South Korea’s Personal Information Protection Commission (PIPC) has fined Worldcoin Foundation and Tools for Humanity (TFH) for violating personal data protection laws. Specifically, Worldcoin Foundation was fined 725 million KRW (approximately $546,000) for mishandling sensitive information and transferring data overseas without proper consent.

TFH was also fined 379 million KRW (approximately $285,000) for failing to comply with local regulations on the transfer of personal data. The fines stem from an investigation that began in February, when concerns were raised about Worldcoin collecting biometric data without consent in exchange for cryptocurrency.

Despite the fine, Worldcoin continues to expand its operations. The organization recently introduced its digital identity platform World ID in new markets such as Guatemala, Malaysia, and Poland. The platform will also be available in other countries such as Argentina, Chile, Austria, Mexico, and the United States soon. According to the Worldcoin website, the platform has completed over 6.7 million verifications, with 160,000 new accounts created in the past week alone.

Worldcoin Market Performance and Price Increase

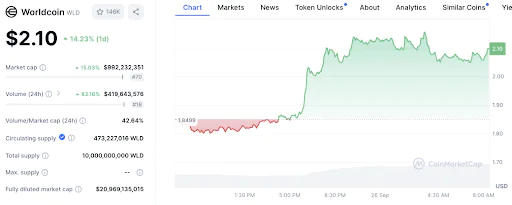

Worldcoin (WLD) has recently recorded a notable price increase, attracting the attention of many investors and traders. At the time of writing, the price of Worldcoin is at $2.10, up 14.23% from the previous day. The trading volume has also increased sharply, reaching $420 million, indicating more active trading, while the market capitalization has reached $1 billion.

Earlier, the price of Worldcoin dropped below $1.85 and continued to decline until around 4 p.m., when the price began to recover. By 8 a.m., Worldcoin had surpassed $2.10.

Technical indicators show bullish trend but correction possible

Technical analysis shows that indicators such as MACD and RSI are both bullish for Worldcoin. The cryptocurrency peaked at $2.17 before correcting to around $2.06. The bullish crossover of the MACD line suggests that the bullish momentum is still continuing.

However, the RSI has reached 70.45, which is in the overbought zone, suggesting that Worldcoin could face a short-term correction.