Named OpenAI o1, this new model represents a significant shift from the company’s previous iterations, promising enhanced reasoning abilities and improved performance on complex tasks.

Worldcoin surges 16%

OpenAI announced that this series of AI models has the ability to “think before responding.”

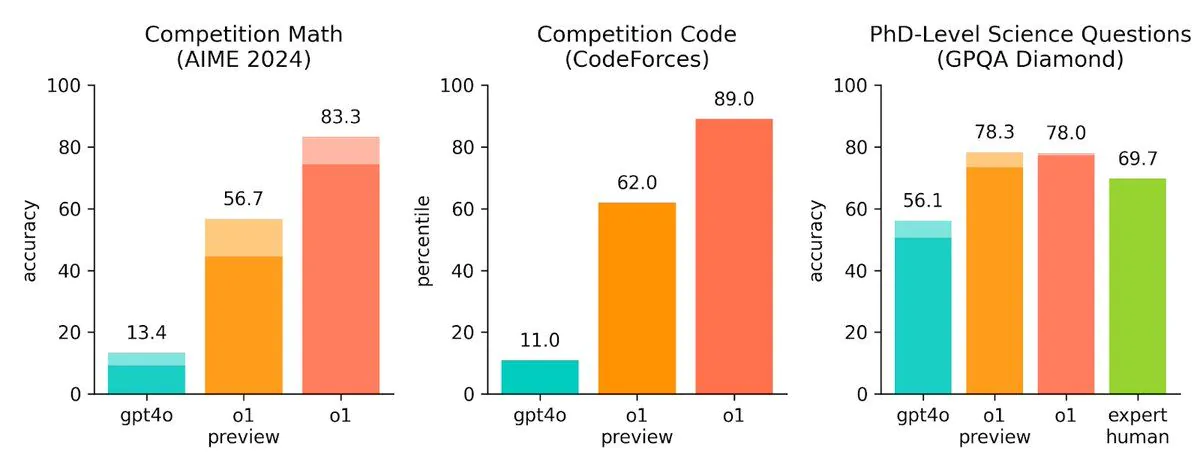

“We have developed a new range of AI models designed to spend more time reasoning before giving responses. These models can tackle complex tasks and solve more challenging problems compared to earlier versions, excelling in fields such as science, coding, and mathematics,” OpenAI stated in a blog post.

Despite its smaller size, the smallest unit in this new model series is said to outperform GPT-4o in several key areas, including AI benchmark tests that simulate PhD-level challenges.

However, in creative domains like writing and artistic endeavors, the improvements are less pronounced. This specificity in enhancements has caught the attention of tech enthusiasts and experts eager to leverage these AI tools for specialized applications.

From a financial perspective, the impact of this technological leap was felt immediately in the cryptocurrency ecosystem. The total market capitalization of AI-related tokens saw a modest 2.1% increase over the past 24 hours.

Meanwhile, Worldcoin (WLD) experienced a significant price surge, climbing approximately 16% following the announcement. However, as of the time of writing, the increase has stabilized at 9.5%, with the token trading at $1.518.

This rise is particularly noteworthy given that Sam Altman is the co-founder of both Worldcoin and OpenAI. Despite this connection, Worldcoin remains a controversial figure within the crypto community due to its tokenomics.

Currently, out of the total 10 billion WLD tokens, only 434 million are in circulation, according to the latest data from CoinMarketCap. This tightly controlled supply is increasing as 2 million tokens are released daily starting from July 24, each batch valued at around $3 million at the current price.

As a result, this gradual token release mechanism is expected to create selling pressure in the market, reflecting the low circulating supply ratio of 0.02, as highlighted in CoinGecko’s May 2024 report. Such a low ratio indicates that only a limited number of tokens are available for trading, potentially leading to increased volatility as more tokens enter circulation.

Critics, including blockchain investigator ZachXBT, have voiced their concerns on platforms like X (formerly Twitter). Opinions on Worldcoin range from cautious optimism to outright skepticism.

“WLD currently has the worst tokenomics and is programmed for a slow rug pull. I expect frequent short-term pump-and-dump cycles on WLD to lure in buyers for exit liquidity, but in the long term, WLD’s price will drop to $0.1,” Marius Capital commented on X (Twitter).