent research conducted by Kaiko reveals that the majority of cryptocurrency trading in the country is centered around XRP, outpacing Bitcoin, Ethereum (ETH), Solana (SOL), and other alternative coins like Dogecoin (DOGE) and Bitcoin Cash (BCH).

This data is derived from Upbit, one of South Korea’s largest cryptocurrency exchanges, renowned for its substantial altcoin trading activities. The Korea Financial Intelligence Unit (FIU) oversees and regulates the operations of Upbit, adding credibility to these findings.

This preference for XRP over Bitcoin in South Korea stands in contrast to trends in other countries, particularly the United States, where the majority of users tend to favor BTC and ETH, according to data from Coinbase, a prominent American cryptocurrency exchange with trading volume nearly on par with Upbit.

While this shift in preference towards altcoins is noteworthy in South Korea, it’s crucial to note that Bitcoin still retains its status as the largest cryptocurrency by market capitalization.

The reasons behind the higher trading volume of the XRP-KRW pair on Upbit compared to the BTC-KRW pair could be multifaceted. However, it’s important to acknowledge that Bitcoin has a broader adoption and has seen the development of more complex financial products over time.

In the United States, analysts are optimistic about the eventual approval of the first spot Bitcoin Exchange-Traded Fund (ETF) by the Securities and Exchange Commission (SEC) in the coming months. This approval is contingent on ensuring that there is no manipulation of the underlying token’s price from the exchanges where price data is aggregated.

Over the years, cryptocurrency exchanges have been diligently combating wash trading and other manipulation tactics that artificially inflate the trading volume of specific cryptocurrency pairs. Wash trading involves a manipulator simultaneously trading the same pair to create the illusion of heightened activity, making it difficult for users to gauge the actual state of the market.

>>> Coinbase Takes Lead Over SEC, Launches Crypto Futures Trading Service in US

In March 2023, South Korea’s FIU investigated several registered exchanges and penalized some for having insufficient internal controls, imposing fines of up to $400,000 for abnormal transactions and mandating improvements within three months.

On October 19, the U.S. Securities and Exchange Commission (SEC) announced that it was dropping all allegations against Brad Garlinghouse, the CEO of Ripple, and its executive chair, Chris Larsen. This decision was made in the District Court for the Southern District of New York, leading to the dismissal of their lawsuit.

As a result, there will be no need for an upcoming trial. However, it remains uncertain whether the SEC is also dropping its lawsuit against the blockchain company itself, which was initiated in December 2020.

Crypto Analyst’s $XRP Price Prediction Indicates Potential Surge to $220

A prominent cryptocurrency analyst has made a bold prediction regarding the price of XRP, suggesting that the native token of the XRP Ledger could potentially reach a remarkable target of $220. This prediction is based on a historical price pattern that, if repeated, could lead to this significant surge.

The analyst, known as CryptoBull, shared their insights on the microblogging platform X (formerly Twitter). They pointed out that in 2013, XRP was priced at approximately $0.002. By 2018, the cryptocurrency had reached its all-time high of $3.84. Following this peak, XRP experienced a correction, dropping to a low of around $0.14 before beginning its recovery. Despite reaching nearly $1.6 during the 2021 bull run, XRP is currently trading at $0.559 per coin.

CryptoBull’s analysis suggests that the bottom and top prices on XRP’s chart seem to align with this retracement pattern. Extrapolating from this historical trend, the analyst believes that the next bull run could potentially see XRP surging to $220.

#XRP went from $0.002 to $3.84 during its first major bullrun. We find that the bottom and the top line up with its retrace. If we follow the very same pattern this bullrun we could find XRP at $220. pic.twitter.com/Bimx3C5AAV

— CryptoBull (@CryptoBull2020) October 25, 2023

It’s worth noting that XRP’s price recently reached a two-month high during a broader cryptocurrency market rally, which also saw Bitcoin (BTC) achieve a 16-month high. This rally was driven by optimism regarding the potential approval of a spot Bitcoin exchange-traded fund (ETF) in the United States, following the listing of BlackRock’s proposed iShares spot Bitcoin ETF on the Depository Trust & Clearing Corporation (DTCC).

XRP has been outperforming many other altcoins due to several factors, including the U.S. Securities and Exchange Commission (SEC) dropping its securities violations charges against Ripple’s executives. This development contributed to the cryptocurrency’s most significant single-day surge in months.

However, it’s important to note that some users expressed skepticism about the $220 price prediction, with one user pointing out that achieving such a high price would require XRP to have a market capitalization of over $20 trillion, which is a substantial hurdle.