While some observers argue that XRP’s rally may be capped around the $4 region, renowned analyst EGRAG Crypto dismisses such projections, asserting that long-term technical patterns point to far higher targets.

The debate sparked when Crypto Rover forecasted that XRP could peak between $3.2 and $4.8 in the coming months, implying a maximum gain of about 65% from current levels. In contrast, EGRAG contends that such estimates are too modest, insisting that XRP is poised for a far more significant surge.

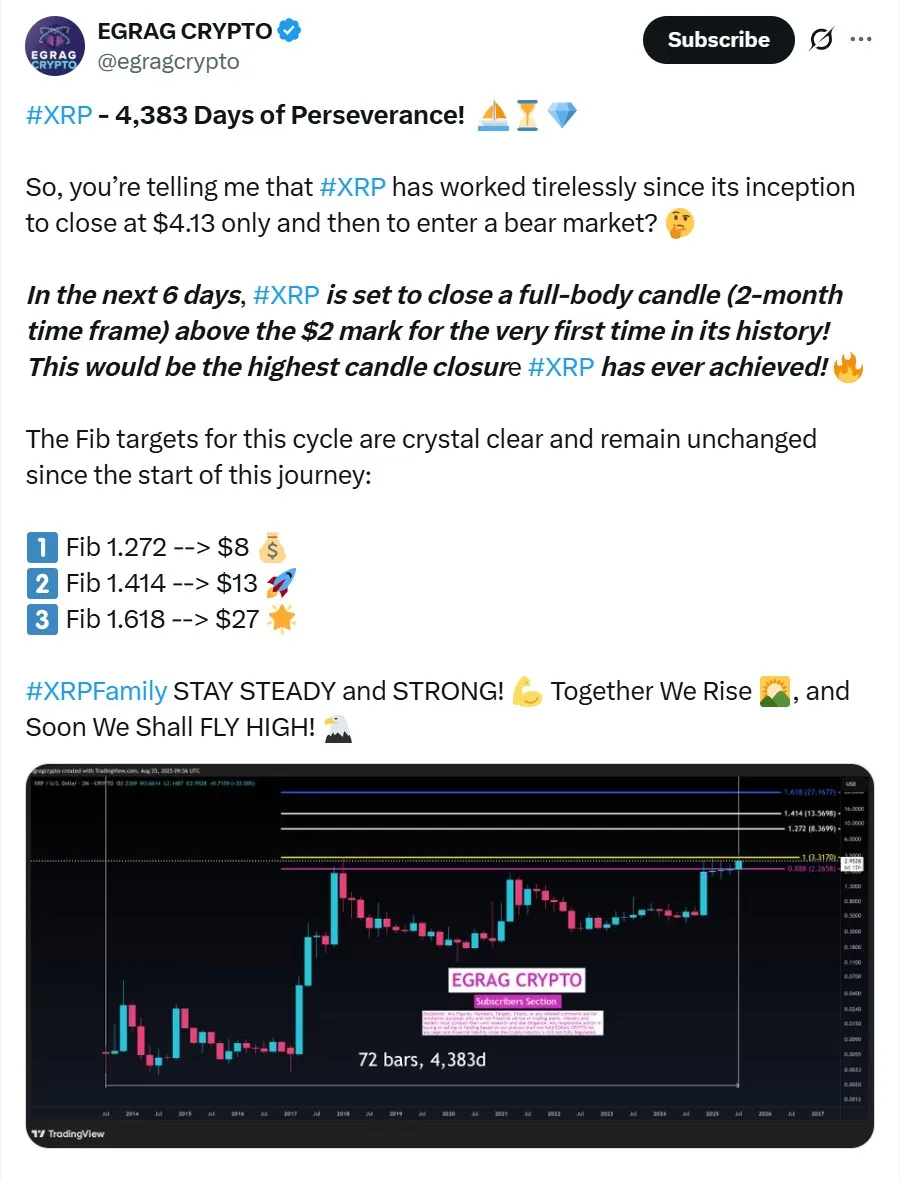

According to EGRAG, the key lies in longer timeframes. He emphasized that the July–August 2025 two-month candle is especially critical: a close above $2 would mark the strongest two-month close in XRP’s history.

As of now, XRP trades around $2.99, just shy of the $3 resistance, after climbing 3.3% in the past 24 hours. EGRAG believes that breaking this threshold could lay the foundation for a sustained upward trend.

Technical Levels and Price Targets

EGRAG’s outlook is rooted in Fibonacci extension levels, outlining potential milestones:

- $3.31: the first critical test, aligning with the all-time high of 2021. XRP briefly exceeded this level in July when it touched $3.66, but reclaiming and holding above it remains crucial.

- $8.37: the 1.272 Fibonacci extension, representing a 188% rally from current levels and a new record high.

- $13.56: the 1.414 Fibonacci extension, signaling a 366% gain and XRP’s first move into double-digit territory.

- $27.17: the projected cycle peak at the 1.618 Fibonacci extension. EGRAG has consistently highlighted this target, though he also warns of a possible severe correction afterward, potentially dragging prices back to $0.80.

Optimism vs. Skepticism

Despite broader market uncertainty, XRP’s resilience above $2 has fueled bullish sentiment. While skeptics claim that expectations above $4 are unrealistic, EGRAG argues that dismissing higher levels ignores the token’s underlying technical trajectory.

With the two-month close approaching, XRP’s performance in the coming weeks could be decisive: will it stall in the single-digit range, or confirm the bold scenario of a historic breakout toward $27?