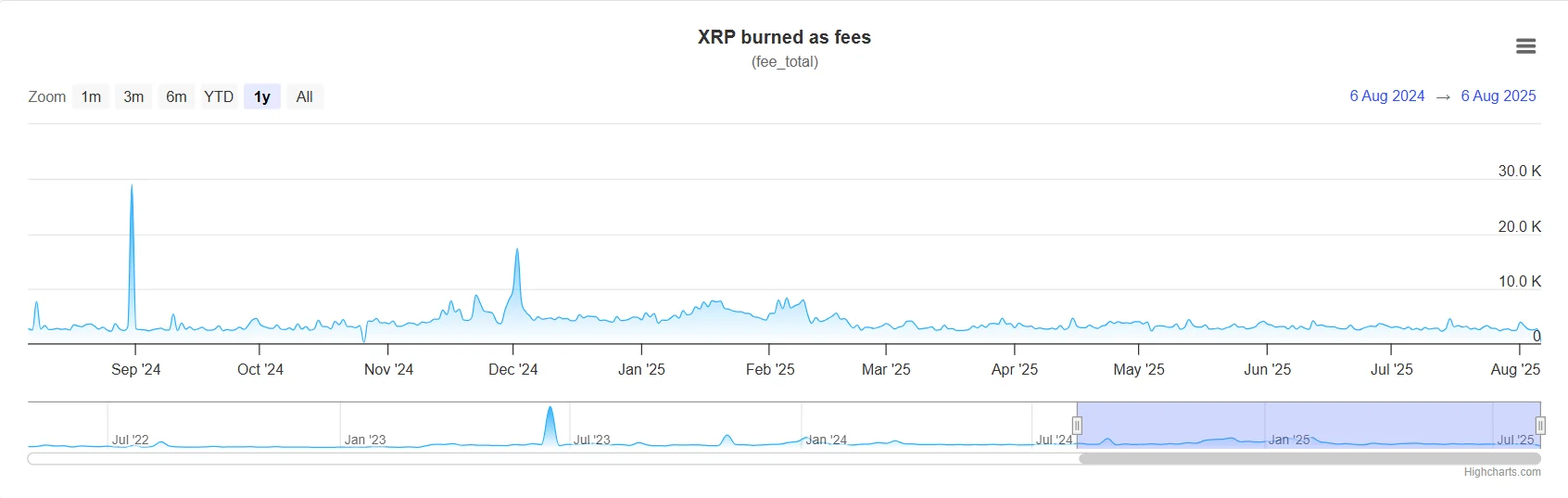

While XRP’s price saw an unexpected pullback within just a few hours, another worrying signal has emerged: its daily token burn rate — a key indicator of the asset’s deflationary strength — has dropped significantly. According to data from XRPSCAN, only 1,808 XRP was burned in transaction fees on August 5, marking a 25.96% decrease compared to the 2,442 XRP burned the previous day.

Notably, payment activity on the XRP Ledger has also taken a serious hit. The total number of XRP transactions between wallets fell to 727,329, reaching a two-month low. This reflects a clear decline in investor engagement with XRP amid broader market uncertainty.

Alongside weakening on-chain activity, XRP’s price was also impacted. After peaking intraday at $3.1028, the coin dropped to a low of $2.9654, before stabilizing around $2.97 by the end of the day — representing a 2.78% decline in the past 24 hours.

What’s next for XRP?

Despite the current short-term downtrend, many investors remain optimistic as they await updates on the anticipated XRP ETF approval by the U.S. Securities and Exchange Commission (SEC). Analysts suggest that if XRP can maintain momentum above $3.10, it could potentially break through the $3.55–$3.65 resistance zone.

For now, the declining burn rate hasn’t significantly impacted XRP’s price performance, but it does signal a cooling in demand and investor interest in the short term. Traders should keep a close watch on upcoming movements in both the market and XRP’s on-chain activity.